It is almost eight weeks now that the Nifty and the broader Nifty500 indices have been moving in a sideways trajectory. Both the frontline and the broader indices marked their high in the first days of June. Since then, barring one incremental high which did not result in a breakout, they have remained in a broad sideways trajectory.

This had made the markets highly stock-specific in nature. The absence of any sectoral leadership is evident as more relative outperformance has come from individual stocks from different sectors.

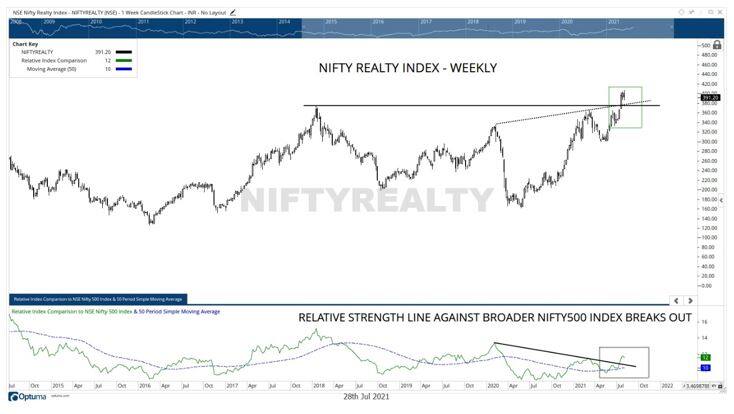

Amid this kind of technical setup, Nifty Realty Index has not only shown a serious technical breakout but has shown all signs of some continued relative out-performance against the broader markets.

Nifty Realty Index has staged a major breakout on the weekly charts when it took out the major resistance point at 375. It was nearly a three-and-a-half-year-old resistance point that was created when the Realty index had formed its high in early 2018. The Realty Index stands at 391; even if a full throw back occurs and the index tests the 370-375 zone, the breakout will still remain in force.

The Relative Strength line of Nifty Realty Index has also taken out a pattern resistance; it has changed its trajectory and crossed above the 50-week MA while moving higher.

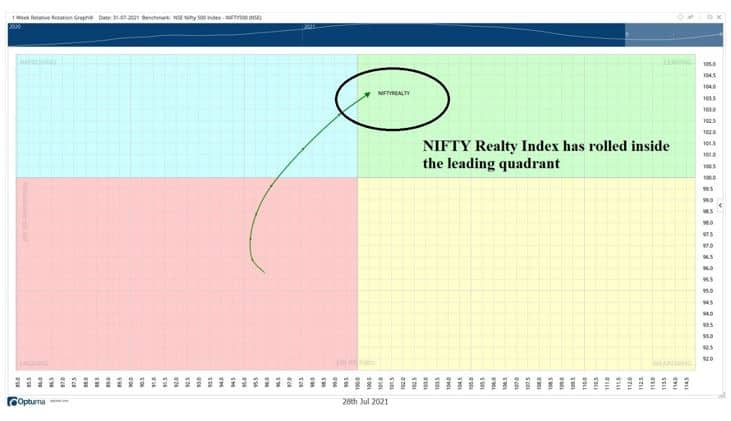

Interestingly, Nifty Realty Index has rolled inside the Leading Quadrant of the Relative Rotation Graph (RRG) when benchmarked against the broader Nifty500 Index. This means that this sector is set to relatively outperform the broader markets.

It is a natural question to ask; if realty is the sector that one should look at for resilient and relative outperformance, what stocks should one focus on? The answer to this will come from understanding how the Realty Index is constructed.

Top two stocks, DLF and Godrej Properties have weight of 25.81% and 24.22% in the Realty index. So, these two stocks combined, they represent 50.03% of the entire Nifty Realty index.

The price measurement targets through the use of classical concepts of technical analysis of the Nifty Realty Index which is presently at 391 can be put at 460-475 levels in the medium term. The weekly charts of DLF (Right axis) and Godrej Properties (Left Axis) show that they are structurally buoyant and remain in a primary uptrend. It is quite obvious that if the Nifty Realty Index has to move higher, these two stocks that make 50% of the Index have to move higher.

We can fairly draw a conclusion from this top-down analysis that we will see Nifty Realty Index remaining resilient during any corrective move and it will show strong relative outperformance against the broader markets. The top stocks that investors need to watch over and above DLF and Godrej Properties would be Oberoi Realty and Phoenix Mills as these four stocks make up 72.94% of the total Realty Index.

This theme should play out well for investors over the near-to-medium term.

The author is Consulting Technical Analyst at Gemstone Equity Research & Advisory Services

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.