Australia’s Central Bank Expects Record Low Rates Until 2024

(Bloomberg) -- Australia’s central bank took the first steps toward winding back emergency monetary stimulus for an economy that’s exceeded forecasts.

Governor Philip Lowe opted against extending the yield-target horizon and scaled back purchases of longer-dated bonds, the Reserve Bank said in a statement Tuesday after keeping interest rates unchanged. Once the current A$5 billion a week quantitative easing program ends in September, it will shift to A$4 billion a week with a review in mid-November.

“It makes sense for the RBA to start winding back its emergency stimulus moves,” said Shane Oliver, chief economist at AMP Capital Investors Ltd. in Sydney. “But it also makes sense to do this gradually.”

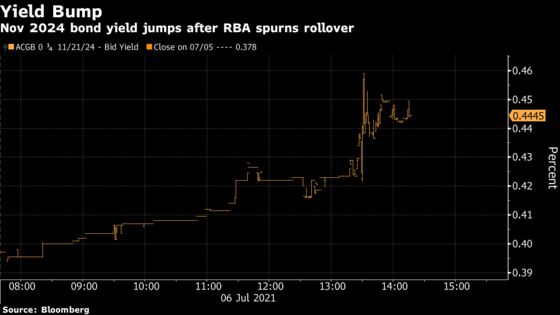

The Australian dollar briefly dipped after the statement, then recovered to be trading at 75.68 U.S. cents at 3:38 p.m. in Sydney. The April 2024 bond yield stuck just above the RBA’s 0.1% target while the yield on the November 2024 note climbed 6 basis points to 0.43%. Ten-year yields rose 4 basis points.

The RBA is determined to stay near the tail of global central banks unwinding emergency stimulus -- particularly the Federal Reserve -- even as Australia has recovered earlier and faster than many peers. That stance is likely aimed at avoiding the currency damage of previous early exits while also reflecting the continued vulnerability of the nation to further virus outbreaks due to a low vaccination rate.

“The bond purchase program is playing an important role,” Lowe said Tuesday. “The bank will continue to purchase bonds given that we remain some distance from the inflation and employment objectives. However, the board is responding to the stronger-than-expected economic recovery and the improved outlook by adjusting the weekly amount purchased.”

Covid Uncertainty

While Sydney’s ongoing coronavirus outbreak, which leaked to several other states and at one point forced the lockdown of almost half the population, adds a layer of uncertainty to the near-term outlook, the RBA sees limited long-term impact for now.

“The experience to date has been that once outbreaks are contained and restrictions are eased, the economy bounces back quickly,” Lowe said,

The governor and the government are using a monetary-fiscal combination to push the economy toward maximum employment as the governor seeks to drive wage growth above 3%, a level it hasn’t reached since the start of 2013. Faster wage gains would help spur long dormant inflation.

The bank “will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range,” Lowe said. “The bank’s central scenario for the economy is that this condition will not be met before 2024.”

The key debate is how quickly the labor market tightening -- unemployment has fallen to 5.1% from 7.4% in less than 12 months -- translates into pay gains.

Part of the reason the jobless rate has fallen so fast is border closures that have locked out temporary workers. With these not expected to lift until at least the second half of next year, wages could rise quickly. Alternatively, a prolonged period of weak price growth might mean it takes longer for broad-based wage-push inflation to take hold across the economy.

“Despite the strong recovery in jobs and reports of labor shortages, inflation and wage outcomes remain subdued,” Lowe said. “While a pick-up in inflation and wages growth is expected, it is likely to be only gradual and modest.”

The governor will deliver remarks and take questions at a press conference at 4 p.m. in Sydney.

©2021 Bloomberg L.P.