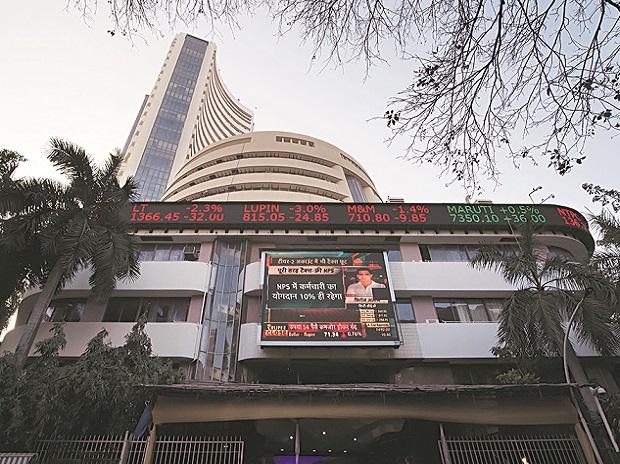

The domestic markets on Thursday fell along with other global peers as the spread of the new covid-19 variants stoked fears of stall economic revival and derail the reflation trades that has been driving the stocks for months now.

The benchmark Sensex fell 486 points to end the session at 52,569, a decline of 0.92 per cent—most since May 12. The Nifty, on the other hand, fell 151 points to end the session at 15,728, a drop of 0.9 per cent.

Asian equities were volatile amid continued losses in Hong Kong-listed Chinese tech stocks. The government’s plan to declare a new emergency battered Japanese stocks, whereas a rise in daily Covid cases scared investors in South Korea. A political crisis in Malaysia rattled investors after the largest party in the coalition announced it would withdraw support for the Prime Minister.

Analysts said the spread of the delta variant had raised fears of whether economic growth and the opening up of economies will take a backseat. And hurt investor expectation that the pandemic’s effects on the global economy are behind us. On Thursday, the US bond yield was trading at 1.25 per cent, their lowest level since February 15, 2021.

“Most of the Asian equity benchmarks traded lower in early deals on Thursday as the market remained cautious with the continued spike in the covid cases over the globe. And fears that more regions might impose stricter restrictions if the viral spread does not subside spurred concerns about the pace of global economic recovery,’ said Vishal Wagh, Research Head, Bonanza Portfolio.

From now on, monetary easing will continue to remain critical to the market outlook. Though the US Federal Reserve’s meeting minutes did not give a definite date for reducing the bond purchase programme, the US central bank indicated that a move is needed sooner.

“The global sell-off caught the traders on the wrong foot, and the index breached the intraday supports, resulting in more selling pressure. Nifty is back within the range that it has been consolidating for the last one month with today's correction. This indicates that traders will still have to wait for a breakout on either side to predict the next directional move,” said Ruchit Jain, Senior Analyst - Technical and Derivatives, Angel Broking.

The results season for the quarter will kick off on Thursday with the June quarter results of Tata Consultancy Services. Analysts said markets would first react to TCS numbers in early trade on Friday, which might set the tone for the result of the session. Further, demand scenarios and management commentary will be crucial factors to watch in Q1FY22 results.

On an overall basis, 378 stocks hit their 52-week highs, and 411 hit their upper circuit. The market breadth was negative, with 1,448 stocks advancing and 1,738 declining. More than two-thirds of Sensex stocks ended the session with losses. Tata Steel was the worst-performing stock and ended the session with a loss of 2.3 per cent. Sun Pharma fell 1.96 per cent, and SBI fell 1.8 per cent. Barring two, all the sectoral indices ended the session with losses. Metal and Banking stocks fell the most, and their gauges declined 2.4 per cent and 1.4 per cent, respectively.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU