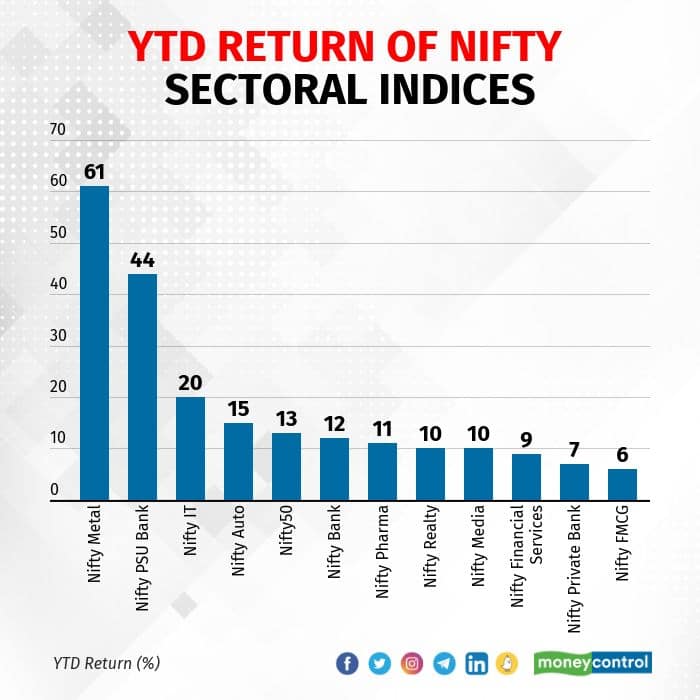

The Indian market has made healthy gains in the first half of the calendar year 2021, with most sectoral indices logging double-digit gains. But sectors such as Nifty FMCG, private banks and financial services have lagged, rising in single digits and underperforming the benchmark Nifty50.

As of June 29, Nifty FMCG, private bank and financial services were up 6 percent, 7 percent and 9 percent, respectively against the Nifty's rise of 13 percent this year.

Media, realty, pharma and bank indices have risen in double digits but they, too, have underperformed the Nifty.

Defensive sectors such as FMCG and pharma underperformed as investors shifted focus to growth stocks, anticipating a faster economic recovery. The second wave of COVID-19 and elevated inflation also had an impact on them.

"There had been the rotation of sectors for the past six months as investors moved away from growth stocks, which had a dream run in CY20, to value stocks which were available at throwaway valuations. That led to the underperformance of the defensive sectors like pharma and FMCG," said Hemang Jani, Head Equity Strategist, Broking & Distribution, Motilal Oswal Financial Services.

With a steady decline in Covid cases, opening up of the economy and faster vaccination, these sectors are expected to make a comeback especially, private banks and pharma.

FMCG still faces headwinds of inflation, which would keep pressure on margins for one or two quarters, said Jani.

What led to the underperformance?

Several analysts shared their views on what triggered the fall in these sectors and the outlook for them. Take a look:

Analyst: Hemang Jani, Head Equity Strategist, Broking & Distribution at Motilal Oswal Financial Services

Private banks: The resurgence of COVID-19 cases posed a risk to the asset quality, which led to underperformance. As the second wave was severe, there was a fear of a higher impact on economic activity.

FMCG: Lockdowns wave took a toll on FMCG companies. Though they are now better prepared to handle disruption, reduced consumer mobility, higher in-home consumption and sale of only essential products nearly washed out discretionary product sales in May.

Nitin Shahi, Executive Director, Findoc Financial Services Group

Banks: With lockdown-like restriction in April and May, there are fears that the banking sector may see an increase in non-performing assets (NPAs), the primary reason for the sector’s underperformance.

Pharma: Pharma stocks have seen a huge rally over the past year and a dip in daily Covid infections has resulted in profit-booking. With the vaccination drive in full swing, the pharma sector may see less interest from investors.

FMCG: The second wave had resulted in a loss of jobs and also affected the purchasing power of middle-class families. Consumption may take a hit in the next few months before the economy stabilises. We may see some underperformance in the upcoming quarter from FMCG companies.

Gaurav Garg, Head of Research, CapitalVia Global Research Limited

Pharma: Since the return of the COVID-19 epidemic, pharmaceutical stocks have taken centre stage. From January 2021, the number of cases began to decline but in April, there was a spike in daily infections, with the country reporting more than 1,00,000 cases a day.

A comparison of Covid cases with the performance of Nifty Pharma in CY21 shows that the index was bearish when the cases were falling but it began to be bullish when India started reporting more than 1,00,000 cases a day, as was the case for most of April.

Private banks: Banking stocks have been underperforming the benchmarks off late due to subpar earnings in Q4FY20, an extended moratorium, and overall weak market sentiment in the banking sector.

The earnings decline represented just a minor impact of the Covid-led shutdown. Most banks have set aside large amounts of money to cover any potential bad-loan situation that may arise due to the pandemic.

FMCG: When the economy opened up and new money flooded the market, growth-oriented industries began to outperform. The Nifty FMCG moved in a narrow range from January to May 2021. Rising commodity costs and partial lockdowns in the first quarter of FY21 again disrupted the supply chain, which led to the underperformance.

Aishvarya Dadheech, Fund Manager, Ambit Asset Management

With the gradual opening up of the economy in CY21, investor started chasing sectors which are levered on economy opening up. This led to sector rotation and most cyclical sectors like metals, cement, industrial, real estate, PSU, etc., started outperforming compared to defensive sector likes of pharma, FMCG, etc.

Most of the defensive sector (excluding IT) has underperformed Nifty50 in CY2021 so far. Private banks didn’t participate in the rally due to the uncertain outcome of the second lockdown on the asset quality and growth of banks’ balance sheets.

The road ahead

Hemang Jani

Private Banks: Large private banks are well-placed to accelerate market share gains, given their strong capital positions, robust balance sheets, and higher provisioning coverage on stressed assets.

Large private banks are better placed with the focus shifting from asset-quality issues to strong growth opportunities, market share gains, and earnings oscillation to decade-high RoEs.

Pharma: The second wave boosted growth in the Indian pharmaceutical market (IPM), with a sharp uptick seen in drugs used to treat Covid as well as immunity boosters.

The second wave downtrend, coupled with seasonal change, would result in a higher offtake of drugs associated with acute therapies, aiding better growth prospects over the medium term. The outlook for formulations/API/CDMO in the developed and emerging markets remains robust.

Developed markets are recovering faster from Covid following robust vaccination programmes. This will enable normalisation of sales in the US.

Injectables associated with elective surgeries are expected to see a demand revival with the easing of restrictions. The pace of approvals will also improve with fewer administrative hurdles.

FMCG: Most management teams are confident of a quick recovery on return to normalcy. While some turbulence in operations and supply chains has been observed, companies are better prepared to manage them when compared to last year. A pick-up in demand and margin sustenance would be key monitorables in the case of FMCG.

Nitin Shahi

Pharma: With lockdowns coming to an end and the economy coming back on track, pharma will witness some consolidation or profit booking.

Private banks: Private banking is consolidating for the last month in a tight range. Add-on dips are the advice for investors, as they will outperform the indices on a medium- long term basis.

FMCG: FMCG stocks are trading at rich valuations and considered as a defensive sector. In the short term, there can be profit-booking in select counters and money can be rotated to other sectors like realty, infra, finance and tourism once lockdowns end.

Gaurav Garg

Pharma: The pandemic has had a significant impact on the Nifty Pharma. With the government prioritising the healthcare sector, the pharmaceutical industry may be a good investment for the medium to long term. The stocks can be held for the long term.

Private banks: Looking forward, banking stocks may move in sideways to the bearish territory until the economy fully stabilises. Overall, it may take another two-three quarters for the banking stocks to normalise.

FMCG: Rising demand for essential products, particularly in the health and hygiene portfolio, in both urban and rural markets, has prompted firms to boost their investments in the country.

The FMCG industry may not outperform but can give steady gains. Investors looking for a stable return may consider the sector.

Aishvarya Dadheech

The increased pace of vaccination will provide further comfort on the recovery theme. Hence, sectors linked to the economy opening up are expected to do well going ahead. Cyclical, which are closely associated with the economy should do well.

Banks: The banking sector will continue to see momentum as the credit growth picks up. This time around, both private and PSU banks are expected to participate alongside NBFC.

Pharma: In the pharma space, companies with a focus on Indian business will be better placed. Another theme in healthcare e.g hospitals or diagnostic looks more promising from a growth perspective.

FMCG: Discretionary segment is expected to do better than staples over the next year or so. Pent-up demand in the discretionary space will contribute meaningfully to the growth ahead.

Overall sector-wise, private banks should show good momentum, whereas pharma and FMCG are expected to show modest movement in the remaining part of this calendar year.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.