Top Searches

- News

- Business News

- India Business News

- ‘Weak households, SMEs may need more stimulus’

‘Weak households, SMEs may need more stimulus’

International Monetary Fund (IMF) chief economist Gita Gopinath draws several positives from India’s policy actions — from free food for the poor to healthcare spending and the RBI’s stance. While responding to TOI’s questions over e-mail, she suggests that the government may need to provide a stimulus to vulnerable households, SMEs and step up education and capital expenditure. Excerpts:

Does the government need to provide a bigger fiscal push to spur growth?

Given the ongoing health crisis, fiscal policy should provide agile and flexible policy support to respond to Covidrelated developments. The government’s announcement to provide additional support to minimise the social cost of the pandemic, including the extension of free food rations, additional spending on health infrastructure and provision of free vaccines to states are welcome.

Going forward, additional fiscal stimulus can and should be deployed to support vulnerable households and small- and medium-sized firms and for other priority spending, such as education and support to states for capital spending. It is important that alongside such support, a credible fiscal consolidation plan for the mediumterm is announced as this will reinforce market confidence. Structural reforms, including in the financial sector, will be needed to boost India’s growth potential.

When do you see easy monetary policy in the US and Europe tapering off? How can emerging economies prepare to meet the challenge?

In our July 2021 forecasts, we assume that major central banks will leave policy rates unchanged through next year. If our baseline outlook and fiscal policy assumptions for the US are realised, policy rates will likely start rising in late-2022 or early-2023 (with asset purchases being scaled back in the first half of 2022). For the euro area, given that inflation is projected to stay below target for a while, we expect it will take even longer for policy rates to rise there.

In India, given the large, negative impact of the pandemic on growth, including as a result of the second wave, amid unprecedented uncertainties, the RBI’s accommodative monetary stance, coupled with adequate systemic liquidity through various instruments, remains appropriate. India’s sizeable foreign exchange reserves provide some cushion against spillovers from recalibration of monetary policy in advanced economies.

How does protectionism in India compare with other countries? Do you think this will hurt investment needed to boost growth?

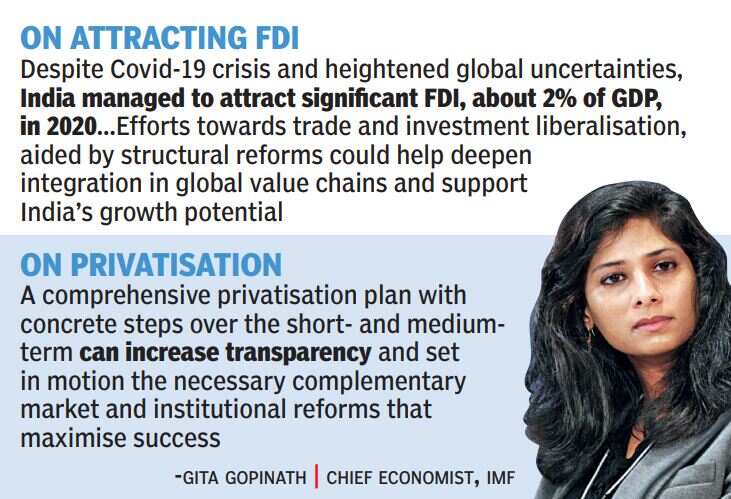

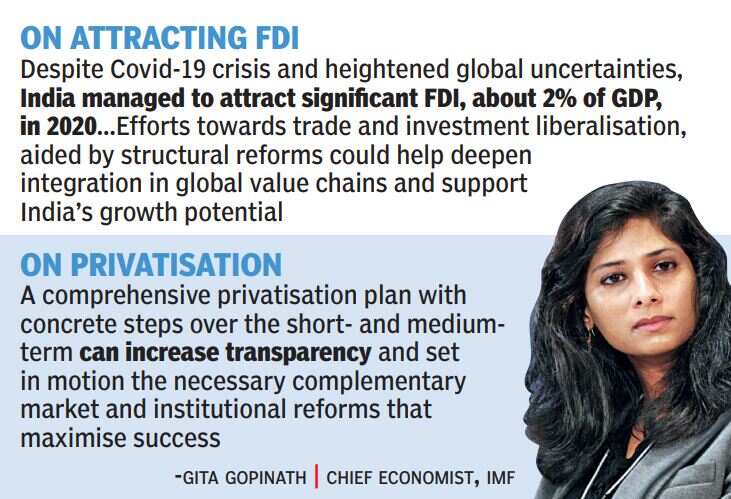

In recent years, India has taken important steps to further liberalise its policies. Despite Covid crisis and heightened global uncertainties, India managed to attract significant FDI, about 2% of GDP, in 2020. The increase in intermediate goods tariffs is, however, a concern since the government wants to strengthen integration into global value chains. Further efforts towards trade and investment liberalisation, aided by structural reforms could help deepen integration in global value chains and support India’s growth potential.

Does the government need to provide a bigger fiscal push to spur growth?

Given the ongoing health crisis, fiscal policy should provide agile and flexible policy support to respond to Covidrelated developments. The government’s announcement to provide additional support to minimise the social cost of the pandemic, including the extension of free food rations, additional spending on health infrastructure and provision of free vaccines to states are welcome.

Going forward, additional fiscal stimulus can and should be deployed to support vulnerable households and small- and medium-sized firms and for other priority spending, such as education and support to states for capital spending. It is important that alongside such support, a credible fiscal consolidation plan for the mediumterm is announced as this will reinforce market confidence. Structural reforms, including in the financial sector, will be needed to boost India’s growth potential.

When do you see easy monetary policy in the US and Europe tapering off? How can emerging economies prepare to meet the challenge?

In our July 2021 forecasts, we assume that major central banks will leave policy rates unchanged through next year. If our baseline outlook and fiscal policy assumptions for the US are realised, policy rates will likely start rising in late-2022 or early-2023 (with asset purchases being scaled back in the first half of 2022). For the euro area, given that inflation is projected to stay below target for a while, we expect it will take even longer for policy rates to rise there.

In India, given the large, negative impact of the pandemic on growth, including as a result of the second wave, amid unprecedented uncertainties, the RBI’s accommodative monetary stance, coupled with adequate systemic liquidity through various instruments, remains appropriate. India’s sizeable foreign exchange reserves provide some cushion against spillovers from recalibration of monetary policy in advanced economies.

How does protectionism in India compare with other countries? Do you think this will hurt investment needed to boost growth?

In recent years, India has taken important steps to further liberalise its policies. Despite Covid crisis and heightened global uncertainties, India managed to attract significant FDI, about 2% of GDP, in 2020. The increase in intermediate goods tariffs is, however, a concern since the government wants to strengthen integration into global value chains. Further efforts towards trade and investment liberalisation, aided by structural reforms could help deepen integration in global value chains and support India’s growth potential.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST