Dish TV India | The company reported consolidated loss at Rs 1,415.23 crore in Q4FY21 against loss of Rs 1,456.25 crore in Q4FY20, revenue fell to Rs 751.75 crore from Rs 869.06 crore YoY.

Dish TV India share price was down over 3 percent at open on July 1, a day after the company declared its March quarter results.

The company reported consolidated loss at Rs 1,415.23 crore in Q4FY21 against loss of Rs 1,456.25 crore in Q4FY20 while on a QoQ basis it reported net loss at Rs 1,408.65 crore against net profit of Rs 90.69 crore.

Its revenue fell to Rs 751.75 crore from Rs 869.06 crore YoY. EBITDA was down 15 percent QoQ at Rs 426.04 crore against Rs 503.94 crore while EBITDA margin came in at 56.7 percent against 61.8 percent QoQ.

Catch all the market action on our live blog

The stock was trading at Rs 13.43, down Rs 0.48, or 3.45 percent. It has touched an intraday high of Rs 13.72 and an intraday low of Rs 12.88.

Global research firm CLSA has maintained a buy rating on the stock with target at Rs 17 per share. "In FY21 the company repaid loans of Rs 1,000 crore with debt at Rs 800 crore, down 70 percent since FY19," it said, according to a CNBC-TV18 report.

"It has been in a share pledging crisis and promoter ownership is down to 7 percent. Resolution is likely and it will be key trigger for the stock," the research firm added.

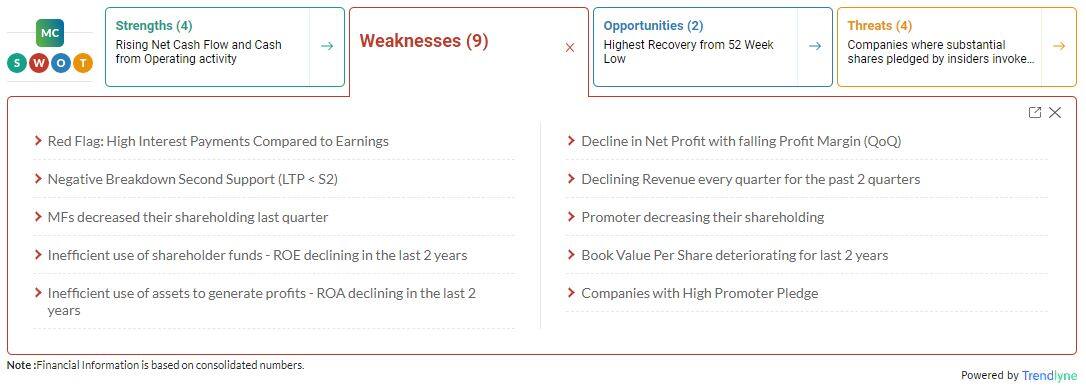

According to Moneycontrol SWOT Analysis powered by Trendlyne, the company is inefficient in use of assets to generate profits - ROA declining in the last 2 years with decline in net profit with falling profit margin (QoQ).

Moneycontrol technical rating is bearish with moving averages being neutral and technical indicators being bearish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.