The initial public offering of vitrified tiles manufacturer Exxaro Tiles is one of four taking place this week. Here are 10 key things to know before subscribing to the issue:

1) IPO DatesBidding opens on August 4 and closes on August 6. The anchor book, if any, opens for subscription for a day on August 3

2) Public Issue Details

The issue size is 13.4 million equity shares comprising of 11.18 million fresh shares and an offer for sale of up to 2.23 million shares by investor Dixitkumar Patel. The company has reserved 268,500 shares for employees.

3) Price Band

The shares will be offered in the range of Rs 118-120 apiece. Employees get a discount of Rs 12 to the final issue price. The total value of all shares on offer is Rs 161.08 crore, at the higher end of the price band.

4) Objectives of Issue

The company will use the net proceeds for repaying certain loans, as working capital and for general corporate purposes.

5) Lot Size and Categorywise Portion

The minimum bid lot is 125 equity shares and multiples of 125 equity shares thereafter. The minimum investment by retail investors is Rs 15,000 per lot and the maximum is Rs 1.95 lakh for 13 lots.

Up to 25 percent of the offer is reserved for qualified institutional buyers, 40 percent for retail investors and 35 percent for non-institutional investors.

6) Company Profile

Exxaro Tiles makes and sells vitrified floor tiles. The company started as a partnership firm in 2007-08 making frit, a raw material used in tile manufacturing, and evolved over the years into a manufacturer of vitrified tiles.

It has two product categories – double charge vitrified tiles and glazed vitrified tiles.

The products are marketed under the Exxaro brand and they are available in six sizes and in more than 1,000 designs. It also supplies wall tiles to certain dealers, outsourcing their manufacture.

Exxaro has more than 2,000 dealers and its tiles were sold in 24 states and Union Territories in FY21. The tiles are also exported to over 12 countries including Poland, the United Arab Emirates, Italy and Bosnia. Exports contributed 13.88 percent of the company’s total revenue and they have increased at a CAGR of 47.92 percent during FY19-FY21.

The company has two plants at Padra and Talod in Gujarat with a combined installed production capacity of 13.2 million square metres per annum.

7) Strengths and Strategies

Strengths

a) State-of-the-art plants with focus on design and quality.b) Two channels for domestic marketing – supply through dealer-distribution network and supply to infrastructure-related projects and private customers.

c) Portfolio range of over 1,000 designs.

d) Management with expertise in ceramic industry, dedicated employee base.

Strategies

a) Marketing initiatives to strengthen brand Exxaro and enhance visibility.b) Expand dealer network in existing markets and widen export market.

c) Increase sales by enhancing manufacturing and procuring materials on outsourced basis.

d) Improve operating efficiencies through technology enhancements and setting up own gas station.

To Know All IPO Related News, Click Here

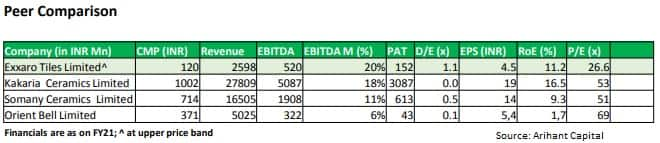

8) Financials and Peer Comparison

Exxaro Tiles made a profit of Rs 15.23 crore on revenue from operations of Rs 255.14 crore (total revenue of Rs 259.85 crore) in FY21 compared with profit of Rs 11.26 crore on revenue of Rs 240.74 crore in FY20. Earnings stood at Rs 8.92 crore on revenue of Rs 242.25 crore in FY19.

Primary peers include Kajaria Ceramics, Asian Granito India, Somany Ceramics, Orient Bell and Murudeshwar Ceramics..

9) Promoters and Management

Mukeshkumar Patel, Kirankumar Patel, Dineshbhai Patel and Rameshbhai Patel are the promoters with a shareholding of 55.19 percent of the pre-offer paid-up capital. The promoters and the promoter group hold 18.8 million shares, or 56.09 percent of the pre-offer paid-up equity capital. The rest is held by others.

Mukeshkumar Patel is chairman and managing director. He was previously account finance manager with Classic Microtech from 2007 to 2011 and manager account and finance with Regent Granito (India) from 2002 to 2007. He has about 19 years of experience in financial and marketing operations in building materials and the ceramic industry. He plans and formulates the company’s overall business and commercial strategy and develops business relations. He manages the entire accounting and financial operations.

Kirankumar Patel is a fulltime director and one of the promoters. He was proprietor of Sunshine Vitrified Tiles from 2006 to 2011. He has over 15 years of experience in sales and marketing and in the manufacturing industry. He manages sales and distribution and leads the human resources department.

Dineshbhai Patel is wholetime director and a promoter. He worked as production and operations manager at Regent Granito (India) from 2002 to 2007 and in a similar capacity with Classic Microtech from 2007 to 2012. He has 18 years of experience. He manages production and administrative operations at the Talod manufacturing facility.

Kamal Dave, Daxeshkumar Thakkar and Nidhi Gupta are independent directors.

Himanshu Shah was appointed chief financial officer of the company on May 20, 2021. He has 14 years of experience in finance, auditing and accounting. Before joining Exxaro, he was general manager – finance and accounts, at Asian Granito India.

10) Allotment, Refunds and Listing Dates

Share allotment on August 11.

Refunds/unblocking of funds from ASBA accounts on August 12.

Shares to be issued and credited to demat accounts of eligible investors on August 13.

Trading in equity shares to commence August 17.

Shares to be listed on BSE, National Stock Exchange.

Lead manager: Pantomath Capital Advisors