Passive investing in India has been gaining ground. Recently, the NSE has announced that it has listed the 100th ETF (exchange traded fund) in its exchange platform, a remarkable milestone in the Indian financial market.

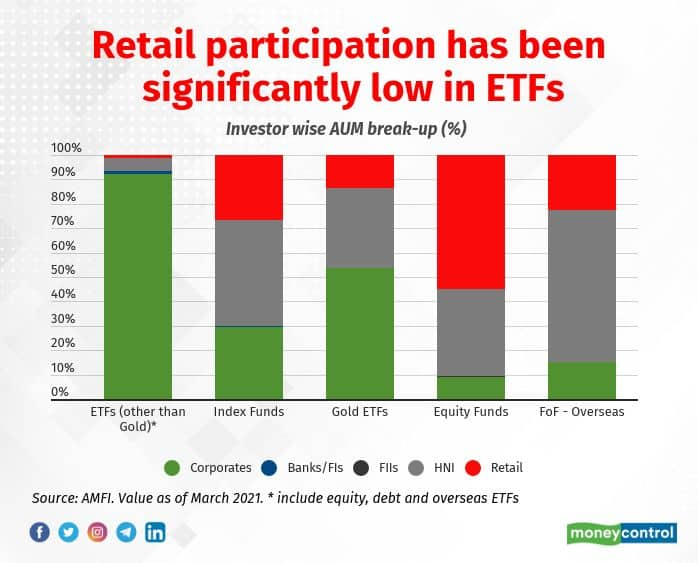

While institutional investors have dominated the ETF space, the retail participation has been minuscule. AMFI data shows that the share of retail investors in the AUM (assets under management) of ETFs was just 1.4 percent as on March 31, 2021. On the other hand, retail investors account for a large share of AUM of equity funds (55 percent) and index schemes (27 percent).

The assets under management of all ETFs in India is now at Rs. 3.16 lakh crores (end of May 2021), and has increased manifold in the last five years, thanks to the investment from the Employees Provident Fund Organisation (EPFO).

Why have retail investors not taken to ETFs?

You need a demat account to buy or sell an ETF in the exchanges. The other variant is index funds which are regular MF schemes.

The recent attraction towards passive investing is thanks mainly to the underperformance of actively managed large-cap equity funds against benchmarks such as the Nifty 50 TRI.

Retail AUM in ETFs (other than gold) as on March 31, 2021 was only Rs 3,860 crore or 0.6 percent of the retail money invested in the overall MF industry.

Vishal Jain, Head-ETFs, Nippon Life India AMC says, “One of the primary reasons is that there is no incentive being paid to any distributor to sell ETFs. These ETFs are more of pull products.”

Dhawal Dalal, Chief Investment Officer-Fixed Income of Edelweiss AMC says that the other reasons were weak market infrastructure set up of Authorized Participants (AP) by the ETF providers and lack of awareness.

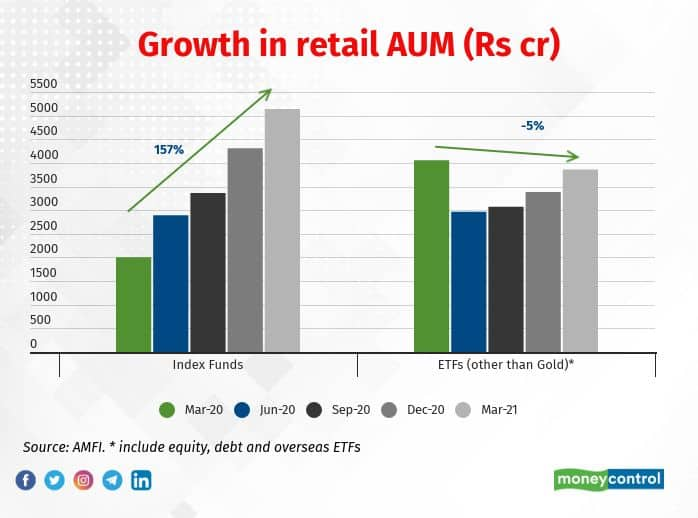

If you look at the growth of retail AUM in ETFs over the last one year, it has been inconsistent. A senior executive from a discount broking firm explains, “Many retail investors who had exited ETFs during the market correction in March 2020 did not come back. On the other hand, index funds have gained popularity among retail investors due to their simple structure and systematic investing facility. ETFs don’t offer the SIP facility.”

Investing in index funds is easier, but ETFs require demat and trading accounts, thus making it tough for retail investors. Index funds became long-term investment products, as investors continued their SIPs in index funds during the pandemic, he adds.

Dalal of Edelweiss AMC says, “collective efforts need to be taken to educate investors about various types of equity and bond ETFs, suitability, benefits and usefulness to investors for long-term asset allocation.”

Surge in number of accounts

Despite a low AUM share, there has been increased interest among retail investors in recent times towards investing in ETFs. The total number of retail investor folios increased by 23 lakh or 126 percent in the last one year, to 41.4 lakh.

“Over the past couple of years, digital adoption, easy execution on exchanges, low-cost schemes and product innovation have brought ETFs under spotlight among retail investors,” explains Nitin Kabadi, Head- ETF Business, ICICI Prudential AMC.

A variety of ETFs are now on offer

The choice of ETFs has increased in India over the last few years. Currently, they are available across asset classes, including equity, debt, gold and overseas equities.

“Within equity, an investor has the option of choosing from Market capitalisation based, sector based or Smart beta ETFs. Depending on an investor’s requirement and risk appetite, he/she can make a selection,” says Kabadi of ICICI Prudential AMC. In terms of allocation, on the equity side an investor can consider Nifty ETF, Nifty Next 50 and Gold ETF can be a part of the core portfolio. Savvy investors can add smart beta, Midcap ETFs as a part of their satellite portfolio he adds.

Retail investors flocked into PSU bond ETFs

One of the other innovation in the ETF space was introduction of PSU bond ETFs. “Although first G-Sec based bond ETFs were launched in 2016, investors got the opportunity to invest in the real corporate bond ETFs in December 2019 when the first tranche of Edelweiss Bharat Bond ETF (BBETF) was launched. Since then, retail investors have traded around Rs 2,233 crore worth of four BBETF units on the exchanges, with ~60 percent market share of trading in BBETF – 2030 and BBETF – 2031,” says Dalal.

It is easier for investors of these target maturity bond ETFs to gauge what kind of returns they will be able to generate if they remained invested till maturity. Dalal advises that these debt ETFs can be part of the long-term portfolios of retail investors.

There are 11 gold ETFs. Three overseas ETFs are available for investors wanting global diversification in their portfolio.

Before investing in an ETF do check for liquidity, tracking error and expenses.