Unlike UPI, e-RUPI is a digital voucher that limits where and how someone can spend money, but it also stockpiles data which in turn raises concerns of financial surveillance.

On August 2, Prime Minister Narendra Modi launched e-RUPI, a payment system that sits on top of the Unified Payment Interface (UPI). But what exactly is it and what is it supposed to accomplish?

Why it matters? The National Payments Corporation of India is an association of public and private banks, and yet, time and again, its systems are launched under the auspices of the government (BHIM, UPI in Bhutan, Bharat Bill Pay Service) giving it the appearance and benefits of a state-sponsored scheme. State and private-sector dependence on e-RUPI-like systems may have far-reaching consequences, especially with the data that is being collected and the potential exclusion that may follow as the instrument starts seeing wider adoption.

The what and the how

What is e-RUPI, and how does it work? “e-RUPI is basically a digital voucher which a beneficiary gets on his phone in the form of an SMS or QR code. It is a pre-paid voucher, which he/she can go and redeem it at any centre that accepts it,” a government press release explains.

What can e-RUPI be used for? Essentially, e-RUPI is a meal pass programme like Sodexo — a tool to limit where and how someone can spend money. This could be, for instance, an employer who gives their workforce e-RUPI vouchers for COVID-19 vaccines, or a hospital without an X-Ray machine giving a poor patient a voucher to get a scan done at a different facility. The latter example was cited by RS Sharma, the CEO of the National Health Authority in an interview with NDTV; the NHA is the first organisation within the Health Ministry to have access to the tool.

How is e-RUPI different from UPI? For starters, it has two more letters and a hyphen. In all seriousness, though, e-RUPI sits on top of UPI, and rides on the same infrastructure. But unlike transactions with the National Payments Corporation India-developed UPI, e-RUPI vouchers don’t reveal the beneficiary’s identity to the merchant — that information stays with the issuing organisation and the bank. Beneficiaries aren’t required to reveal their identity during redemption, the NPCI website says.

What is the difference between RBI’s Digital Rupee and e-RUPI? The Reserve Bank of India’s Digital Rupee is what is called a central bank-backed digital currency (CBDC). It is equivalent to money itself, and not an instrument to transfer it. The RBI has yet to decide on the specifics of how this CBDC will work, and where it will be used, but the problem it solves is completely different: T Rabi Sankar, Deputy Governor of the Reserve Bank of India, said it would safeguard the public from volatility in private cryptocurrencies (whose purchase by Indians the RBI tried to curtail, only to be overturned by the Supreme Court.)

e-RUPI should not be confused with Digital Currency which the Reserve Bank of India is contemplating. — Government Press Release

Where e-RUPI is being accepted

Who is issuing e-RUPI vouchers right now? It’s a small number. “To begin with NPCI has tied up with more than 1,600 hospitals where e-RUPI can be redeemed,” the government said in its press release, citing unnamed “experts” as saying that private businesses will pick it up for B2B transactions. The hospitals are pilot-testing e-RUPI as vaccination vouchers.

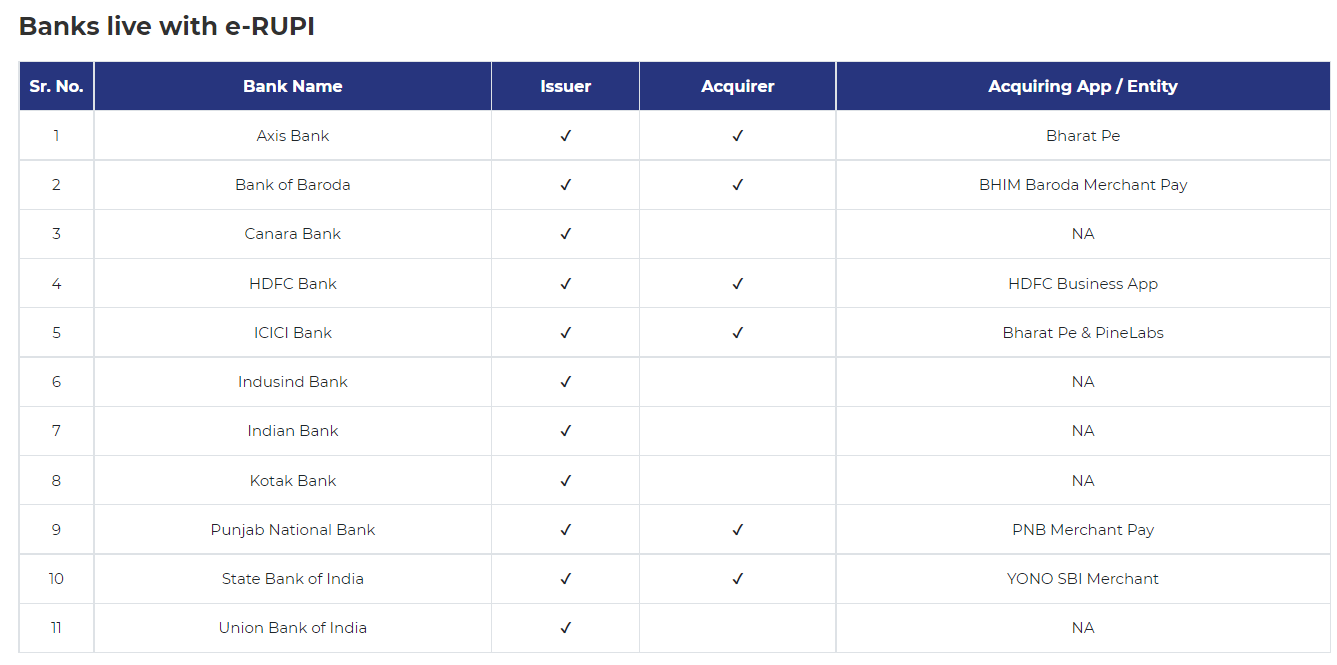

Which banks support e-RUPI, and what are they charging? According to the NPCI, the following banks listed in the table support issuing and acquiring e-RUPI vouchers (‘acquiring’ in this context refers to the merchant’s bank that accepts the transaction). For the moment, eleven banks can issue e-RUPI vouchers, and just about six banks support acquiring them. Charges depend on the bank — Bank of Baroda charges anywhere between Rs 2 to Rs 20 for issuing vouchers up to a value of Rs 10,000.

What will change with e-RUPI

How does e-RUPI change direct benefit transfers? Direct benefit transfers from the government use Aadhaar information to route subsidies into beneficiaries’ bank accounts. e-RUPI adds a restriction to this process by saying where exactly this money can be spent. While this purpose limitation may not necessarily be used in all DBTs, the government may be keener when disbursing funds for, let’s say, health insurance. The NHA’s CEO Sharma told NDTV that e-RUPI wouldn’t become limiting, arguing that there are 3 billion UPI transactions every month, and that these days “every rehadhiwala today has a QR code on his thela,” referring to pushcart vendors. That aside, having merchants configured correctly — and abundantly — will be important for e-RUPI to take off.

RS Sharma on Merchant Hesitancy: “No, the merchants will not do that [refuse e-RUPI payments],” Sharma told NDTV. “The merchant knows that if I don’t take it [an e-RUPI payment], somebody else will take it. The three important things in India are cost, convenience and confidence. These are there in digital payments system today. Cost is also zero, so obviously the merchant is not going to pay anything, so to them, it is as good as cash!”

Are there privacy concerns around e-RUPI? The NPCI says that since merchants don’t have access to beneficiaries’ personal details, e-RUPI is “Safe and Secure“. But the system follows a growing trend of financial transactions being tied to a lot of data. Srikanth Lakshmanan, who frequently writes on payments systems in India, said that e-RUPI was “embedding automatic data emission about” beneficiaries. “It converts a bearer instrument like stamp/coupon into a person/purpose specific instrument,” Lakshmanan said. Without adequate privacy protections, such stockpiling of data at different levels of payments infrastructure may have implications related to financial surveillance.

What this means is in digital India it is mandatory to have mobile phones. The will be no physical delivery of vouchers. #DigitalDivide #JioTax

— Srikanth ஸ்ரீகாந்த் (@logic) August 1, 2021

Also read

- UPI Transaction Value Up By 2.1x To Rs 6.06 Lakh Crores In July 2021: NPCI Data

- UPI Apps Are Allegedly Being Used To Bribe Voters In Tamil Nadu Elections

- UPI Payments Of Rs 50 For Gaming To Be Banned

Have something to add? Subscribe to MediaNama and post your comment

You must be logged in to post a comment Login