Table of Contents

State governments in India fix a rate, below which properties cannot be registered in a particular location at the time of title transfer. This rate is known by various names, including guideline value, circle rate, ready reckoner rate, etc. In Tamil Nadu, the usage of guideline value (GV) is more common. Prospective buyers must know all about the GV before they make up their mind to buy a property in Tamil Nadu. To help such buyers, we provide a step-by-step process on how to find the guideline value for a property in Tamil Nadu, based on which the stamp duty on property transactions is calculated.

How to find land guideline value in Tamil Nadu?

So far, the guidance value for 2.19 lakh streets and 4.46 billion field numbers / subdivision numbers is available on the department’s website.

Login to the TNREGINET website

To know the guideline value in various districts of Tamil Nadu, all you need to do is to go to the official website of the Registration Department. One of the tabs is ‘Guideline Value’. Feed in the details here. Note that content on the website is available in both Tamil and English. You can change the language as per your preference.

Details required for guideline search

Or, you may also try:

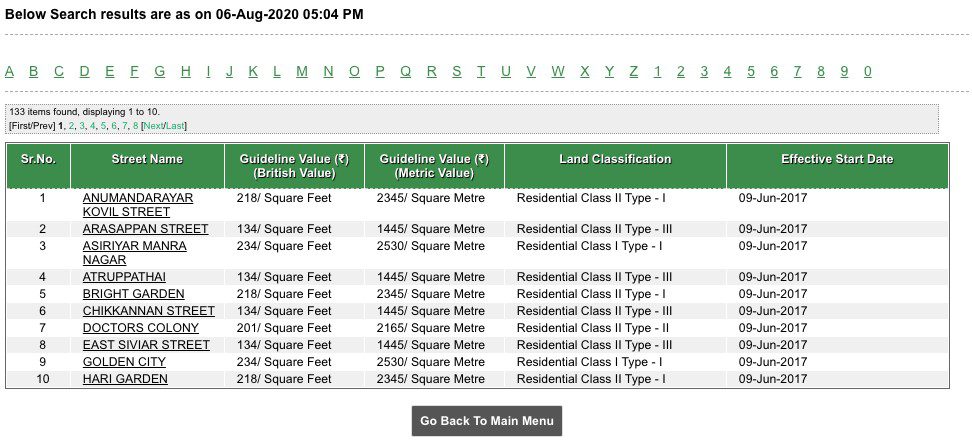

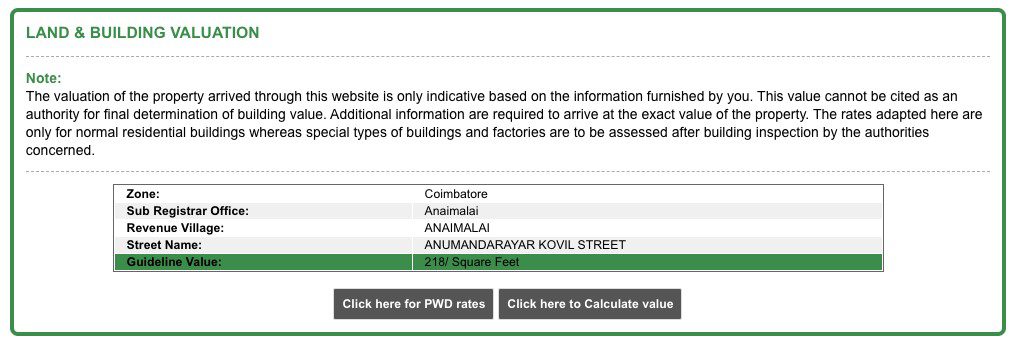

Enter Street or Survey Number, choose the criteria and proceed. Hit ‘Search’ to see the street-wise details. Click on the one you are seeking information about.

See also: All about guideline value in Coimbatore

Why is guideline value important?

Having an established and updated guideline value is necessary, for the following reasons:

- It helps you to estimate and calculate the overall pros and cons of a house purchase decision.

- It plays an important role, when it comes to the payment of stamp duty and registration charges and is a source of revenue. At the same time, it helps both, the authorities and buyers, to understand and detect undervaluation of properties.

- It keeps fraud in check. Those who try to avoid paying the registration charges can be tracked and therefore, this gets rid of corruption and scams with regard to land-related deals, to an extent.

- It is also a good index that helps buyers understand land value as to price their properties competitively.

How to view encumbrance certificate on TNREGINET website

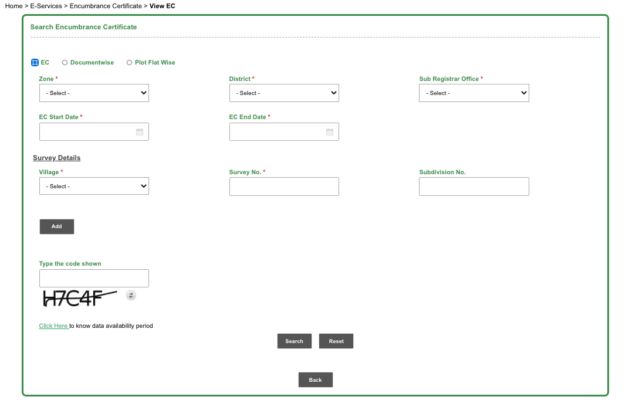

On the official website, click on the ‘E-Services’ tab and go to ‘View EC’. Input the details, either document-wise or plot/flat-wise and add details of the zone, district, EC start date, its end date, survey details, verification code and then click on submit, to view the encumbrance certificate.

Are registrar offices in TN open on holidays?

Given that many home buyers may wish to register their properties on auspicious days, the Commercial Department has directed registrar offices to work during three national holidays, including Tamil New Year (Chithrai Mudhal Naal – April 14, 2021), Aadi Perukku (September 8, 2021) and Thai Poosam (January 18, 2022). The department may or may not collect an additional charge for registrations on these days and this will depend on further directions.

Latest updates on Guideline Value in Tamil Nadu

After 2003, revisions in the guideline values happened in 2007, 2012 and then, in 2017. Since 2017, there has been no further revision, so far. In fact, in 2017, the state cabinet decided to cut the guideline values by 33%. A committee under the inspector-general of the Registration Department had recommended this reduction.

At the same time, the registration fee was increased from 1% to 4%. In short, stamp duty and transfer of a property is now attracts 7%+4% tax (i.e., 11%), as against the 7%+1% (i.e., 8%) earlier. It is important to note that any cut in stamp duty, if coupled by a raise in registration fee, would only offset the savings that a buyer would have got. Cost of acquisition of a property, therefore, is higher.

Registration fee cut, JV registration made mandatory in state

The registration and finance departments of Tamil Nadu are planning to cut the registration charges of joint venture (JV) projects, which forms the bulk of residential and commercial development being undertaken in the state. From 11% of the guideline value, the new registration value may come down to only 2% of the guidelie value for JV projects. This will encourage more and more JV projects to get registered and it would add to the state’s revenue. The plan, however, is not final yet.

Check out properties for sale in Chennai

FAQ

When was the Guideline Value in Tamil Nadu last revised?

Guidance Value for properties in Tamil Nadu was last revised in 2017.

What is the impact of guideline value revision on property buyers?

It is believed that any cut in guideline value will bring down property prices. However, property value is also determined by other factors, such as registration charges.

Where can I address queries regarding Guideline Value in Chennai?

You can call on 18001025174 or write to helpdesk@tnreginet.net

Comments 0