Indian market ended marginally lower in a truncated week amid mixed cues and rising concerns over Delta variant of COVID, but better earnings from India Inc capped losses.

Last week, BSE Sensex ended 0.30 percent lower at 52,975.8, while the Nifty50 was down 0.42 percent to close at 15,856 levels.

S&P BSE Midcap index ended lower by 0.47 percent, while BSE Smallcap index ended flat in the week ended July 23.

Experts expect the volatility to continue in the coming week considering the expiry of July derivative contracts. The focus will remain on the global Covid situation along with US Federal Reserve meeting outcome.

"We expect volatility to remain high due to the scheduled derivatives expiry of July month contracts. Besides, the update on the global COVID situation and US Fed meeting outcome on July 28 will be in focus," said Ajit Mishra, VP Research at Religare Broking.

"We are again at the record high however the underperformance of the banking index is still a concern. The recent surge in volatility warrants extra caution in the selection of stocks and trade management. We advise limiting leveraged positions and waiting for further clarity."

On Monday, the market will first react to the earnings of Reliance Industries, ICICI Bank and ITC, which were announced in the after market hours on Friday and Saturday.

Here are 10 key factors that will keep traders busy in the coming week:

The June quarter earnings season will be in full force as more than 380 companies will release their quarterly scorecard in the coming week. The prominent names to watch out for would be Axis Bank, Kotak Mahindra Bank, Larsen & Toubro, DLF, SBI Life Insurance Company, Tata Motors, Dr Reddy's Labs, IndusInd Bank, Maruti Suzuki India, Nestle India, Tech Mahindra, Britannia Industries, Indian Oil Corporation, Sun Pharmaceutical Industries, and UPL.

Among others, Alembic Pharmaceuticals, Apollo Pipes, Coromandel International, GSK Pharma, Jindal Stainless, KPIT Technologies, M&M Financial Services, Sun Pharma Advanced Research Company, Vedanta, Canara Bank, Dixon Technologies, InterGlobe Aviation, Karnataka Bank, Torrent Pharmaceuticals, TTK Prestige, ABB India, Birlasoft, Central Bank of India, Happiest Minds Technologies, IDBI Bank, Route Mobile, UTI Asset Management Company, Colgate-Palmolive, Indus Towers, JK Lakshmi Cement, LIC Housing Finance, Motilal Oswal Financial Services, PVR, TVS Motor Company, Union Bank of India, Bandhan Bank, BHEL, Equitas Small Finance Bank, Exide Industries, JSW Energy, Macrotech Developers, Marico, IDFC First Bank, NTPC, and Sobha will also release their quartery numbers next week.

India’s brutal second wave of COVID-19 pandemic is receding and the country is preparing for the possible third coronavirus wave. So far, the country has recorded over 3.13 crore confirmed COVID-19 cases, including 4,20,551 deaths. A total of 3,05,43,138 people have recuperated from COVID-19 so far. There are 4,08,212 active COVID-19 cases in the country, which comprises 1.3 percent of the total caseload, the data stated. India's recovery rate now stands at 97.36 percent.

Globally, more than 19.31 crore people have been infected by the coronavirus and 41.51 lakh have died so far. India has begun the third phase of the vaccination drive in which everyone above 18 years of age will be able to get the COVID-19 vaccine. The cumulative number of COVID-19 vaccine doses administered in India has crossed 42.78 crore, according to the Union Health Ministry.

Hence, this will remain a key thing to watch out for next week.

FOMC

Globally, investors will keep a close watch on the meeting of Federal Open Market Committee which is scheduled for two days - July 27-28. The Fed funds rate is expected to remain at 0.00-0.25 percent levels for a longer time, but the commentary with the respect to any hint of tapering of bond purchases will be keenly watched.

Fed officials at their last meeting projected the possibility of two rate hikes by 2023 and also began discussions to taper asset purchases. "Since then, Fed officials have largely painted a mixed view on the need for monetary tightening. However, Fed Chairman Jerome Powell has repeatedly maintained a dovish stance and played down inflation risks," said Ravindra Rao of Kotak Securities.

He further said, "US economic numbers have also been mixed highlighting uneven recovery. Consumer price in June rose at the fastest pace since 2008 amid further signs of rising inflation concerns. Labour and housing data has been mixed while manufacturing activity has paused."

Two initial public offerings - Glenmark Life Sciences and Rolex Rings - will hit the Street next week

Glenmark Life Sciences, the subsidiary of Glenmark Pharma, will open its IPO for subscription during July 27-29, with a price band of Rs 695-720 per share. The company is planning to raise Rs 1,513.6 crore through its public issue.

Automotive components manufacturer Rolex Rings will also open its offer on July 28 and will close on July 30, comprising a fresh issue of Rs 56 crore and an offer for sale of up to 75 lakh equity shares by Rivendell PE LLC.

Specialty chemicals company Tatva Chintan Pharma Chem will debut on the bourses around July 29. The Rs 500-crore issue had seen a stellar subscription of 180.36 times during July 16-20.

Its shares were available at a premium of Rs 1,000 in the grey market, the IPO Watch data showed. This equates to a 92 percent premium over the higher end of the issue price of Rs 1,083, which actually increased considerably from Rs 750 seen a week back, pointing towards a bumper listing.

FII Flow

Foreign institutional investors continued to offload equity shares in India and remained net sellers during the week ended July 23, restricting the upside of market, though domestic institutional investors continued supporting the market through consistent buying. Hence, the flow will be closely watched going forward as experts feel any increase in FII selling could derail the market momentum.

FIIs have net sold Rs 5,444.57 crore of shares during the week, taking the total monthly selling to Rs 12,368.18 crore in July, while DIIs have net bought Rs 5,051.15 crore worth of shares in a week, taking the total to Rs 10,187.60 crore in the month of July.

Technical View

On Friday Nifty50, after morning volatility, turned positive in afternoon and remained higher for the rest of the session to close 32 points higher, but witnessed Doji Cross formation on the daily charts as the closing was near to its opening levels and there was mild selling pressure at higher levels. The index fell 0.4 percent during the week and formed a bullish candle on the weekly scale.

"A close observation of weekly charts reveal that 6 out of last 7 weeks remained extremely narrower hinting that market may be in distribution phase at higher levels which will be confirmed only on a breakdown below 15,600 levels on closing basis. These kind of narrow trading ranges with indecisive formations on the back of negative advance decline ratio can be a cause for concern," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.in said.

Contrary to this, he feels if the index sees a strong sustainable close above 15,900 then it can give much needed confidence to bulls who can then get the courage to march towards 16,300 levels. "In next trading session it remains critical for bulls to sustain above 15,768 levels to retain positive bias as breach of said level can induce more selling pressure on intraday basis," he said.

F&O Cues

The option data suggested that the Nifty50 could trade in the range of 15,700-16,000 levels in the coming F&O expiry week, while the decline in volatility indicated that the market is unlikely to see a major fall in coming days.

On option front, maximum Put open interest was seen at 15000 followed by 15800 and 15500 strikes while maximum Call open interest was seen at 16000 followed by 15900 and 15800 strikes. Call writing was seen at 16000 then 15900 and 16100 strikes while Put writing was seen at 15800 then 15000 and 15900 strikes.

"The options activity is concentrated at ATM strikes of 15800 for both Call and Put. While the highest Call base is at 16000 strike, Put base is highest at 15800 strike. Hence, prima facie, a move below 15,750 should trigger downside towards 15,500," said ICICI Direct.

On higher side, the brokerage believes retesting of last week's high itself may trigger short covering momentum, which may take the Nifty towards 16,200 levels.

Volatility index has moved back below 12 levels after testing 14 last week, closing at 11.76 levels compared to 11.70 levels on week-on-week basis. During the month, "on multiple occasions, it has found resistance around these levels. We believe move above 14 levels for volatility index should be considered negative. Including the weekend, we have results from almost 16 Index companies, which may trigger some volatility," ICICI Direct said.

Corporate Action and Economic Data

Here are key corporate actions taking place in the coming week:

Moreover, deposit & bank loan growth for fortnight ended July 16, and foreign exchange reserves for week ended July 23, fiscal deficit & infrastructure output for June, will be released on Friday.

Global Cues

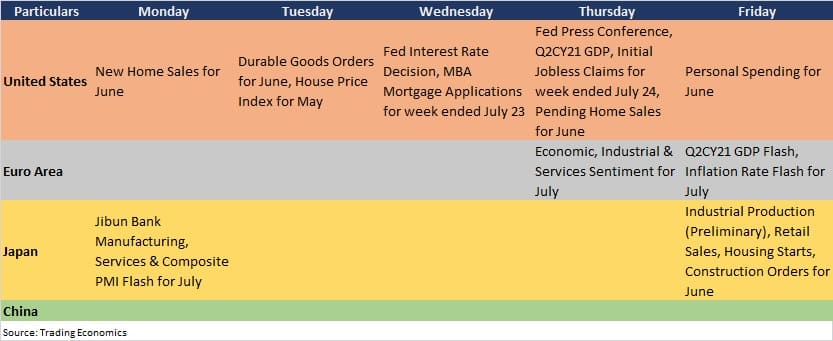

Here are key global data points to watch out for next week: