DLF Ltd, the country’s largest realtor by market capitalisation, reported Rs 337.2 crore profit after tax (PAT) for the April-June quarter. The group had posted Rs 71.5 crore net loss during the corresponding quarter last year.

In June, the Delhi-headquartered real estate major’s operating revenue stood at Rs 1,139.5 crore, 108 per cent higher from Rs 548.6 crore last year. The firm's PAT and revenue both grew significantly on a low base, but fell by double digits sequentially. While its operating revenue fell 33.5 per cent from Rs 1,712.6 crore in the March quarter, PAT was down 29.4 per cent from Rs 477.4 crore.

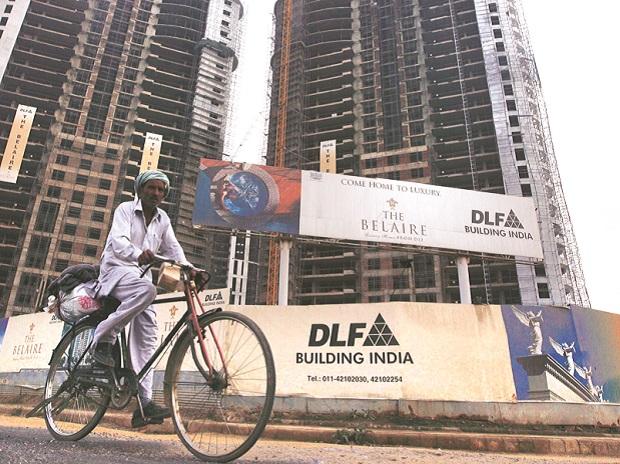

According to the company, demand in the residential segment has been encouraging and since the pandemic, the inherent demand for homes has gone up. New sales bookings exhibited sustained performance sequentially and stood at Rs 1,014 crore, growing 5.67 times YoY. “We clocked new product sales bookings of Rs 542 crore during the quarter. The launch of independent floors across Gurgaon continues to garner an enthusiastic response from the market and exhibited healthy absorption trends, while the luxury segment remains attractive,” it said.

While the rental business continues to face disruption due to Covid-related curbs, DLF said it expects demand for office space to bounce back in the second half of the year. “The retail business is witnessing some short-term dislocations with intermittent local lockdowns. All our malls are now operational, though, with certain restrictions. Since the opening of these malls, we are witnessing a steady increase in footfalls, mirroring the trend of the second half of FY21”.

At the end of June, its net debt shrank to Rs 4,745 crore from Rs 5,267 crore in March-end. The outbreak of the Covid second wave severely disrupted and slowed down economic activities. This has led the group to reassess its asset positions recently, the company management informed the Bombay Stock Exchange.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU