After underperforming for more than two years since 2018, the broader markets (Midcap and Smallcap indices) picked up momentum in the second half of CY20 and have gradually outperformed benchmark indices not only in the last one year, but also in the first half of CY21.

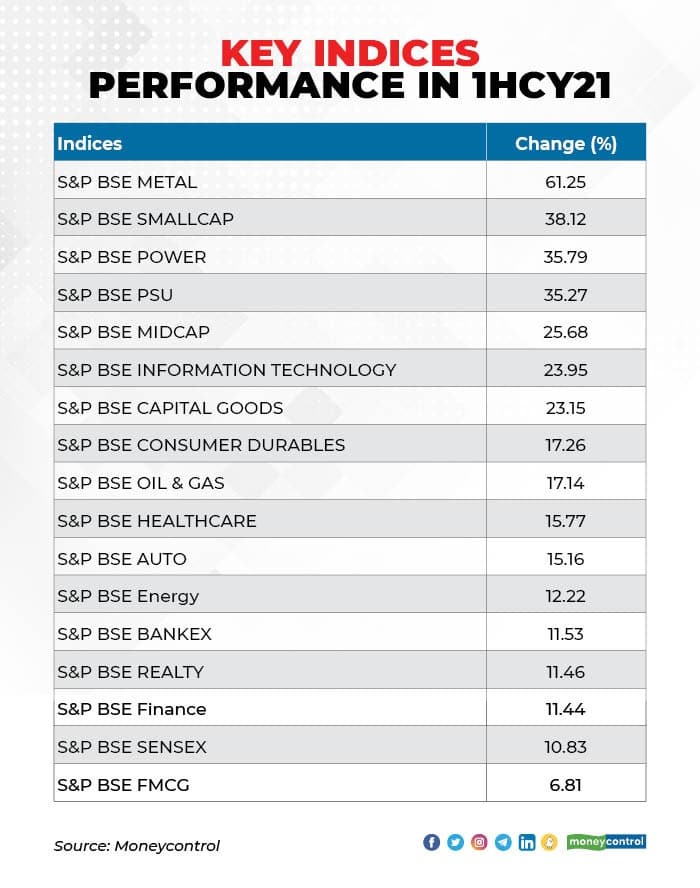

The BSE Midcap and Smallcap indices surged 70 per cent and 98 per cent, respectively, in the last one year, and 26 per cent and 38 per cent, respectively, in the first half of CY21.

In same period, the BSE Sensex spiked 50 per cent and 11 per cent, respectively. In fact, all these indices traded at record high levels in June 2021, which boosted investor confidence.

The improving domestic as well as global economic data points, better-than-expected quarterly earnings performance since the opening up of the economy in the second half of CY20, and valuation catch-up with benchmark indices have kindled expectations of a good economic growth in FY22. These are some of the key reasons for the outperformance in the broader markets, experts feel.

After the underperformance for more than two years, the valuation gap had widened, which is expected to narrow down, going forward. The increase in retail participation and FII ownership also boosted sentiments.

“There are many reasons behind the outperformance of the BSE Midcap and Smallcap indices, such as the revival of the global and domestic economies. The Indian economy is expected to expand 8.3 per cent in FY 2021-2022 and the global economy at 5.6 per cent in FY 2021-2022, which will fuel earnings growth,” Gaurav Garg, Head of Research, CapitalVia Global Research, told Moneycontrol.

“The broader markets were underperforming over the past two years, so that the valuation of the benchmark indices and broader markets widened. Valuation catch-up is another reason for this outperformance," he said.

“FPI ownership in Nifty Midcap 100 is at 17 percent, compared to Nifty50, where it is 27 percent. This gap might converge in the coming times and we can see the trend (broader market outperformance) to continue,” he said.

In 2021, the government did not close the economy like last year to check the spread of the virus, since there were lockdowns by most states. Even these were gradually lifted later. As a result, the market momentum did not break, though there was consolidation during the days of rising COVID infections.

Experts believe the momentum will continue for more than a couple of years, given the expected economic and earnings growth and the continuity of low interest rates till next year.

Superior performance here to stay

“The Nifty Smallcap 100 Index was 0.89 times of Nifty50 during early 2018, but there was large underperformance during 2018-2019 and the first half of 2020. The Nifty Smallcap 100 Index had become just 0.41 during April-May 2020. Currently, with some outperformance by the Nifty Smallcap 100 index, this ratio is at 0.61. So there is enough headroom for sustained superior performance by midcap and smallcap companies,” Shailendra Kumar, Chief Investment Officer, Narnolia Financial Advisors, told Moneycontrol.

Another way to look at it is how BBB- bond spreads are behaving, he said.

“BBB and BBB- rated bond spreads had increased, post IL&FS crisis, during 2018, but the spread now is at 4 years’ low, suggesting that the balance-sheet issues these smallcaps were grappling with are now a thing of the past,” he explained.

Even if we look at the stock performance, more than 85 per cent stocks in the Midcap and Smallcap indices traded in the green. Among them, more than 65 per cent reported double-digit gains.

A major rally was seen in metals due to the rising steel spread in the global markets, with the BSE Metal index rising 61 per cent in the first half of CY21. Power and PSU indices gained more than 35 per cent, while auto, bank, capital goods, healthcare and IT indices climbed 12-24 percent each in the same period.

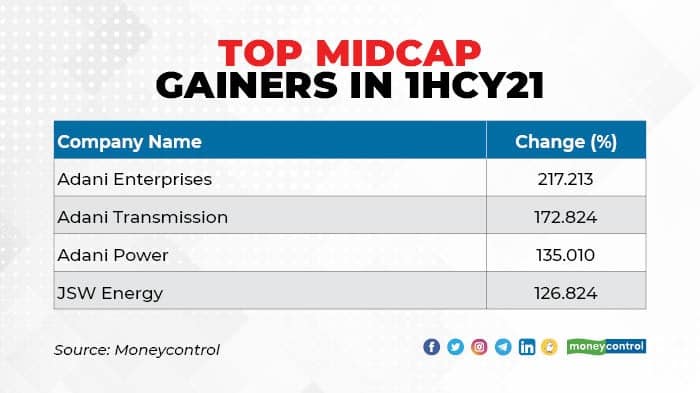

Among midcaps, four stocks - Adani Enterprises, Adani Transmission, Adani Power and JSW Energy - registered triple-digit returns (127-217 per cent) in the first half of CY21.

In the small-cap space, top 69 stocks clocked triple-digit gains between 100-500 per cent. They include Majesco, Magma Fincorp, Adani Total Gas, Balaji Amines, Hikal, Happiest Minds Technologies, Centrum Capital, Deepak Fertilizers, Hindustan Copper, Angel Broking, Prince Pipes & Fittings, Indian Overseas Bank, Lux Industries, Anant Raj, HSIL, Filatex India, Graphite India, Pricol, Tata Elxsi, Somany Home Innovation, Redington (India), and Supreme Petrochem.