More than half the initial public offerings (IPOs) delivered at least double-digit returns in the last one year on debut.

In fact, the last one year turned out to be spectacular for the primary market, mirroring the positive sentiments in the secondary market. Ample liquidity in the global markets, especially after central banks adopted low interest-rate environments to boost economies dented by COVID-19, also helped.

Rising retail participation, too, lifted the mood in the primary market.

“The liquidity condition in the market improved substantially, with more and more retail participants entering the markets. That led to substantial over-subscription of various IPOs during this time span. This overall optimism has created a positive environment for various small and big companies to raise funds through the IPO market, and we have seen many companies going public in 2021," Anita Gandhi, Wholetime Director, Arihant Capital Markets, told Moneycontrol.

Specialty chemicals and new technology companies, instead of traditional firms, gathered momentum in the last one year. In fact, these companies have a strong advantage when the world is fighting with COVID-19. Experts believe these segments are expected to outshine in the coming quarters.

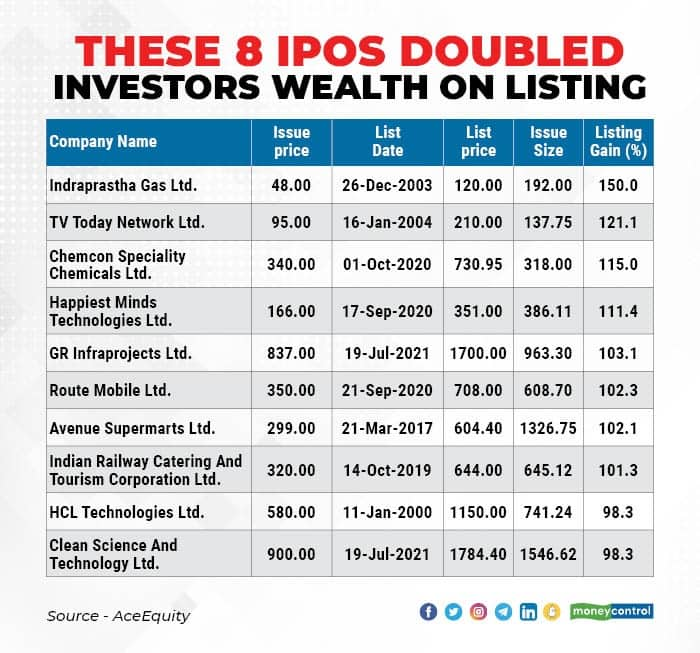

In the last one year, while four companies registered more than 100 per cent gains on debut, one gained close to 100 percent.

Among the five, Chemcon Speciality Chemicals gained the maximum, rising 115 percent over its issue price, followed by Happiest Minds Technologies (up 111.4 percent), Route Mobile (up 102.3 per cent), GR Infraprojects (up 103.1 percent), and Clean Science & Technology (up 98.3 percent).

If we take the listing data since 2020, four more companies joined the list of stocks that gained more than 100 percent on debut. In 2019, IRCTC (Indian Railway Catering and Tourism Corporation) debuted with 101.3 percent premium, and Avenue Supermarts, in 2017, climbed 102.1 percent. Indraprastha Gas, in 2003, gained 150 percent on listing and TV Today Network, in 2004, jumped 121.1 percent.

So since 2020, eight companies had seen more than 100 per cent gains on debut, while 183 others registered double-digit gains.

Experts expect the momentum to continue as several companies have lined up IPOs. Fundraising of more than Rs 50,000 crore has taken place so far in 2021.

“This year, we may see some big names like Paytm, Life Insurance Corporation, National Stock Exchange, Flipkart, GoAir (now Go First), Policybazaar and HDB Financial Services launching IPOs," said Vishal Wagh, Research Head, Bonanza Portfolio.

“This is not the end of the story. Till the time there is potential, big corporate houses as well as new-theme businesses will come in search of additional funding to get on to the growth path soon. Overall, the Indian IPO market has big potential ahead," he added.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.