Praveen Jagwani CFA

Until Jim O’Neill coined the term BRIC in 2001, India was largely irrelevant in the global context. However, during the past twenty years, India’s economy has been quietly compounding at approx. 6.5% per annum to become the fifth-largest in the world. There is a universal conviction that India’s GDP will become the third-largest within this decade, eclipsing Germany and Japan in the next 3 and 6 years, respectively.

It is not just the absolute growth of India that is remarkable but the sheer consistency of it despite the vagaries of economic cycles and shifting geopolitical sands. It owes this predictable consistency to the steady consumption by a rising youthful middle class.

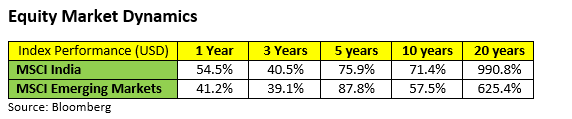

India’s equity market recently crossed the USD 3 trillion mark in market capitalisation, reflecting the escalating momentum of economic activity. As the table shows, the returns from Indian equities have not been disappointing for investors. In the backdrop of the optimistic macro-outlook for the Indian economy and markets, it bears to reason that corporate earnings will climb to the mid-teens, and India will continue to outperform EM indices through this decade.

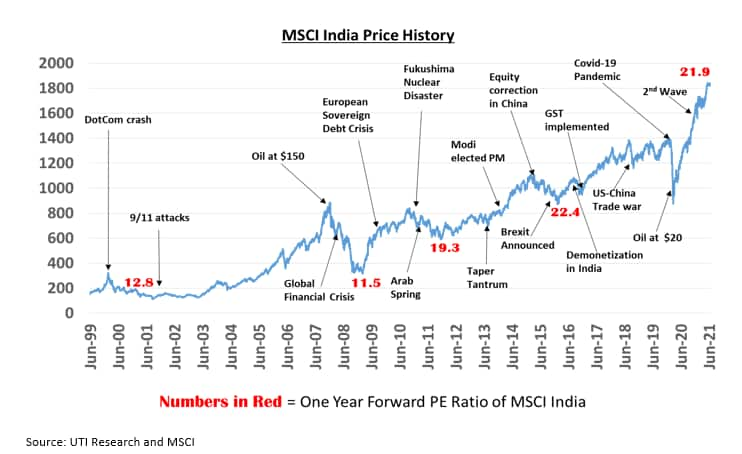

Historically, Indian equities have consistently traded at a premium to the broader Emerging Market (EM) index. As is evident from the chart below, there’s never been a time when global investors have not been hesitant about India, even as the long term factors continue to propel markets higher.

Ten years ago, foreign investors controlled nearly 40% of India’s free-float market cap. However, with the frenetic rise of domestic investors (institutional and retail), the foreign investors now influence only about 33% of the free float. Consequently, the ability of foreign flows to cause wild swings in Indian markets is gradually declining.

Studies have revealed Foreign Institutional Investors behave like momentum traders while domestic investors adopt a more buy-and-hold and systematic investment style. Between these two groups, the investment approach of domestic investors has proved to be marginally more profitable than the tactical in & out the style of foreign investors. Perhaps it is time for foreign investors to hunker down and ride the coming India wave.

Covid Update

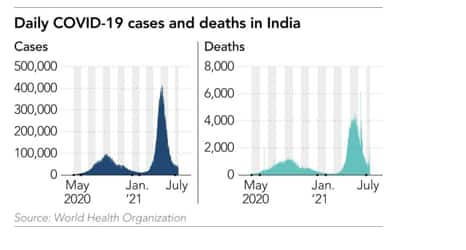

The second covid wave has abated in India, and its economic impact has been slight. The fourth national sero-survey conducted by the Indian Council of Medical research over June-July 2021 has indicated that 68% of Indians have developed antibodies against SARS-Cov2 versus 24% reported in the previous survey done in Dec’20-Jan’21.

The high presence of antibodies among two-thirds of the population is likely to mitigate the scale of the third wave if it occurs. India has been vaccinating 3.9m people daily, on average, during this month, and the Indian Government is resolved to prevent stoppage of economic activity.

Unicorn Boom

While China’s crackdown on its big tech is spooking global investors, India is busy minting unicorns. With 50 recognized unicorns, India ranks at third place behind US and China. Of these 50, 16 were born just this year and the total number is expected to grow to 150 by 2025.

Earlier this month, Zomato, a food delivery app, became India’s first unicorn to list, raising $1.3 billion in its IPO. Online retailer Flipkart recently raised $3.6 billion at a $38 billion valuation, while Paytm, a digital payments company, is slated to list later this year with a $2.2 billion IPO.

These unicorns are primarily funded by global capital chasing the buying power of India’s 625 million internet users. India’s population is expected to overtake China’s this decade, and astute investors don’t want to miss out.

India is the final country that offers sustainable growth opportunities at scale with improving incomes and digital infrastructure.

Capex Revival

The revival of global & domestic demand has caused capacity utilisation in India to reach 67% from the low of 47% in Jun-20. New investment projects and private investment flows have seen a spectacular revival, particularly in the manufacturing sector suggesting a gradual resurgence of the much-awaited Capex cycle.

We believe that recovery in consumption and exports over the coming quarters will help lift capacity utilisation rates even higher.

In summary, Indian companies are undertaking expansion as balance sheets become stronger with improving earnings. This is most visible in sectors like electronics and pharmaceuticals, where supply chains are migrating to India, creating long term employment.

The Government supports through conducive policy measures like reduction in corporate tax rates, labour reforms and Production Linked Incentives.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.