Nvidia Stock - How to Trade It After the Split

Nvidia (NVDA) - Get Report shares have not had a pretty run lately and the company’s stock split doesn’t seem to be helping.

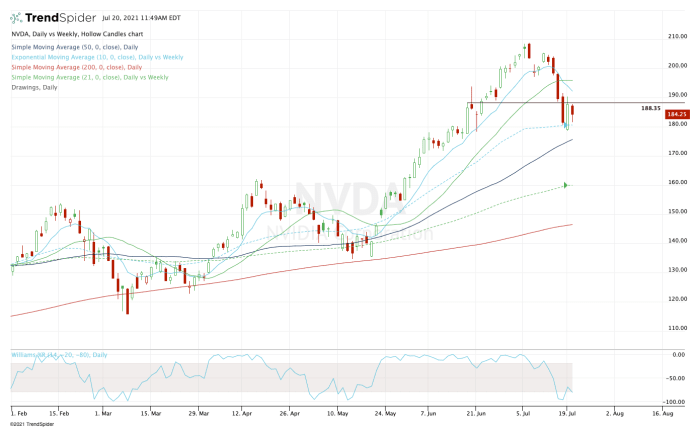

While the stock went on an impressive rally — climbing 55% from the May low to the July high — we’ve seen Nvidia lose some air lately.

That also came as Advanced Micro Devices (AMD) - Get Report stock has been struggling on the long side, too. The struggling stocks even drew a "hard look" from TheStreet's Jim Cramer.

It doesn’t help that the broader markets have been under pressure as well.

While the stock showed some impressive strength on Monday as the market was getting clobbered, it's back under pressure on Tuesday, the day its stock split went into effect.

Nvidia and Advanced Micro Devices are holdings in Jim Cramer's Action Alerts PLUS investing club. Want to be alerted before Jim Cramer buys or sells NVDA or AMD? Learn more now.

Trading Nvidia Stock

A look at the chart shows that powerful run from May to early July before Nvidia’s painful correction.

Shares cleared the $200 level, which was my price target in June (at the time, that price target was $800 when adjusted for the stock split).

TST Recommends

Jim Cramer: Buy Nvidia Stock Today

Later, I turned to the $215 level as a possible upside target, that being the 261.8% extension of the 2021 range. Nvidia didn’t quite get there, but it did get close.

Markman on Tech: Beware the Nvidia Stock Split

In any regard, the past few days have been quite volatile, with the $188 to $190 area failing to act as support. The 10-week moving average has stepped in for now.

From here, we must keep an eye on these two levels. Bulls want to see Nvidia move above $190 and clear the 10-day moving average.

If the stock can do that, it puts the 21-day moving average back in play, followed by $200-plus. It also puts the bulls back in control and allows for a potential run back to all-time highs.

On the downside, a break of the 10-week moving average puts this week’s low in play. Below this week’s low, and a test of the 50-day moving average may be in order. That doesn’t mean it will necessarily be the low, though.

Nvidia is a great company and the stock has been trading really well lately. As a result, we’re looking at it from the long side and looking at dips as an opportunity.

But if the technicals deteriorate, we’ll have to step away from it as a trading vehicle for the time being.