Table of Contents

Residents of Chennai can easily pay their , also known as ‘sotthu vari’, online. They also have the option to make the payment offline. The due date for Chennai property tax payment is September 31 and March 31 every year. In case of any defaults, there is a 1% penalty every month.

In this article, we look at the step-by-step process for payment of property tax in Tamil Nadu, an annual levy that property owners have to pay, apart from paying income tax on house property when filing their taxes for the financial year. This financial year (FY 2021), the civic body has collected property tax of Rs 45 crores in the 15 days of the October-March tax cycle.

What constitutes residential, non-residential property in Chennai?

Individual houses, flats and apartments that have not been rented out for commercial/ business purposes, are treated as residential for tax purposes. On the other hand, shops, offices, malls, movie theatres and party or marriage halls, are considered non-residential.

Property tax rates in Chennai

In case of residential properties, basic rate ranges between Rs 0.60 per sq ft and Rs 2.40 per sq ft. For non-residential projects, the price is between Rs 4 per sq ft and Rs 12 per sq ft.

Check out property price trends in Chennai

Zones under Chennai municipal corporation

| Zone number | Name of the Zone | Ward number |

| I | Thiruvotriyur | 1-14 |

| II | Manali | 15-21 |

| III | Madhavaram | 22-33 |

| IV | Tondiarpet | 34-48 |

| V | Royapuram | 49-63 |

| VI | Thiruvikanagar | 64-78 |

| VII | Ambattur | 79-93 |

| VIII | Anna Nagar | 94-108 |

| IX | Teynampet | 109-126 |

| X | Kodambakkam | 127-142 |

| XI | Valasaravakkam | 143-155 |

| XII | Alandur | 156-167 |

| XIII | Adyar | 170-182 |

| XIV | Perungudi | 168, 169, 183-191 |

| XV | Sholinganallur | 192-200 |

How to pay property tax online in Chennai

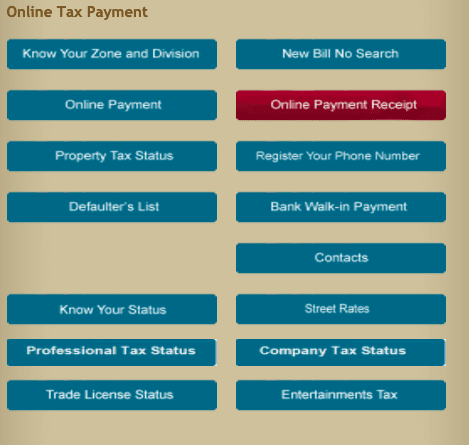

Step 1: Log on to the Chennai Corporation’s online portal for property tax payment. Opt for ‘Online Payment’ under the ‘Online Civic Services’ section.

Step 2: Enter the required details, such as your zone number, ward number, bill number and sub number and submit these details. If this is the first time you are trying to pay the house tax Chennai online, then, you can refer to the previous bills received for all the aforementioned details.

You can also determine the details with the old or new bill number:

Step 3: Submit the details and you will be able to see a page, where the amount that needs to be paid will be mentioned. All you need to do is select the assessment period and make the payment, by choosing your preferred mode of payment. An acknowledgement will be sent to you, upon successful payment.

Offline assessment of property tax

In case you choose the offline route to pay property tax, you should do the following for modification of building, appeal with respect to property tax and transfer of property tax.

- Submit a filled application form and receipt of tax paid, if the tax was paid at any of the TACTV counters in the Greater Chennai Corporation areas or headquarters.

- You will receive an acknowledgment through SMS for receipt of the request.

- Your application will be scrutinised by the assessor and they will assess the newly constructed building, after which a proposal will be submitted to the concerned officer and then to the Assessment Committee. This is subject to further verification.

- The assessee will receive a notice through SMS, once the committee approves the assessment.

Online assessment of property tax

Citizens can submit a request for property tax assessment, through the official website of the Greater Chennai Corporation.

- Access the online citizen portal and get the user ID and password, by providing the username and mobile number or email ID.

- After obtaining the user ID and password, one can submit the application by furnishing the details, such as division, name of the assessee, location and complete address of the property and contact number.

How to use the Chennai property tax calculator?

You can access the property tax calculator provided on the portal (click here). You will need to enter the type of building for which you have to pay the property tax and other details such as the area, location, street, type of occupancy and the floor details. While you can use this calculator, the website mentions that this calculator is for test purposes only.

Another way to ascertain the exact amount of property tax, is by following this formula:

Assuming the following,

| Plinth Area x Basic Rate per sq ft (say 1,000 sq ft x Re 1) | Monthly rental value = Rs 1,000 per month. |

| Annual rental value = Rs 1,000 x (12 months) – 10% for land. Annual value for building only | Rs 12,000 – Rs 1,200 = Rs 10,800. |

| Less 10% depreciation for the building (repairs / maintenance) | Rs 1,080 (which is 10% of Rs 10,800). |

| Depreciated value of the building | Rs 10,800 – Rs 1,080 = Rs 9,720. |

| Add 10% of the land value | Rs 1,200 (which is 10% of Rs 12,000). |

| Annual value for land and building | Rs 9,720 + Rs 1,200 = Rs 10,920. |

You can see that 10.92 is the common factor that can be used to calculate the annual value of all buildings. Multiply the annual rental value with 10.92 to arrive at the annual value for any building.

Method of fixing annual value for land on lease or rent

The website offers the following explanation:

Monthly rental value (as per agreement between lessor and lessee) x 12 = Annual Value

No depreciation is allowed for vacant land: Rent per 2,400 sq ft (one ground) = Rs 8.00 per month.

Annual value (Rs 8.00 x 12) = Rs 96 per month.

Method of fixing annual value for the super structure only (land being separate): Annual rental value – 10% x (MRV x 12).

The half-yearly property tax for any property is calculated as a percentage of its annual rental value, as per this table:

| Annual Value | Half year tax (as a percentage of annual value) | |||

| General Tax | Education Tax | Total | Lib. (less) | |

| Re 1 to Rs 500 | 3.75% | 2.50% | 6.25% | 0.37% |

| Rs 501 to Rs 1,000 | 6.75% | 2.50% | 9.25% | 0.67% |

| Rs 1,001 to Rs 5,000 | 7.75% | 2.50% | 10.25% | 0.77% |

| Rs 5,001 and above | 9.00% | 2.50% | 11.50% | 0.90% |

Concessions allowed on property tax in Chennai

- 10% library cess is calculated from the general tax of property tax.

- Tiled, thatched and other structures except those with terrace roofing, get a 20% rebate over the monthly rental value.

- Owner-occupied residential structures get a 25% rebate in monthly rental value.

- There is a 10% rebate over monthly rental value, for those commercial structures that are owned by the owner.

- A depreciation of 1% is given for every year for every building that is over four years old. However, there is a maximum limit of 25%.

What happens if you do not pay the property tax on time?

The corporation penalises defaulters at the rate of 2% and it is charged automatically with the assessed value, after a grace period of 15 days. In case you wish to make changes to the property or its name, a no-dues property tax is mandatory.

How to get the property tax payment receipt in Chennai?

On the official website, click on the option ‘Online Payment Receipt’. In the next step, you will be required to choose the zone number, division code, bill number, etc to get the property tax receipt online.

What is vacancy remission?

The City Municipal Corporation (CMCC) Act, 1919 in Section 105 says that if any building which is either owned by self or rented happens to lie vacant for over 30 days in half-year, the Commissioner can remit so much not exceeding one-half of such portion of the tax as relates to the building. In the case of FY 2020-21, the second half term is till October 15, 2020.

How to register your complaints about officials?

The online medium not only makes your work easier but also keeps it transparent. You could pay your taxes online without having to meet the officials. However, in case you have had to make this payment offline and you are asked for a bribe or if you witness any form of corruption, the Chennai Corporation mandates that you inform the Directorate of Vigilance and Anti-Corruption and get in touch with them on any of the following numbers: 24615989 / 24615929 / 24615949

Latest information about Chennai property tax

Revenue through property tax estimated to decrease

Property tax collection in 2020

Interestingly, in spite of the Coronavirus pandemic, the Corporation has been able to collect more property tax than the previous year. The Ccorporations’ target is Rs 350 crores by March 2021 and it has already managed to collect close to 45% of the target.

| Year | Property tax collected |

| 2018 | 142 crores |

| 2019 | 132 crores |

| 2020 | 152 crores |

Civic body reduces penalty on delayed payments

The civic body has decided to slash the penalty this year (2020), owing to the economic tumult brought about by the Coronavirus pandemic. So far, those who delayed the payment of property tax were liable to pay 2% of the tax towards penalty but the civic body has reduced the rate to 0.5%, based on a simple interest calculation for the half-year period from October 2020 to March 2021.

The civic body’s record says that till October 2020, 1.3 lakh assessees have paid the property tax while another 10.9 lakh are yet to pay from October 2020 to March 2021. Those who have already paid will also benefit from the move, as they will be charged an adjusted amount in the next cycle.

Solid waste disposal tax rolled back

Starting January 1, 2021, the local authority was in favour of levying a garbage disposal tax on residents. The residents could pay this tax along with their property tax. However, the decision was not received well among the citizens, who pointed out they had been paying a similar tax. Residents in Pallavaram also recently protested outside the municipality office, demanding that officials remove the garbage tax in their area. Some others allege that a bias on the part of authorities has been noticed, in coercing suburban residents to pay the garbage tax, when it had been revoked in the city.

FAQs

Are there any extra charges for paying property tax in Chennai online?

If you are using a credit card or net banking, there are nominal charges that could vary from time to time.

What if I face problems while paying my property tax online?

You can contact the revenue department and apprise them. You can also call on 044- 25619258 for payment-related complaints.

Where can I pay the property tax if I am unable to do it online?

You can do so by visiting the walk-in counters of select banks. Chennai property tax collection through offline medium is done by Electronic Clearing Scheme (ECS).

I purchased a new flat and paid the property tax but lost the receipt. How do I find the property tax number?

Please check your property deed and other documents when you purchased the house.

Comments