personal-finance

Why do millennials flock P2P platforms?

Jul 16, 05:07

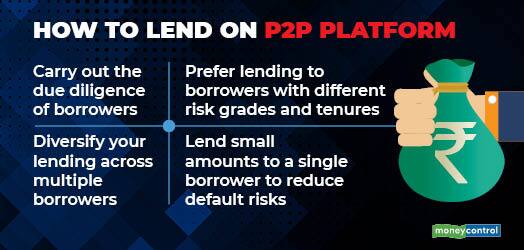

The onset of Covid-19 has pushed more millennials to borrow on peer-to-peer (P2P) platforms. Lenders on the other side are only too happy to oblige. According to an analysis done by LenDenClub, a P2P platform, of around 4 lakh users on its platform in 2020-21, millennials (those in the ages of 21-30 years) were among the most active, as both borrowers (56%) and lenders (54%) on its platform. Borrowers on P2P platforms don't get loans from banks so easily because of weak credit profiles or ineligibility. Lenders know this and that is why they charge higher interest rates, all in the name of ‘investment'. But there is a high risk of defaults while lending on P2P platforms.