Paradoxically, it was the NCR real estate market’s erstwhile reputation as a hotbed for untoward market practices that laid the foundation for structural reforms like RERA. Contrary to all previous perceptions of this region’s real estate market, NCR is now the new frontier of change.

From the glory days of local players between 2010 and 2015, the NCR housing market has been completely transformed in the period between 2016 and H1 2021 as. A market once notorious for being driven by speculators, NCR was also a veritable hunting ground for unscrupulous developers churning out unchecked and unnecessary inventory, playing squarely to the speculator gallery, cashing in on the trust of unwitting homebuyers, and diverting their money elsewhere.

“The aftermath of this period is still glaringly evident,” says Anuj Puri, Chairman – ANAROCK Property Consultants. “More than 3,28,600 homes are either terminally stalled or heavily delayed in NCR alone, accounting for 52% of all such units across India’s 7 major cities. Launched in 2014 or before, these projects are ugly testimony to NCR’s darkest ‘Wild West’ years. Unregulated and unchecked, this market saw close to 2.58 lakh units unleashed between 2010 and 2015 by the leading 15 local players alone.”

“The aftermath of this period is still glaringly evident,” says Anuj Puri, Chairman – ANAROCK Property Consultants. “More than 3,28,600 homes are either terminally stalled or heavily delayed in NCR alone, accounting for 52% of all such units across India’s 7 major cities. Launched in 2014 or before, these projects are ugly testimony to NCR’s darkest ‘Wild West’ years. Unregulated and unchecked, this market saw close to 2.58 lakh units unleashed between 2010 and 2015 by the leading 15 local players alone.”

NCR’s profiteering speculators and cut-throat developers have now faded into the past. To the backdrop of the cancer that had beset this market in previous years, the implementation of RERA in 2017 wiped out unscrupulous developers and brought speculative buying and selling of homes to a complete halt.

Between 2016 and the first half of 2021, corporate and national developers like Godrej Properties Ltd., Tata Housing, Hero Realty, Sobha Ltd., Shapoorji Pallonji Group, Birla Estates and Mahindra Lifespaces took centre-stage. In this period, the top 15 local players throttled their supply down to approx. 70,500 units – a 73% drop from their heyday years. Now, more national players like Prestige Estates are also foraying into NCR.

Source: ANAROCK Research

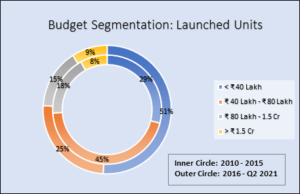

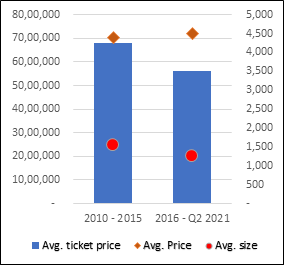

An analysis of new launches during these two periods (2010-2015 & 2016-H1 2021) highlights many contrasting trends. The NCR market now favours buyers rather than developers, and supply largely follows demand:

- The average ticket price of properties being launched now has reduced from INR 68.20 lakh (2010-2015) to INR 56.25 lakh (2016 to H1 2021). The increasing demand for affordable and mid segment homes has led this change

- The average size of homes has also reduced from 1,550 sq. ft. in 2010-2015 to 1,250 per sq. ft. between 2016-H1 2021. While developers reduced home sizes to bring down prices, they will have to reconsider this aspect now – there is increasing demand for bigger spaces to accommodate the WFH and e-schooling realities brought on by the pandemic

- Even project sizes have decreased – previously, the average NCR project had approx. 950 units; this has now come down to 650 units/project. Resultantly, the average project completion time between 2016-H1 2021 has also reduced to 4.9 years from 7.8 years in the 2010-2015 period.

- Between 2010-2015, at least 63% units were launched in the INR 40 lakh to INR 1.5 Cr budget range. Affordable housing accounted for a mere 29% share of 2.58 lakh launched units. In the 2016-H1 2021 period, at least 51% of 70,500 units was in the affordable category, and 40% in the INR 40 lakh to INR 1.5 Cr. budget range.

New Launches Trends: 2010-2015 vs 2016-H1 2021

Source: ANAROCK Research

Revival of Stalled Projects

By far the most glaring aspect of NCR’s darker years –stalled and heavily delayed projects – is now beginning to see some light at the end of the tunnel. Several large developers like Jaypee Infratech, Amrapali and Unitech previously delayed projects, causing distress to a staggering number of homebuyers.

- Greater Noida comprises 50% of stuck or delayed units or approx. 1,62,720 units, followed by Noida with 16% share or approx. 53,680 units.

- In Gurugram, nearly 40,380 units or 12% homes are stuck/delayed.

- Ghaziabad comprises 10% of the overall share of stuck or delayed projects (approx. 33,970 units).

- Delhi has nearly 15,740 units stuck or delayed which is nearly 5% total share.

- The remaining 7% are collectively in Bhiwadi and Faridabad – 22,110 units.

| City | Launched Units (launched before or during 2014) |

| Greater Noida | 1,62,720 |

| Noida | 53,680 |

| Gurgaon | 40,380 |

| Ghaziabad | 33,970 |

| Delhi | 15,740 |

| Bhiwadi | 14,070 |

| Faridabad | 8,040 |

| Grand Total | 3,28,600 |

Source: ANAROCK Research

Approx. 1,13,860 units in NCR worth INR 86,463 Cr are completely stalled – a whopping 66% of the total 1.74 lakh stalled units in the top 7 cities.

The Central government’s SWAMIH funds with a corpus of INR 25,000 Cr. has now come forward to complete nearly 1,500 stalled projects across the country. So far, SWAMIH funds have given approvals to more than 204 final or early-stage projects involving investments of INR 18,500 crore across tier 1,2 and 3 cities. At least 13 projects in Delhi-NCR are likely to be completed within the next one year, as per the government.

Likewise, the government-backed NBCC and a few well-capitalized developers have taken charge of various stuck projects in NCR. For instance,

- Gurugram-based Alpha Corp will invest approx. INR 900 crore in three stalled projects of Earth Infrastructure (in Gurugram and Greater Noida) that were launched between 2010-2012.

- Lotus Panache project at sector 110 in Noida is likely to complete this month. Nearly 600 homebuyers will finally get their completed homes.

- NBCC has also successfully completed over 2,060 homes across projects in Noida and Greater Noida. It has also delivered around 8,500 flats at Jaypee Wish Town project while another 6,000 flats are to be complete by 2022-end.

- Gaurs Group has taken charge to complete over 10,964 Amrapali stuck homes.

In testimony to the sea-change in perception about the NCR housing market, unsold inventory in the region has witnessed 26% decline – from 2.28 lakh units in 2015 to approx. 1.69 lakh units as on Q2 2021-end.

| Unsold Inventory Trends in NCR (Units) | ||

| 2015 | Q2 2021 | %Change |

| 2,28,130 | 1,68,710 | -26% |

It is apparent that NCR’s residential market has been reinvented almost from the ground up. Terms like resilience, transparency and professionalism have finally found a place in its narrative – largely on account of the entry of the large listed and corporate developers. This is evidenced by the significant resumption of homebuyer interest since 2015.