After witnessing heavy selling yesterday, the broader market indices - smallcap and midcap stocks weakened further today.

Over 300 stocks had closed at the lower circuit limit yesterday. The BSE Midcap index and the BSE Smallcap index ended 1% and 2% lower, respectively yesterday.

The selling took market participants by surprise as broader market indices have rallied continuously over the past few months.

So what triggered the fall?

An obvious reason attributed to the sudden selling can be profit-booking.

Broader indices have outperformed benchmarks during the second wave. Smallcap and midcap stocks have been scaling new highs as they are going through adjustment of their valuations.

After the second wave peaked, smallcap and midcap stocks have outperformed benchmarks by nearly 3 times.

Since these returns were so steep, coming in such short time, experts were predicting the slide to be also fast and furious.

Another not so obvious reason can be the new circular published by the Bombay Stock Exchange (BSE) on Monday.

The circular had a cautious tone.

It notified trading members that it's going to place an additional price limit on securities listed on its bourse from 23 August.

--- Advertisement ---

URGENT REMINDER

The Super Smallcaps Summit with Richa Agarwal is NOW LIVE...

Make Sure You Don't Miss It...

Watch Now

------------------------------

India's oldest exchange said this move is aimed at maintaining market integrity and curbing excessive price movement.

Here's a brief excerpt from the circular:

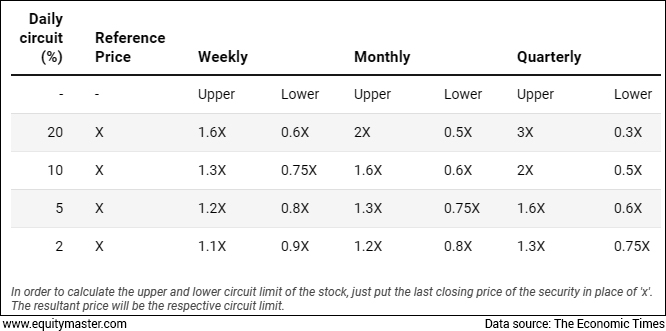

The new surveillance measure intends to cap the price movement in stock on a weekly, monthly, and quarterly basis over and above the daily price band.

Simply put, a stock that is priced at Rs 100 and is already in the 10% circuit filter can rise by just Rs 30 in a week and Rs 100 in three months.

Similarly, a stock priced at Rs 100 can fall by Rs 25 in a week and Rs 50 in three months.

BSE has spelt out several such caps about stocks that attract circuit filters between 2-20%.

Surveillance measures are used to put certain stocks that show unusual activities under watch. Some of the common ones are Graded Surveillance Measures (GSM), Additional Surveillance Measure (LT-ASM), Short-Term Additional Surveillance Measure (ST-ASM), etc.

Circuit filters are also a kind of surveillance measure.

These measures are not related to the fundamentals of the business aspect of stocks but largely based on volume or price movements.

For example, the National Stock Exchange (NSE) has certain stocks under the long-term ASM while some are also under short-term ASM.

LIVE NOW: 3 Super Smallcap Stocks You Don't Want to Miss Out On

The sell-off in broader indices dragged the entire market lower.

The BSE midcap index and the BSE smallcap index both fell over 2% today.

From the midcap space, shares of KIOCL, Godrej Agrovet Whirlpool, Adani Power, JSW Energy, and Info Edge were among the top losers.

Meanwhile, midcap metal stocks including Jindal Steel & Power, SAIL, and NALCO reversed the trend and rose up to 4%.

Steel stocks rose after the senate voted to pass a US$1 tn bipartisan infrastructure bill on Tuesday, which now moves to the House for what is expected to be a tougher fight for approval.

The bill includes US$550 bn in new spending on roads, bridges, and internet access, which would be a boon for steel stocks that sit well positioned to supply materials in the massive infrastructure rollout.

Other gainers from the midcap space include Page Industries, Exide Industries, and Natco Pharma.

The selling was more intense in smallcaps. The BSE smallcap index fell over 3% to a low of 26,065. Currently, it is down 2.7%.

Among the top losers were Sequent Scientific, Manappuram Finance, Subex, Trent, Prestige Estates, and Kiri Industries.

Stocks from the smallcap space which stood strong were Hinduja Global, Dwarikesh Sugar, Hikal, Radico Khaitan, and TVS Srichakra, gaining 2-5%.

Overall, more than 700 stocks, combined from midcap and smallcap space, hit their lower circuit limit on the BSE in intraday trade today.

Later in the session, stocks made a smart recovery after BSE provided clarification.

The BSE clarified in a circular today that in partial modification and supersession of the Exchange circular dated 9 August 2021, on the captioned subject, the following clarifications are being provided to simplify the understanding and implementation of the framework:

The 9 August circular had no mention of the stock groups.

--- Advertisement ---

Everyone has a bullish view on India these days.

But few really get why India will do well in the next decade.

There's an opportunity staring at us right in our faces and most ordinary investors have almost no clue about it.

Worse, they do not know the specific steps on how to potentially profit from this 10-year bull run...

At her upcoming MEGA event, our co-head of research, Tanushree Banerjee, is going to reveal-3 specific reasons why India's economy will do extremely well in the coming 10 years

And, even more importantly...

3 specific stocks that are best placed to leverage on this opportunity

If you are a believer in the idea that India's time has come, join us at 5 pm on August 13

Click here for the full details. It's Free

------------------------------

Despite the recent correction, the broader indices are up significantly from their multi-year lows touched in March 2020.

There's always panic selling by retail investors when any such circular comes out. Many retail investors usually trade on an intraday basis and that is seen from the huge volumes for a particular day.

If you have stocks with strong fundamentals in your portfolio, you need not worry as they will have huge potential and will perform well over the long run.

Rather than panic selling, this can be treated as an opportunity for averaging good stocks.

Richa Agarwal, smallcap analyst at Equitymaster, shared her views on the current rally in a recent editorial.

Here's Richa...

If you don't have the stomach to withstand a 20%-30% kind of corrections and volatility, the smallcap space may not be for you at all.

As per Richa, there is still some juice left in the rally and smallcaps will provide you with a great opportunity to make some big returns.

If you want to benefit from the ongoing revival in smallcap stocks, join Richa at the Super Smallcap Summit.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Top agriculture stocks that should have your attention now.

List of stocks that have zero promoter holdings, where FPIs hold stake.

So far in 2021, IPOs in India have raised nearly US$ 3 bn, the best start to the year since 2018.

This edition of Daily Wealth Letter explains, How to Inculcate the Good Habit of Regular Mutual Fund Investments.

Follow this simple hack to boost your intraday trading profits.

More Views on NewsAll you need to know about successful investing in the smallcap space.

These stocks are the best from a traders point of view.

In this video, I'll tell you about a simple hack to increase your profits from day trading.

These stocks are good buys even at all-time high levels.

Jul 29, 2021The epicentre of a tech-bubble led market crash in 2021 is closer than you think.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!