Adani Wilmar's IPO comprises of fresh issue of Rs 4,500 crore.

Adani Wilmar, the maker of popular cooking oil brand Fortune, filed draft papers for Rs 4,500 crore share sale via initial public offering (IPO) with the market regulator Securities and Exchange Board of India (Sebi), Adani Enterprises, which owns stake in the company said in an exchange filing post market hours on Monday. Adani Wilmar's IPO comprises of fresh issue of Rs 4,500 crore and there will not be any secondary offering, Adani Enterprises said in an exchange filing.

Adani Wilmar will use the proceeds from IPO to fund capital expenditure for expansion of AWL's existing manufacturing facilities and developing new manufacturing facilities, repayment/prepayment of borrowings, to fund strategic acquisitions and investments and for general corporate purposes, Adani Enterprises added.

"The Proposed Listing is intended to further the growth of AWL's operations by increasing its market visibility and awareness among current and potential customers," Adani Enterprises said in a statement.

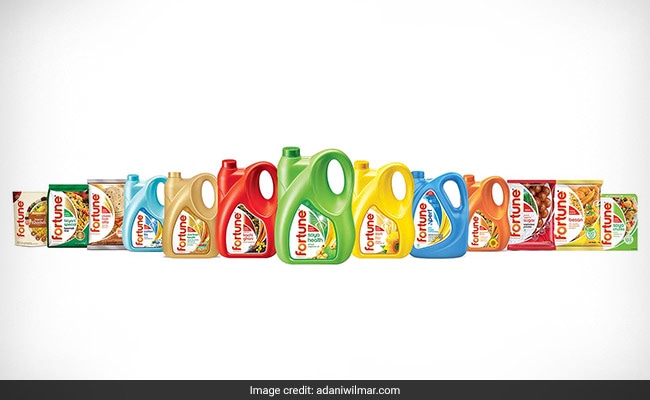

Adani Wilmar is a 50:50 joint venture between Adani Group and the Wilmar Group and is one of the few large FMCG food companies in India that offer essential kitchen commodities including edible oil, wheat flour, rice, pulses and sugar under a diverse range of brands across a broad spectrum.

The company has not mentioned the price band and dates for the IPO in the draft prospectus.

Adani Enterprises shares declined 0.22 per cent to Rs 1,434 after the announcement of proposed IPO of Adani Wilmar.