Top Searches

- News

- Business News

- India Business News

- Low taxes, low interest, and expenditure cut: Triple benefits for India Inc during Covid

Low taxes, low interest, and expenditure cut: Triple benefits for India Inc during Covid

Sectors like consumer durables, healthcare and cement has benefitted the most from low interest rates. (Representative image)

NEW DELHI: The reduction in effective tax rate (ETR), low interest rate regime and fall in expenditures amid the Covid-19 pandemic seem to have been a blessing in disguise for India Inc, a report by the State Bank of India (SBI) said on Monday.

ETR is the percentage of income that an individual or a corporation pays in taxes. For a company, it is the rate that is paid on pre-tax profits.

For about 4,000 listed entities, ETR decreased from 35 per cent in FY20 to 26 per cent in FY21. However, actual tax paid increased by more than Rs 50,000 crore to Rs 1.90 lakh crore in FY21 as against Rs 1.40 crore collected last year.

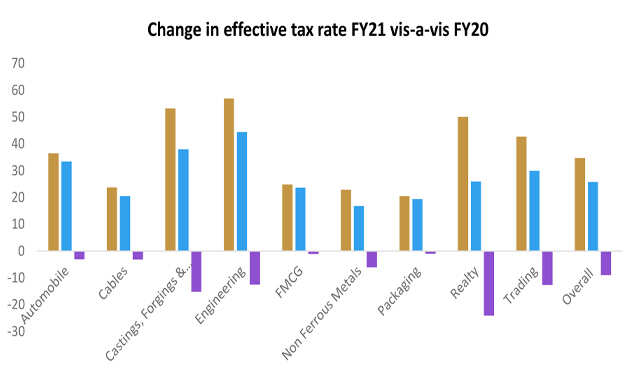

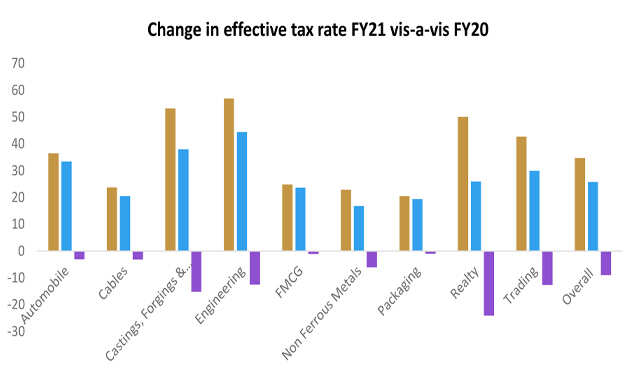

Sector-wise fall in ETR

The ETR came down significantly-- ranging from 1 per cent to 24 per cent -- for many sectors including engineering, realty, automobiles and trading.

For realty, ETR declined from 50 per cent in FY20 to 26 per cent in FY21.

Automobile sector reported a reduction of 3 per cent in ETR -- from 36 per cent in FY20 from 33 per cent next year.

Further, trading sector reported a reduction of 13 per cent in ETR while FMCG and packaging reported a reduction of 1 per cent each, the SBI report said.

Best corporate tax collection

Reduction in tax rates, however, led to best corporate tax revenue collection in almost three decade in FY22.

As per SBI's analysis, cut in taxes in FY20 contributed 19 per cent to the top line of sample sectors during the pandemic with cement, tyres and consumer durables showing significant contribution -- even in excess of 50 per cent.

"Interestingly, with robust direct tax collections, especially corporation tax, in Q1 of FY22 we believe that the gap between GVA and GDP will be large as the GDP growth in Q1 FY22 would be buoyed by the taxes," the report said.

Low interest rates

The report further notes that an extended period of low interest rate has also helped companies in massive deleveraging and contributed on an average 5 per cent to the overall top line sectors with consumer durables, healthcare and cement benefitting the most.

The report also showed that an extended period of low interest rate has also helped companies in massive deleveraging and contributed on an average 5 per cent to the overall top line.

Sectors like consumer durables, healthcare and cement has benefitted the most.

Besides, employee costs have been cut on an average by 3 per cent in FY21. The maximum cut in employee costs has been in sectors facing the consumers.

Fall in expenditures

Expenditure reduction has contributed as much as 31 per cent to top line with most companies finding out new ways to navigate through the pandemic.

Sectors like apparel and refineries have cut cost by as much 107 per cent on an average.

However, expenditure has climbed up in sectors like metals, agro chemicals among others reflecting the increase in input costs with a surge in global commodity prices.

Corporate performance

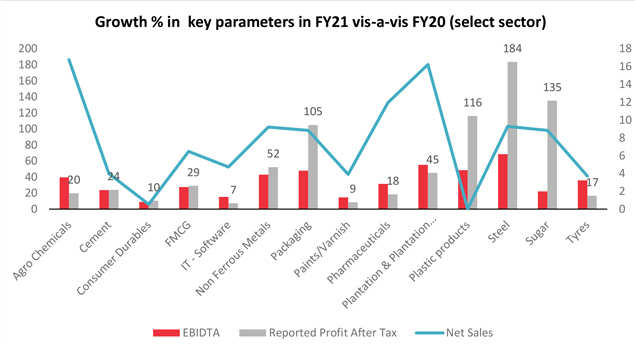

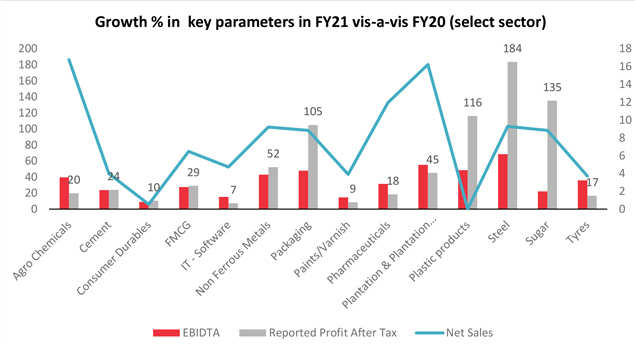

Even though 4,000 listed entities observed a 5 per cent decline in top line, their earnings before interest, tax, depreciation and amortisation (EBITDA) and profit after tax (PAT) grew by 24 per cent and 105 per cent, respectively in FY21.

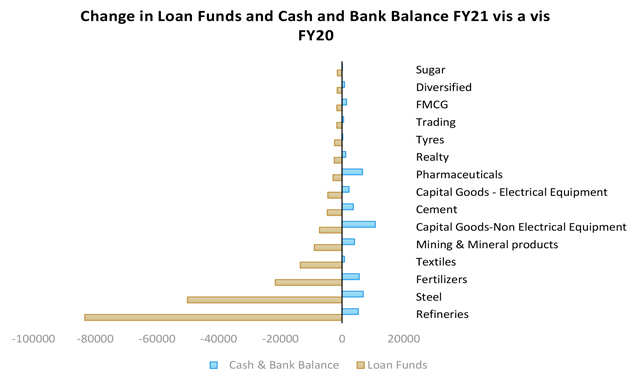

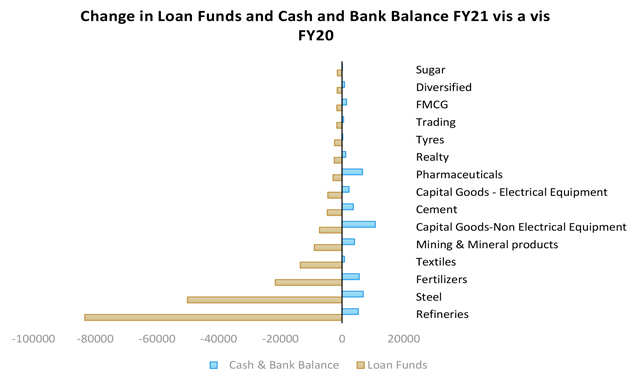

Besides, top 15 sectors have reduced loan funds by almost Rs 2.09 lakh crore during the pandemic.

Sectors like refineries, steel, fertilisers, textiles, mining and others have reduced their loan funds in range of 6 per cent to 64 per cent.

ETR is the percentage of income that an individual or a corporation pays in taxes. For a company, it is the rate that is paid on pre-tax profits.

For about 4,000 listed entities, ETR decreased from 35 per cent in FY20 to 26 per cent in FY21. However, actual tax paid increased by more than Rs 50,000 crore to Rs 1.90 lakh crore in FY21 as against Rs 1.40 crore collected last year.

Sector-wise fall in ETR

The ETR came down significantly-- ranging from 1 per cent to 24 per cent -- for many sectors including engineering, realty, automobiles and trading.

For realty, ETR declined from 50 per cent in FY20 to 26 per cent in FY21.

Automobile sector reported a reduction of 3 per cent in ETR -- from 36 per cent in FY20 from 33 per cent next year.

Further, trading sector reported a reduction of 13 per cent in ETR while FMCG and packaging reported a reduction of 1 per cent each, the SBI report said.

Best corporate tax collection

Reduction in tax rates, however, led to best corporate tax revenue collection in almost three decade in FY22.

As per SBI's analysis, cut in taxes in FY20 contributed 19 per cent to the top line of sample sectors during the pandemic with cement, tyres and consumer durables showing significant contribution -- even in excess of 50 per cent.

"Interestingly, with robust direct tax collections, especially corporation tax, in Q1 of FY22 we believe that the gap between GVA and GDP will be large as the GDP growth in Q1 FY22 would be buoyed by the taxes," the report said.

Low interest rates

The report further notes that an extended period of low interest rate has also helped companies in massive deleveraging and contributed on an average 5 per cent to the overall top line sectors with consumer durables, healthcare and cement benefitting the most.

The report also showed that an extended period of low interest rate has also helped companies in massive deleveraging and contributed on an average 5 per cent to the overall top line.

Sectors like consumer durables, healthcare and cement has benefitted the most.

Besides, employee costs have been cut on an average by 3 per cent in FY21. The maximum cut in employee costs has been in sectors facing the consumers.

Fall in expenditures

Expenditure reduction has contributed as much as 31 per cent to top line with most companies finding out new ways to navigate through the pandemic.

Sectors like apparel and refineries have cut cost by as much 107 per cent on an average.

However, expenditure has climbed up in sectors like metals, agro chemicals among others reflecting the increase in input costs with a surge in global commodity prices.

Corporate performance

Even though 4,000 listed entities observed a 5 per cent decline in top line, their earnings before interest, tax, depreciation and amortisation (EBITDA) and profit after tax (PAT) grew by 24 per cent and 105 per cent, respectively in FY21.

Besides, top 15 sectors have reduced loan funds by almost Rs 2.09 lakh crore during the pandemic.

Sectors like refineries, steel, fertilisers, textiles, mining and others have reduced their loan funds in range of 6 per cent to 64 per cent.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST