India, the world’s third largest oil consumer after the United States and China, imports more than 80% crude it processes and pays in dollar. Thus, it is affected by volatility of both — global oil prices and rupee-dollar exchange rate.

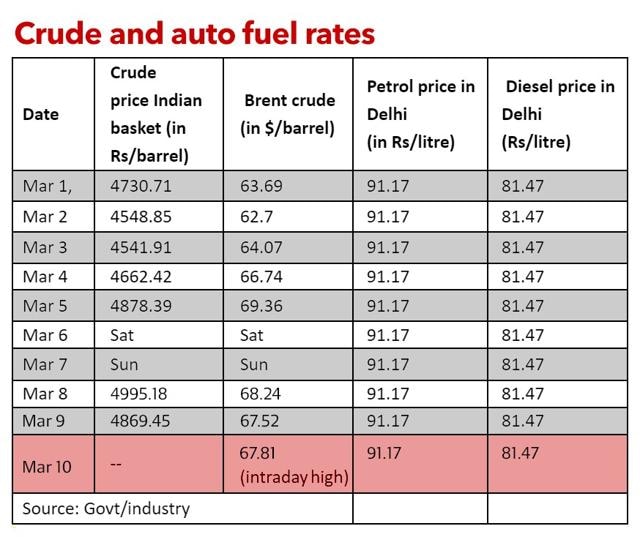

State-controlled fuel retailers have frozen petrol and diesel rates—often aligned with daily movement of global oil prices—for more than a week, even as international crude oil prices surged by 12% during this period.

According to experts, India needs to take concrete policy decisions to negotiate better pricing terms with oil producers and reduce dependence on imported crude in medium to the long run.

What experts say

Debasish Mishra, Leader Energy Resources and Industrial Products at Deloitte India:

If oil prices continue their upward journey, very soon, the Centre and states will have to take coordinated action to cut excise and VAT to give relief to consumers. Else, as the Reserve Bank of India (RBI) has recently pointed out, rising fuel prices will fan inflation and might damage prospects of post pandemic economic recovery.

Also Read | Disruption in oil supply from Saudi Arabia causes US oil prices to fall

In the short term, while India has been demanding “responsible pricing” by oil producing nations, it will remain exposed to short term volatility in the crude prices.

Overall US production is down to 10 million barrels per day (mbpd), down from 13 mbpd pre pandemic time. As OPEC, led by Saudi Arabia, refused to roll back the production cuts and the demand recovery underway, reaching 94 mbpd, with the world economy inching back to normalcy. This artificial supply constraints and recent Houthi missile attack on Saudi energy facilities has put crude oil on boil and it is expected to remain volatile with an upward bias in the near term.

India has, however, reasons to be concerned. On the one hand, its domestic production is dwindling, leading to increased oil imports and, on the other hand, alternate energy solutions are still couple of years away.

Given concerns around long term prospects for oil and challenges of Indian geology and regulatory systems, despite several policy initiatives in last seven years, India has struggled to get meaningful capital or technology in its upstream sector.

India has been diversifying its energy mix away from oil with alternate sources such as renewables, bio fuel, gas, hydrogen etc contributing more to the energy mix in the long term, but their contribution in the short term remains insignificant.

Nomura, Oil and Gas team:

In the short-term, to give relief to consumers and also to abate concerns of inflation, the government could reduce taxation on retail fuel. In 2020, when oil prices had collapsed, the Central government had sharply increased excise duties on petrol/diesel by ₹13-16 per litre, and also several state government had increased VAT. These taxes could be reduced.

In the medium-to-long term, efforts need to be made to reduce India’s rising dependence on oil imports. The government can encourage domestic exploration and production (E&P)investment by more favorable investment climate. But, as India is not endowed with large resources, upside is limited.

To reduce dependence on oil, in the medium term, India needs to focus increasing the share of gas in economy. Compared to oil, gas prices are lower on energy equivalence basis. Also, compared to liquid fuel, gas is relatively cleaner and has lower carbon footprint. The Indian government has an aggressive target of increasing share of gas in energy basket from present 6% to 15% (by 2030).

Over the longer-term, switching to renewables for energy generation, and increasing share of electric vehicles will need to be the strategy. In the last few years, India has seen sharp increase in renewable energy production. However, compared to target of 175GW by 2022, the current capacity of 93GW is low; investments in renewable needs to be ramped-up further, particularly as India has a very aggressive target of reaching 450GW of renewable energy by 2030. Similarly, the government would need to give a policy push to electric vehicles as well.

Prashant Vasisht, vice president and co-head, Corporate Ratings, ICRA Ltd:

Oil prices have surged post OPEC+ decision to keep production steady, including the voluntary cut of one million barrel per day by Saudi Arabia which has been extended till April 2021 and the attack on Saudi oil facilities. Moreover, real and perceived recovery in products demand following Covid-19 vaccination programmmes in different parts of the world and colder than expected winters in some countries have also contributed to the surge in prices. The industry has also been under-investing lately, which is diminishing the spare capacities available for sudden surge in demand.

What should be India’s short-term, medium-term and long-term strategies? Short term strategies could include bringing down the taxes by the Centre and states to make the impact on consumers palatable.

Over the medium to long term, ethanol blending program could be further intensified used to cut dependence on crude imports. Moreover, thr strengthening of the public transport system and electrification of transport through EVs should be pursued.

India should also try to attract more risk capital into the E&P space by making the sector attractive by addressing the perennial “above the ground” (taxes, arbitrations, pricing issues etc) and “below the ground” (statutory approvals, infrastructure etc) issues.

SC Sharma, energy expert and former officer on special Duty at the erstwhile Planning Commission:

Oil-importing nations have been at the mercy of very high price volatility due to speculations and OPEC+ announcing production cuts, thus overlooking the natural balance of commodity demand supplies. The global trade of other commodity such as metals, food, services etc does not have a group of producer exporters which cut production to create artificial shortages to hike prices — like it is done in oil trade — and the market for these commodities works purely on demand supply mechanism.

Oil is the only commodity where production cuts have become a tool to push up the prices by the major exporting nations and, accordingly, there is a need to constitute a group of major oil importing nations to counter very high volatility in prices with better bargaining power and an understanding to mitigate any quick spike of oil prices.

There is also a need to lift sanctions on Iran for it to produce oil at its full potential. In 2016-17, Iran produced 4-5 million barrels per day (mbpd) of oil, which is currently come down to 1.95 mbpd. Iran also holds very large gas reserves, which could not be developed for exports due to sanctions. The sanctions defeat the purpose of natural market demand supply mechanism where major oil importing nations are sufferers.

It is believed that the new administration [in the US] would ease the sanction for Iran to produce oil. Iran had been producing at 4-5 mbpd of oil where India was one of the major importers. Since India has cut its imports from Iran and has been importing those volumes from Saudi Arabia and Iraq, a gradual shift is required to import oil from Iran. Any additional production volumes of oil from Iran would help easing oil prices.

Neelakantan V R, partner, project & project finance, Shardul Amarchand Mangaldas & Co.

The global spike in oil prices has been fuelled to a large extent by a combination of normalisation of demand ,which had seen a substantial reduction due to the Covid pandemic, and, the continued production cuts by the OPEC+.

More immediately of course, geo-political concerns such as the recent rebel attacks on crude oil facilities in Saudi Arabia have also been a significant factor in the sharp increase in global crude prices.

Given India’s significant dependence on imports, commodity prices in India will naturally continue to remain affected by global crude volatility. The government should focus on significantly increasing the strategic petroleum storage capacity in India, to enable enhanced stockpiling which would be a mitigant during periods of price spikes. There is also a need for greater emphasis on E&P activities within India, as well as acquisition of acreages outside India to better manage India’s energy security position.

Finally, given the dependence on imports, in the long term it is important for there to be a significant energy diversification, to reduce long term dependence on oil.

Leave a Comment