- SARS will not tolerate corrupt staff, says its commissioner, Ed Kieswetter.

- Since 2020, the revenue service has completed 553 internal corruption cases, which has led to ten criminal convictions of its staff.

- SARS on Thursday launched the 2021 tax return filing season.

In an effort to be an organisation with unquestionable integrity, SARS will not tolerate corrupt staff, according to its commissioner, Ed Kieswetter.

Kieswetter was speaking during a virtual launch of the 2021 tax return filing season on Thursday. SARS's branches are closed for the next six weeks amid the third wave of the Covid-19 pandemic, and the tax filing season will be completely virtual.

Taxpayers who need to visit a branch for assistance after the six-week period have to book an appointment. SARS intends for all taxpayers to be converted to its digital offerings.

Kieswetter also spoke to efforts to drive taxpayer compliance and rooting out corruption within the revenue service.

"We have stepped up efforts to deal with internal corruption," he said. As part of its vision, SARS aims to be an organisation with "unquestionable integrity" that can be trusted and admired, said Kieswetter.

"We cannot tolerate any staff members who do not honour this and seek to collude with taxpayers to defraud the fiscus," Kieswetter said.

Since 2020 SARS completed 553 internal corruption cases. This has led to ten criminal convictions of staff, as well as 51 resignations and 55 dismissals.

SARS has also been working on rebuilding its capacity and capability, which had been eroded in the past decade. It launched a massive recruitment drive targeting 570 critical skills. This includes 200 graduates, Kieswetter said.

So far, 140 positions have been closed for finalisation. About 86 graduates have started a training programme at SARS and 26 of these are participating in a chartered accountant programme, Kieswetter said.

SARS has also reskilled 250 service agents to be proficient in compliance related activities, Kieswetter added. This will also help with turnaround times and provide a service that taxpayers are entitled to," he said.

SARS has been improving capability to detect non-compliance, such as fraudulent attempts to obtain refunds. "SARS with increasing vigour, imposed penalties and potential criminal prosecution where this is relevant," said Kieswetter.

SARS also detected more than 26 000 individuals with economic activity in excess of R1 million, but were not registered for tax. "These cases are being risk-profiled. And have entered into the investigative process. Work to detect such delinquent taxpayers will continue," Kieswetter said.

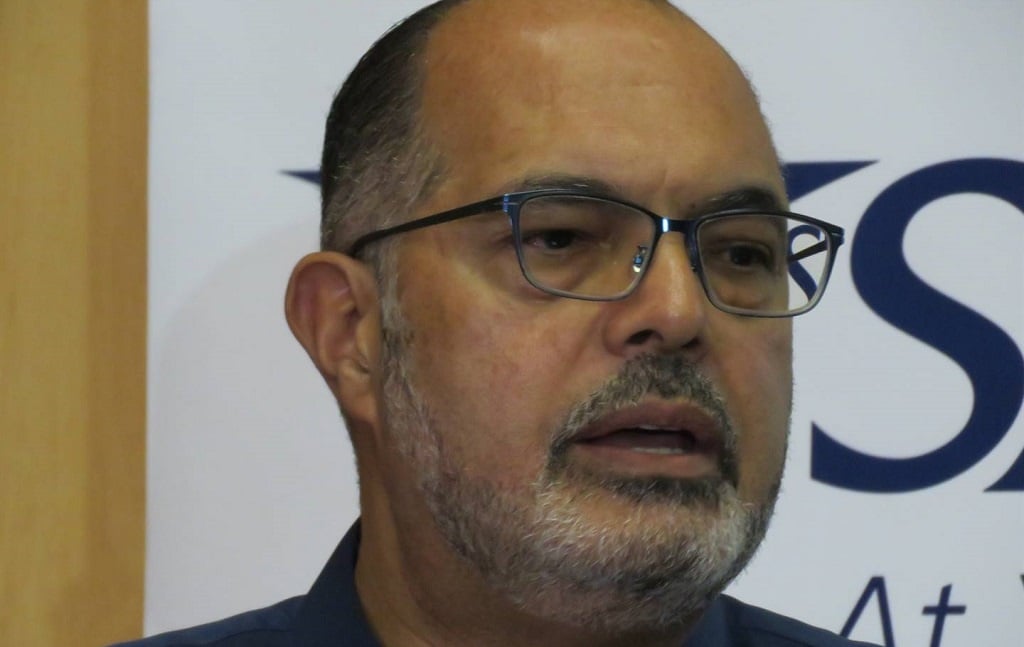

SARS Commissioner, Edward Kieswetter, addressing the launch of the 2021 Filing Season for Individuals and Trusts.

— SA Revenue Service (@sarstax) July 1, 2021

Launching today for the first time, a completely virtual Tax Season.

Tune in to SARS TV on YouTube: https://t.co/3tRKtdrjA1#YourTaxMatters pic.twitter.com/aUucfqN3ly

Of concern is employers who collect taxes from employees but do not pay over the funds to SARS.

The revenue service is collaborating with the National Prosecuting Authority in a joint project to detect non-compliance by employers. Prosecutions and convictions have commenced, he noted. "We have already had three successful convictions in terms of Pay As You Earn transgressions and 11 convictions in terms of the income tax convictions."

There are 622 000 employers on the tax register, and nearly 455 000 have filed monthly returns. This is impacting employees' ability to comply with SARS and possibly holding up their refunds.

For this year's tax filing season, SARS will also continue to make use of auto-assessments, which was introduced last year. It involves sending SMSes to over three million taxpayers, offering to complete their tax assessments automatically, based on the information the revenue service has access to.

Taxpayers can accept the auto assessment or edit it if they have additional information material to the outcome of the assessment, Kieswetter explained.

Working from home

SARS will also focus on new risks linked to Covid-19 such as working from home, donations to the Solidarity Fund and travel expense claims, the latter of which should be much lower given lockdown.

Kieswetter said that taxpayers need to carefully consider claims for work-from-home expenses, SARS had received over 1 500 tax returns with home office expenses claimed and over 1 300 have been stopped for verification. "The current risk-identification rate is 50% in this area."

He cautioned taxpayers to "correctly and truthfully" complete their returns. "Think carefully about whether you want to submit a claim if you did not actually incur any material costs." He noted that working from home had saved taxpayers certain expenses.

Between 1 July and 23 November, taxpayers who were not auto assessed can use the eFiling or SARS MobiApp to file tax returns, or can visit a ranch by appointment.

From 1 July to 31 January 2022, provisional taxpayers can file via eFiling.