- There's a compelling case for SA to lower its inflation targets, SA Reserve Bank governor Lesetja Kganyago told the Financial Times.

- The 4% to 6% target has been in place for over two decades.

- Kganyago also believes that the country is strong enough to weather a rise in international interest rates.

SA Reserve Bank governor Lesetja Kganyago told the Financial Times there is a "compelling case" for lowering the bank’s inflation target range, which is currently between 3% and 6%.

The target range has been in place since 2000, with the bank getting more specific in 2017: stating that it wanted to see inflation close to the 4.5% midpoint.

Almost all large countries have in recent years lowered their inflation target, Kganyago told the UK publication, adding "for South Africa to remain competitive, it is important that our inflation is in line with those of the countries that we compete with".

The inflation target guides the bank's decisions about interest rate movements. The closer inflation moves to breaching the upper end of the target, the more likely it is that interest rates will be hiked.

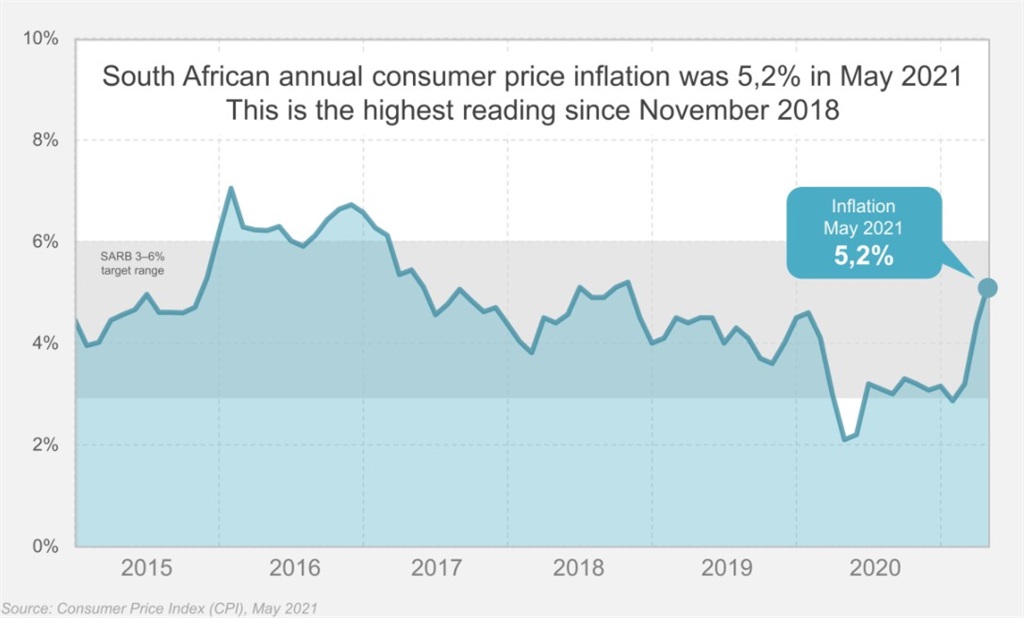

Consumer inflation has stayed below 6% for more than four years, but in May spiked higher to 5.2% - from close to 3% for many months.

The inflation target must be agreed upon between the Minister of Finance and the Reserve Bank governor.

'SA less vulnerable than last year'

The rand recently took a big knock after Fed chair Jerome Powell said the US central bank would begin a discussion about trimming bond purchases. The Fed also recently said that it expects two interest-rate hikes by 2023, sooner than economists thought.

In recent months, South African markets have benefited from strong inflows as global investors seek higher interest rates and yields in world where many countries have rates close to, or below, zero. If US rates move higher, investors would be less inclined to invest in South Africa, and it may also subdue their appetite for riskier assets.

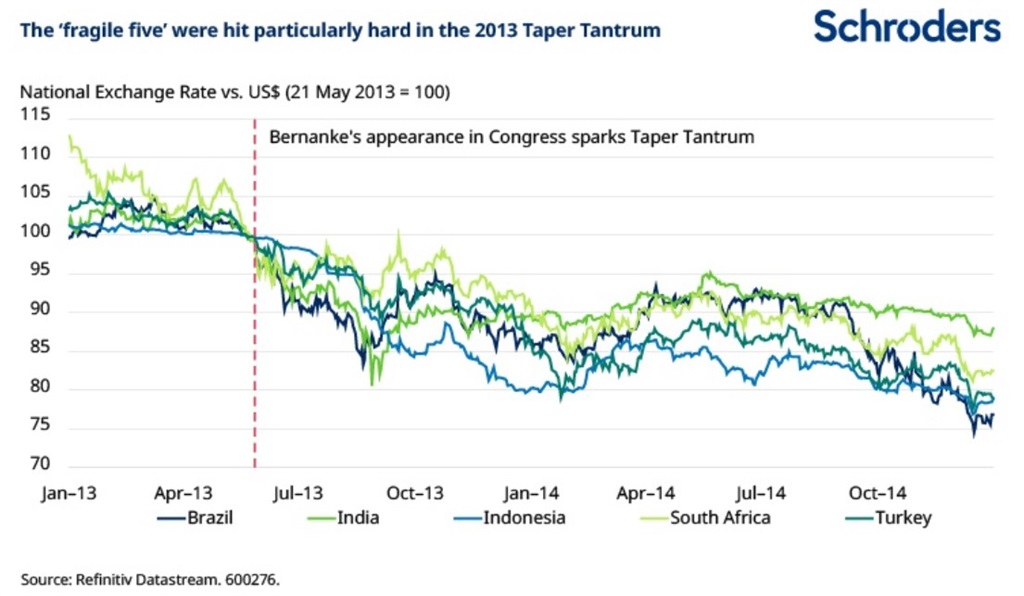

The Fed's recent comments triggered fears of a repeat of 2013's "taper tantrum". After pumping almost $2 trillion into markets following the financial crisis, the US central bank indicated that it would start to cut ("taper") quantitative easing – which resulted in sell-offs in South Africa and other emerging markets.

But Kganyago told the Financial Times that South Africa is financially strong enough to weather a rise in international interest rates, and "less vulnerable this year than it was last year".

While still strained, South Africa's government finances currently look in better shape than expected. The budget deficit (R552 billion) for the past year was 11.2% of GDP, Bloomberg reported. This was far lower than government’s own projections, thanks to surprisingly strong tax income, as well as subdued state spending.

Unlike 2013, South Africa is also far less dependent on capital inflows.

Its current account surplus – an indicator of exports and imports, as well as other outflows and inflows - has widened to 5% of GDP for the first quarter of the year,

In monetary terms, the surplus came to R267 billion, the second largest recorded. This was in part due to booming commodity prices, which have benefited South African mining exports.