The market extended losses for third consecutive session with the Nifty50 falling below 15,700 levels on July 20. Banking & financials, auto, metals and pharma stocks saw selling pressure.

The BSE Sensex was down 354.89 points at 52,198.51, while the Nifty50 fell 120.30 points to 15,632.10 and formed bearish candle on the daily charts as the closing was lower than opening levels.

"With the current close, the index is approaching its four to six weeks multiple support zone of 15,600 levels which remains a crucial level to watch for," Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities told Moneycontrol.

He said on the downside, any violation of an intraday support zone of 15,580 levels may cause profit booking towards 15,500-15,400 levels.

"The next higher levels to be watched are around 15,700 levels. Any sustainable move above 15,700 levels may cause momentum towards 15,800-15,850 levels," he added.

The broader markets fell sharply, underperforming benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices declined 1.4 percent each.

The market was shut on July 21 for Bakri-Id.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,564.23, followed by 15,496.37. If the index moves up, the key resistance levels to watch out for are 15,714.23 and 15,796.37.

Nifty Bank

The Nifty Bank plunged 663.75 points or 1.89 percent to 34,415.45 on July 20. The important pivot level, which will act as crucial support for the index, is placed at 34,217.16, followed by 34,018.93. On the upside, key resistance levels are placed at 34,753.87 and 35,092.34 levels.

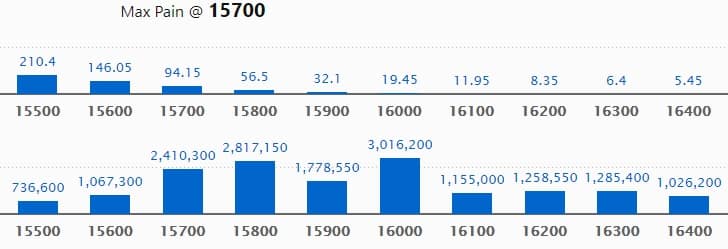

Call option data

Maximum Call open interest of 30.16 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the July series.

This is followed by 15,800 strike, which holds 28.17 lakh contracts, and 15,700 strike, which has accumulated 24.10 lakh contracts.

Call writing was seen at 15,700 strike, which added 13.67 lakh contracts, followed by 15,600 strike which added 8.17 lakh contracts and 15,800 strike which added 6.19 lakh contracts.

Call unwinding was seen at 16,200 strike, which shed 2.45 lakh contracts, followed by 16,400 strike which shed 2.30 lakh contracts, and 16,300 strike which shed 2.05 lakh contracts.

Put option data

Maximum Put open interest of 34.57 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the July series.

This is followed by 15,500 strike, which holds 29.86 lakh contracts, and 15,300 strike, which has accumulated 18.89 lakh contracts.

Put writing was seen at 15,600 strike, which added 3.27 lakh contracts, followed by 15,200 strike which added 2.33 lakh contracts, and 15,300 strike which added 1.92 lakh contracts.

Put unwinding was seen at 15,800 strike, which shed 5.48 lakh contracts, followed by 15,900 strike which shed 2.55 lakh contracts, and 15,000 strike which shed 2.51 lakh contracts.

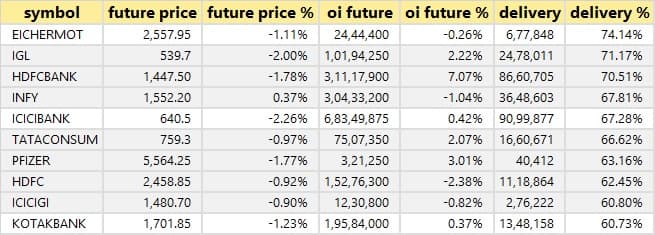

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

14 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

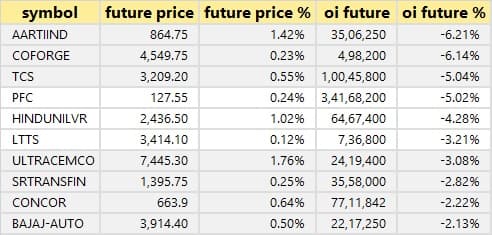

77 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

55 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

16 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

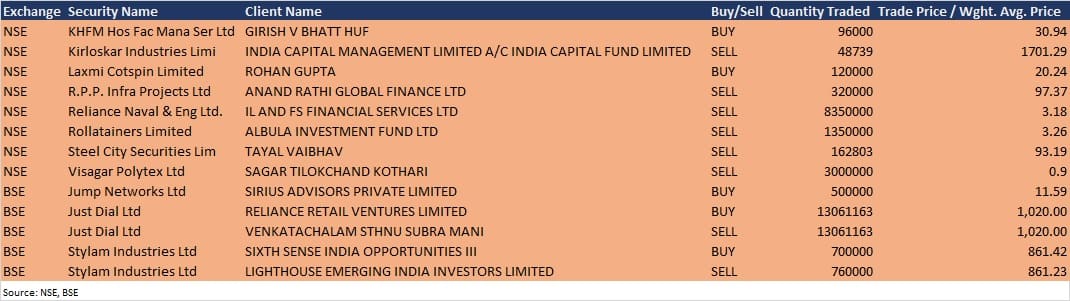

Bulk deals

Jump Networks: Sirius Advisors acquired 5 lakh equity shares in the company at Rs 11.59 per share on the BSE, the bulk deal data showed.

Just Dial: Reliance Retail Ventures bought 1,30,61,163 equity shares in the company at Rs 1,020 per share, whereas Venkatachalam Sthnu Subra Mani sold 1,30,61,163 equity shares in the company at same price on the BSE, the bulk deal data showed.

Stylam Industries: Sixth Sense India Opportunities III acquired 7 lakh equity shares in the company at Rs 861.42 per share, whereas Lighthouse Emerging India Investors sold 7.6 lakh equity shares in the company at Rs 861.23 per share on the BSE, the bulk deal data showed.

(For more bulk deals, click here)

Results on July 22, and Analysts/Investors Meeting

Results on July 22: Hindustan Unilever, UltraTech Cement, Bajaj Auto, Agro Tech Foods, Bajaj Holdings & Investment, Biocon, Can Fin Homes, Chennai Petroleum Corporation, CSB Bank, Heidelbergcement India, Hindustan Zinc, ICICI Lombard General Insurance Company, Indian Energy Exchange, IIFL Securities, IndiaMART InterMESH, India Pesticides, Lloyds Steels Industries, Bank of Maharashtra, Mahindra EPC Irrigation, Mphasis, Persistent Systems, Music Broadcast, Shiva Cement, South Indian Bank, Sterlite Technologies, and Wockhardt will release their quarterly earnings on July 22.

South Indian Bank: The company's officials will meet analysts and investors on July 23 in respect of unaudited financial results.

GE T&D India: The company's officials will meet analysts and investors on July 23.

HeidelbergCement India: The company's officials will meet analysts and institutional investors on July 23 to discuss unaudited financial results.

Motilal Oswal Financial Services: The company's officials will meet investors and analysts on July 30 to discuss financial performance.

Godrej Properties: The company's officials will meet investors and analysts on August 3.

Stocks in News

Network18 Media & Investments: The company reported sharp increase in consolidated operating revenue at Rs 1,214 crore for Q1FY22 against Rs 807 crore in Q1FY21. Operating EBITDA jumped to Rs 188 crore from Rs 27 crore YoY

TV18 Broadcast: The company's consolidated operating revenue for Q1FY22 came in at Rs 1,155 crore against Rs 776 crore in Q1FY21, operating EBITDA jumped to Rs 188 crore from Rs 44 crore YoY.

Jubilant Ingrevia: East Bridge Capital Master Fund sold 2.4% stake in the company via open market transaction on July 19, reducing shareholding to 5.61% from 8% earlier.

IDFC First Bank: The RBI said IDFC can exit as promoter of IDFC FIRST Bank after the expiry of lock-in period of 5 years. IDFC holds 36.56% in IDFC First Bank.

Havells India: The company reported consolidated profit of Rs 235.78 crore in Q1FY22 against Rs 63.98 crore in Q1FY21, revenue rose to Rs 2,609.97 crore from Rs 1,483.40 crore YoY.

Gland Pharma: The company reported higher consolidated profit at Rs 350.65 crore in Q1FY22 against Rs 313.59 crore in Q1FY21, revenue rose to Rs 1,153.9 crore from Rs 884.2 crore YoY.

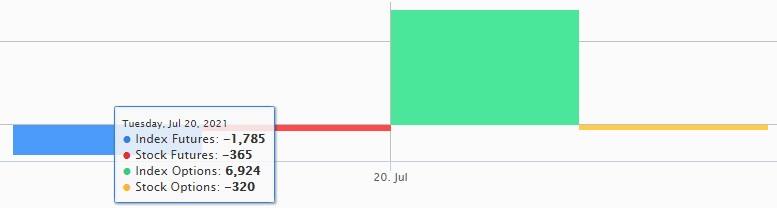

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,834.96 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 873.14 crore in the Indian equity market on July 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Cadila Healthcare, Canara Bank, Indiabulls Housing Finance, NALCO, NMDC, and Sun TV Network - are under the F&O ban for July 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: TV18 Broadcast is a subsidiary of Network18 Media & Investments Ltd which publishes Moneycontrol.

Disclaimer: Network18 is a subsidiary of Network18 Media & Investments Ltd which publishes Moneycontrol.