Although user growth grew considerably in this quarter, the company faced challenges due to the pandemic and subsequent economic disruptions to the supply chain.

Key Takeaways

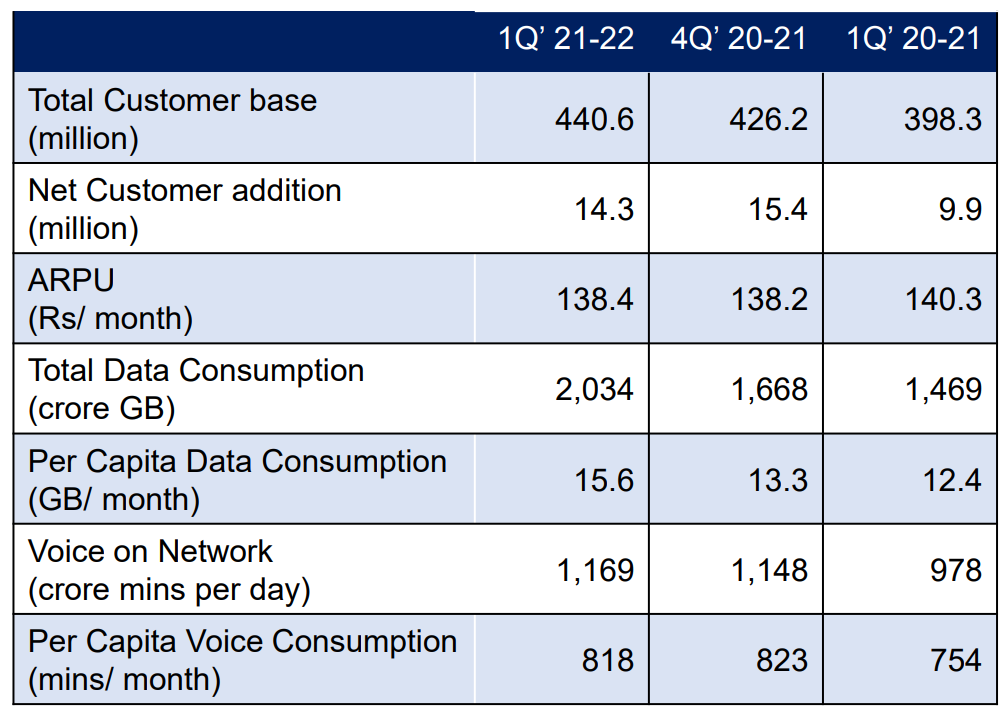

- Jio customers consumed over 2 exabytes of data during Q1FY22, a significant quarter-on-quarter (QoQ) boost from 1.6EB, attributable at least partly to the second wave of the COVID-19 pandemic; the year-on-year (YoY) increase in data consumption was around 38%. This translates to over 2 million terabytes consumed by Jio users over the last three months.

- Per-user data consumption stood at 15.6GB a month, compared to 13.3GB a month in the previous quarter.

- Average Revenue Per User stood at Rs 138.4, barely moving from the previous quarter when it stood at Rs 138.

Revenue flat, but healthy user adds

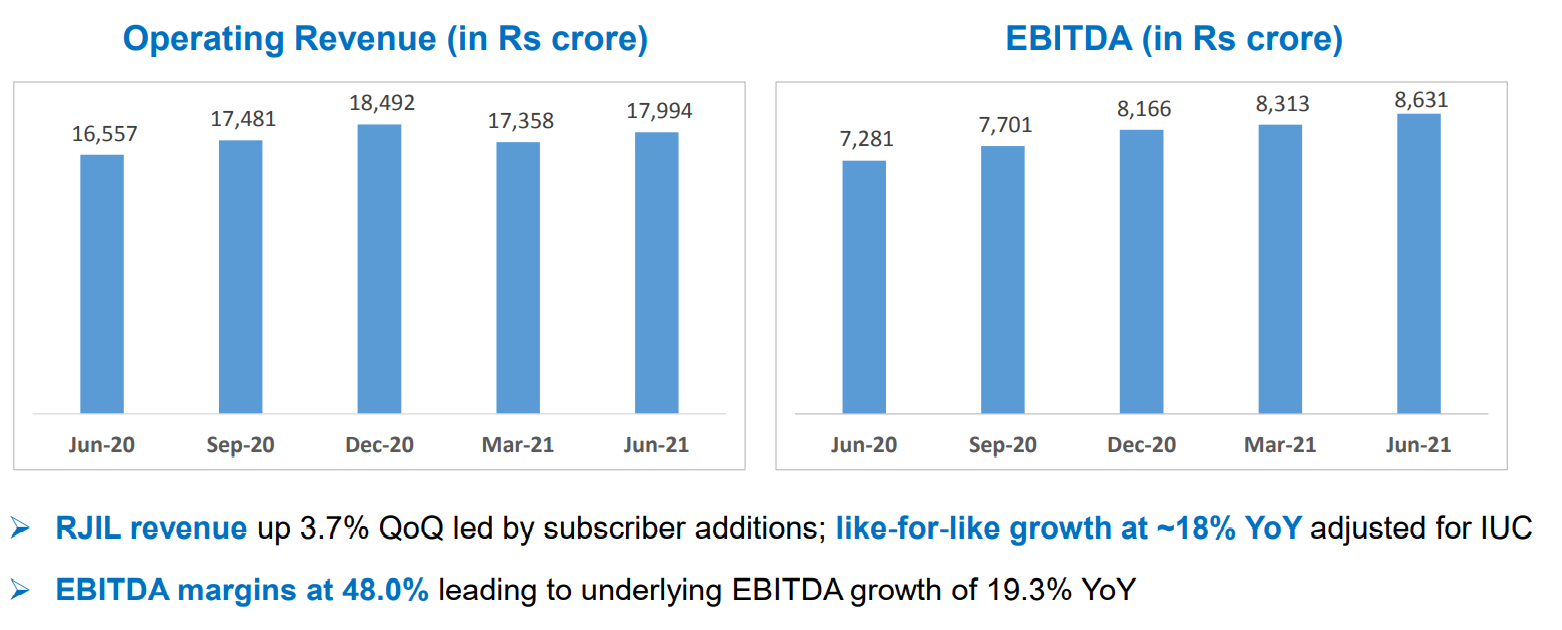

Operating revenue has barely picked up over the last year, even getting a bit depressed in the quarter ended March, before the second wave. Reliance blamed the lackluster QoQ pick-up in growth on the abolition of the Interconnect Usage Charge, a system where telcos used to pay each other a metered fee for calls placed on each other’s network. The “like-for-like growth” ignoring this impact, Jio said, was 19.3%.

User growth, on the other hand, grew considerably, likely outpacing rivals Vi and Airtel:

COVID-19 challenges

The company said that it had trouble scaling fixed broadband and TV subscriptions during the second wave, in spite of telecom being an essential activity — this may perhaps be due to trouble in supply chain management and shuttering of associated businesses

The COVID-19 pandemic and related economic disruptions have delayed execution of:

- Challenges in the ramp-up of customer additions for Homes & Enterprises

- Delay in incremental monetisation of Connectivity and Digital platforms — Reliance Presentation

Growth of fixed broadband: While overall the business suffered from some impact due to COVID-19, home broadband consumption thrived. “Average home consumes almost 300 GB of data per month and trending upwards,” the company said. It also said that the company now has over 3 million JioFiber customers. That translates to a 13% market share less than five years after its launch in an internet service provider market that is far more competitive than the telecom market.

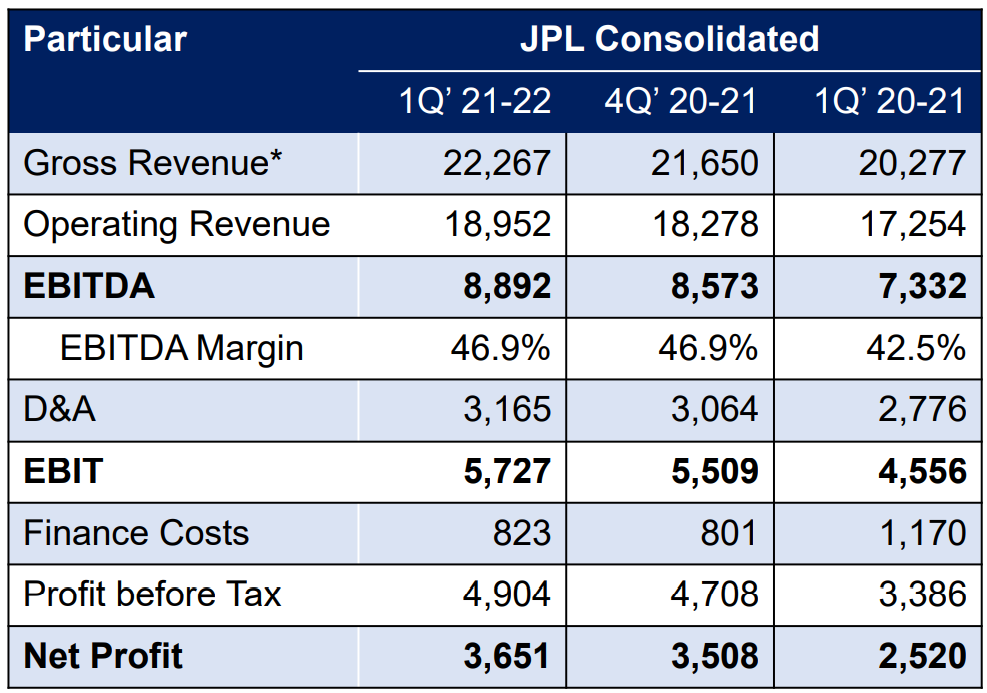

Financial Snapshot — Q1FY22

- Revenue: Rs 18,952 crore (up ~19% YoY)

- EBITDA: Rs 8,892 crore (up 21.3% YoY)

- Net Profit: Rs 3,651 crore (up from Rs 2,520 crore YoY)

Press Release and Results | Presentation

Also read:

- Reliance Jio And Airtel Added 7.3M And 4.8M Active Connections, Vi Lost 0.38M In March 2021

- Jio Objects To TRAI Proposal To Give Fixed Line Broadband License Fee Concessions As DBT

- Airtel, Jio Offer Free Calling For Low-Income Subscribers