Where to Buy Microsoft as Tech Stocks Correct

Microsoft (MSFT) - Get Report may have been lost in the shuffle on Monday, but the software giant had investors’ attention early in the session.

That’s after the White House said the cyberattack on the company came from China.

It’s also as tech stocks and the overall market were under notable pressure. Stocks also closed near the lows on Friday.

If there’s one thing that can prop up the markets, though, it’s big tech. Apple (AAPL) - Get Report, Microsoft and Amazon (AMZN) - Get Report account for $6.25 trillion in combined market caps.

With earnings just around the corner, bulls are hopeful that the dip we’re seeing in the market is just that — a minor dip — and not a longer term correction.

As for Microsoft, we want to be cautiously opportunistic. It already gave us the move we were looking for after that big breakout last month.

Now let’s see how the technicals are setting up again.

Microsoft, Apple and Amazon are holdings in Jim Cramer's Action Alerts PLUS investing club. Want to be alerted before Jim Cramer buys or sells MSFT, AAPL or AMZN? Learn more now.

Trading Microsoft Stock

TST Recommends

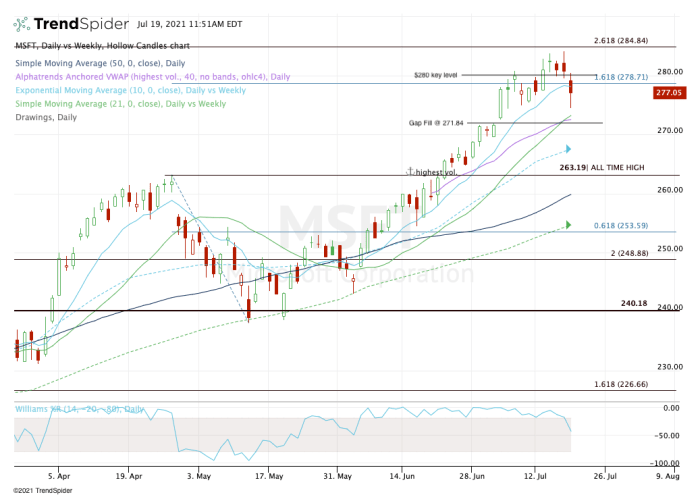

Going back to early June, the 10-day moving average has been strong support for the Redmond, Wash., company's stock. It has continued to guide Microsoft higher on each minor dip and helped push the stock above $280.

While $280 was support last week, it failed as support on Monday. So, too, has the 10-day moving average.

Although Microsoft stock is bouncing nicely from the lows, we need to see the stock reclaim the 10-day moving average and, preferably, the $280 mark.

So far, though, these levels are rejecting the stock.

If Microsoft stock can reclaim these levels, the high near $284 is in focus. Above that and we’ll have to see how it handles the $285 area, near where the 261.8% extension comes into play.

If we see a robust bounce, perhaps $300 is on the table.

On the downside, watch Monday’s low. Below it puts the 21-day moving average and daily VWAP measure in play.

Just below that area is the gap-fill at $271.84. I would love to see a dip to that mark and a close above the 21-day moving average. That would give bulls a reasonable dip and a reasonable risk/reward long setup.

A close below all of these measures could put the 10-week moving average in play.