The market remained in the positive terrain throughout the session and ended at a record closing high on July 15, driven by technology, select banks, FMCG and metals stocks.

The BSE Sensex climbed 254.80 points to 53,158.85, while the Nifty50 jumped 70.20 points to 15,924.20 and formed a bullish candle on the daily charts.

"A reasonable positive candle was formed on Thursday and the market placed near the all-time high towards the close. This pattern indicates an attempt of upside breakout of the larger month-old consolidation pattern at 15,915 levels," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

"But the lack of strength at the highs could dampen the effort of bulls to sustain above the hurdle. Further consolidation at the highs could bring bears into action to witness next round of downward correction from the highs, as happened in past," he added.

"The immediate intraday support of 10 period EMA is going to be crucial at 15,900 levels. Any movement below this area for a few hours on Friday could drag index into a reasonable downward correction," he said, adding emergence of strong upside momentum above 15,950 is expected to open next higher levels of 16,100 in the short term.

The broader markets also traded in line with benchmarks as the Nifty Midcap 100 index was up 0.48 percent and Smallcap 100 index rose 0.95 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,868.7, followed by 15,813.2. If the index moves up, the key resistance levels to watch out for are 15,966 and 16,007.8.

Nifty Bank

The Nifty Bank rallied 239.40 points to 35,907.70 on July 15. The important pivot level, which will act as crucial support for the index, is placed at 35,693.8, followed by 35,480. On the upside, key resistance levels are placed at 36,053.3 and 36,199 levels.

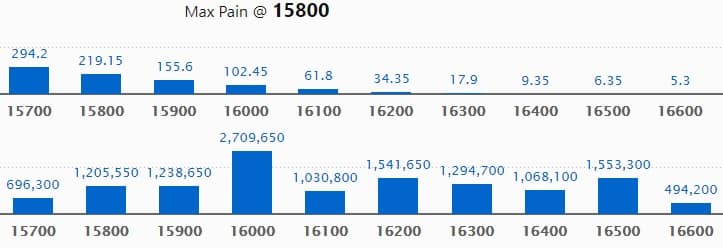

Call option data

Maximum Call open interest of 27.09 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 15.53 lakh contracts, and 16200 strike, which has accumulated 15.41 lakh contracts.

Call writing was seen at 16300 strike, which added 3.14 lakh contracts, followed by 16200 strike which added 96,050 contracts and 16000 strike which added 88,600 contracts.

Call unwinding was seen at 15800 strike, which shed 3.13 lakh contracts, followed by 15700 strike which shed 1.81 lakh contracts, and 16500 strike which shed 90,250 contracts.

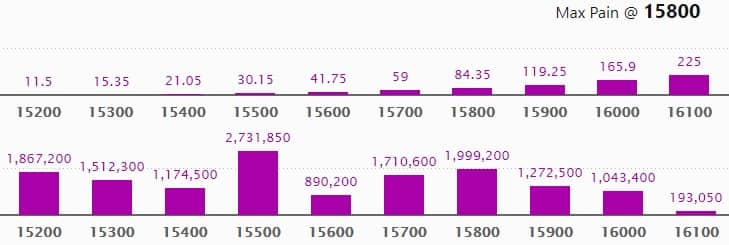

Put option data

Maximum Put open interest of 27.31 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15800 strike, which holds 19.99 lakh contracts, and 15200 strike, which has accumulated 18.67 lakh contracts.

Put writing was seen at 15900 strike, which added 6.04 lakh contracts, followed by 16000 strike which added 3.4 lakh contracts, and 15800 strike which added 3.19 lakh contracts.

Put unwinding was seen at 15500 strike, which shed 5.74 lakh contracts, followed by 15200 strike which shed 4.54 lakh contracts, and 15400 strike which shed 1.62 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

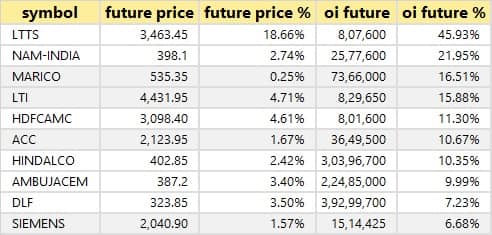

38 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

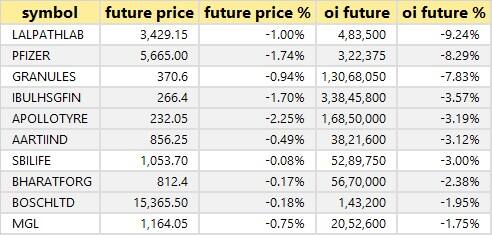

26 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

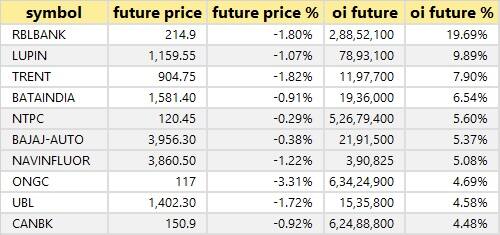

57 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

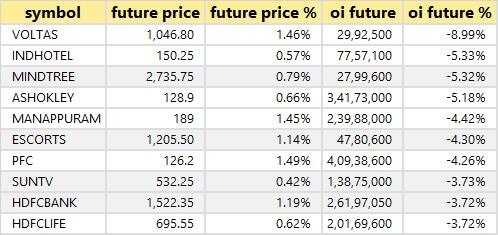

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

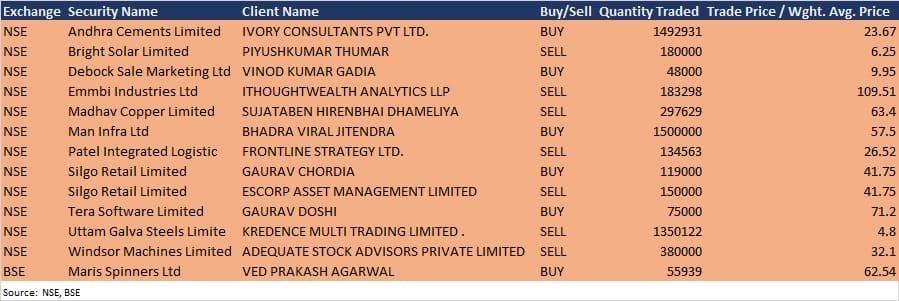

Bulk deals

Emmbi Industries: Ithoughtwealth Analytics LLP sold 1,83,298 equity shares in the company at Rs 109.51 per share on the NSE, the bulk deals data showed.

Results on July 16, and Analysts/Investors Meeting

Results on July 16: HDFC Asset Management Company, Den Networks, GNA Axles, Just Dial, L&T Finance Holdings, Maximaa Systems, Starlog Enterprises, and Visagar Polytex will release quarterly earnings on July 16.

Deepak Fertilisers & Petrochemicals Corporation: The company's officials will meet Capital World – Hong Kong, ICICI Prudential AMC, and Convergent Finance on July 16.

Max India: The company's officials will meet WealthMills Securities on July 16.

Sterling and Wilson Solar: The company's officials will meet analysts/investors on July 16.

Aegis Logistics: The company's officials will meet analysts, institutional investors and funds on July 16 and July 22.

Indian Energy Exchange: The company's officials will meet analysts and investors on July 23 to discuss financial results.

ICICI Securities: The company's officials will meet analysts and investors on July 21 to discuss financial results.

GTPL Hathway: The company's officials will meet analysts and investors on July 20 to discuss financial results.

Stocks in News

Wipro: The company reported higher IT services revenue at Rs 18,368.4 crore in Q1FY22 against Rs 16,334 crore in Q4FY21, and expects Q2FY22 dollar revenue in the range of $2,535-2,583 million, a growth of 5-7 percent over Q1FY22.

Cyient: The company reported higher profit at Rs 115 crore in Q1FY22 against Rs 103.1 crore in Q4FY21; revenue fell to Rs 1,058.2 crore from Rs 1,093.1 crore QoQ.

L&T Infotech: The company reported lower profit at Rs 496.8 crore in Q1FY22 against Rs 545.7 crore in Q4FY21; revenue rose to Rs 3,462.5 crore from Rs 3,269.4 crore QoQ.

Angel Broking: The company reported higher consolidated profit at Rs 121.36 crore in Q1FY22 against Rs 101.9 crore in Q4FY21, and revenue rose to Rs 462.66 crore from Rs 408.6 crore QoQ.

Tata Steel Long Products: The company reported consolidated profit at Rs 331.61 crore in Q1FY22 against loss of Rs 131.31 crore in Q1FY21. Revenue jumped to Rs 1,687.64 crore from Rs 653.1 crore YoY.

Tata Elxsi: The company reported lower profit at Rs 113.37 crore in Q1FY22 against Rs 115.16 crore in Q4FY21. Revenue rose to Rs 558.31 crore from Rs 518.39 crore QoQ.

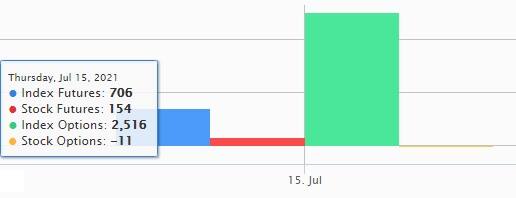

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 264.77 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 439.41 crore in the Indian equity market on July 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Eight stocks - Granules India, Indiabulls Housing Finance, Vodafone Idea, NALCO, NMDC, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for July 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.