Asian Stocks to Fall as Growth Concerns Spur Bonds: Markets Wrap

(Bloomberg) -- Asian stocks look set to fall Wednesday after U.S. shares snapped a winning streak and Treasury yields retreated on concerns about the economic outlook and risks from Covid-19 variants. The dollar firmed.

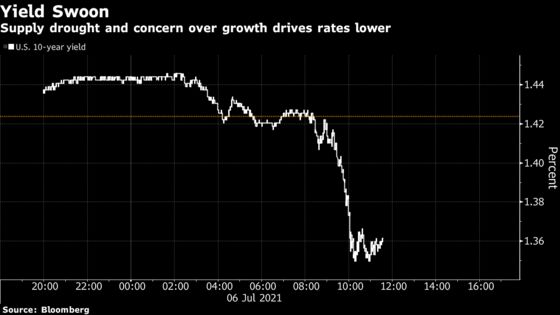

Futures dropped in Japan, Australia and Hong Kong. U.S. contracts edged down after the S&P 500 dipped from a record, led by the energy and financial sectors. Amazon.com Inc. helped take the Nasdaq 100 to a fresh peak. Ten-year U.S. Treasury yields hit February lows amid slower-than-expected service-sector expansion. Australian and New Zealand sovereign bonds rallied.

China’s cybersecurity probe into ride-hailing giant Didi Global Inc. sparked a 20% plunge in its shares. The nation issued a sweeping warning to its biggest firms, vowing to tighten oversight of data security and overseas listings, in a broadening crackdown on its corporate sector.

Oil pared losses after falling toward $73 a barrel. The dollar’s climb spurred a commodities selloff, and uncertainty shrouds the next move in the OPEC+ saga.

While global stocks are near all-time highs, inflationary pressures, reduced central bank stimulus and the spread of the Covid-19 delta strain are potential risks. Traders are looking ahead to the Federal Reserve minutes Wednesday for more clues on when the U.S. central bank may begin tapering the substantial asset purchases that have bolstered financial markets.

“There’re still concerns about what happens with the Fed tapering and there’s lack of traction on the fiscal stimulus side,” said Keith Lerner, chief market strategist at Truist Advisory Services. “Those uncertainties are just injecting some volatility and then you throw in concerns about peak economic growth. That just feeds into the concerns about -- is the best growth behind us?”

The spotlight is also on vaccine campaigns and whether they will obviate virus-related curbs. In the U.K., the government is lifting restrictions but officials have warned pandemic measures may need to be reimposed if infections surge.

For more market commentary, follow the MLIV blog.

Here are some events to watch this week:

- FOMC minutes Wednesday

- The Group of 20 finance ministers and central bankers meet in Venice on Friday

- China PPI and CPI data released on Friday

These are some of the main moves in markets:

Stocks

- S&p 500 futures fell 0.1% as of 7:52 a.m. in Tokyo. The S&P 500 fell 0.2%

- Nasdaq 100 futures dipped 0.1%. The Nasdaq 100 rose 0.4%

- Nikkei 225 futures fell 1.1%

- Australia’s S&P/ASX 200 Index futures fell 0.2%

- Hang Seng Index futures dropped 0.6%

Currencies

- The Japanese yen traded at 110.63 per dollar

- The offshore yuan was at 6.4785 per dollar

- The Bloomberg Dollar Spot Index was steady after rising 0.4%

- The euro traded at $1.1820

Bonds

- The yield on 10-year Treasuries declined about eight basis points to 1.35%

- Australia’s 10-year bond yield slid eight basis points to 1.39%

Commodities

- West Texas Intermediate crude rose 0.5% to $73.71 a barrel

- Gold was at $1,795.38 an ounce, down 0.1%

©2021 Bloomberg L.P.