India’s largest retailer Reliance Retail (RR) has laid out stellar growth targets. RR aims to be amongst the fastest growing retailers in the world. RR is targeting growth of 3x over the next three to five years, which implies a compound annual growth rate (CAGR) of about 35 percent. RR aims to be amongst the top 10 retailers globally and has laid a five-pronged strategy to achieve that goal.

RR plans to invest heavily in research, design, and product development capabilities. In FY22, it plans to set up design, research, technology and innovation centres in key areas globally and nationally to develop differentiated offerings for its diverse customer groups. Secondly, RR plans to strengthen its sourcing ecosystem and work closely with producers, MSME, service providers, local and international brand companies. Thirdly, RR plans to invest in building supply chain infrastructure across the length and breadth of the country by linking all major sourcing and consumption locations. This will lead to maximum efficiencies and minimize losses in the supply chain which can be shared with producers and consumers. RR will expand its store footprint multi-fold with co-located delivery hubs over the next few years. Lastly, RR will continue to acquire businesses to increase its offering and experience to customers, enhance omni-channel capabilities, drive operating efficiencies and strengthen its talent pool.

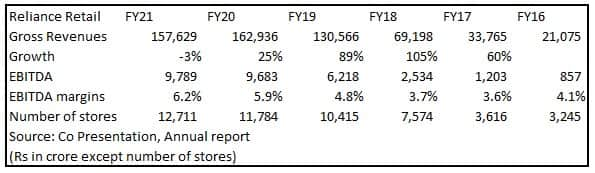

Track record of strong and industry leading growth

RR has emerged as one of the largest retailers in India within a short span of time. Over the last five years between FY2015-2020 (FY21 was impacted by the COVID-19 pandemic), RR had registered 56 and 65 percent CAGR in revenues and profitability, which is probably the highest in the Indian retail industry. During this period, RR’s store count had increased at a CAGR of 35 percent, which is another industry-leading achievement.

Strong cash position can help achieve growth targets

The company has successfully raised about Rs 47,000 cr from marquee investors about six to seven months back. RR has the war chest to pursue organic as well as inorganic growth opportunities to further strengthen its leadership position. With a sales to gross block ratio of 12x, the investment can fetch revenues of Rs 565,000 cr (about 3.9x of the current revenues), a confirmation that the company can reach the targeted revenue levels of tripling the retail business.

RR taking the lead in online retail

RR has been amongst the first movers in online retailing, especially in the areas of grocery and fashion. This has proved useful in the times of COVID-19, where customers are wary of stepping out to visit stores. With ease of shopping and customer convenience, we expect online sales to continue to gain traction in the post COVID-19 era as well and players with established online channels will continue to outperform.

AJIO, which is the online platform for the fashion and lifestyle segment as well as Jio Mart (primarily for groceries) has done exceedingly well. For its online B2B (business to business) foray, RR currently has onboarded 3 lakh shopkeepers across 150 cities enabling them to transform their business, RR aims to enroll over 1 crore merchant partners over the next three years.

Increasing RR valuation based on aggressive growth targets

We expect RR’s growth to accelerate given the well-defined management strategy and cash reserves. We have increased RR’s estimates based on higher growth guidance. We value RR at 3.5x FY23 projected revenues which implies valuation of about Rs 774,000 crores (compared to Rs 656,000 cr as per our last update). Our current target valuation is about 65 percent higher than the deal done in November 2020 wherein RR had raised Rs 47,265 cr for a 10.1 percent stake.

How does the valuation stack up in comparison with peers?

Vis a vis international peers

RR with its distinct online advantage and high growth rates in excess of 50 percent historically (FY21 growth was impacted by carving out of the petroleum retail business and extended COVID-19 wave in India) should be compared with Amazon in the US and Alibaba Holdings of China who have similar high growth rates of 35 to 40 percent. Also, Amazon and Alibaba are leaders in their respective countries, which is also the case with RR. RR should therefore trade at valuations comparable to those for Alibaba and Amazon.

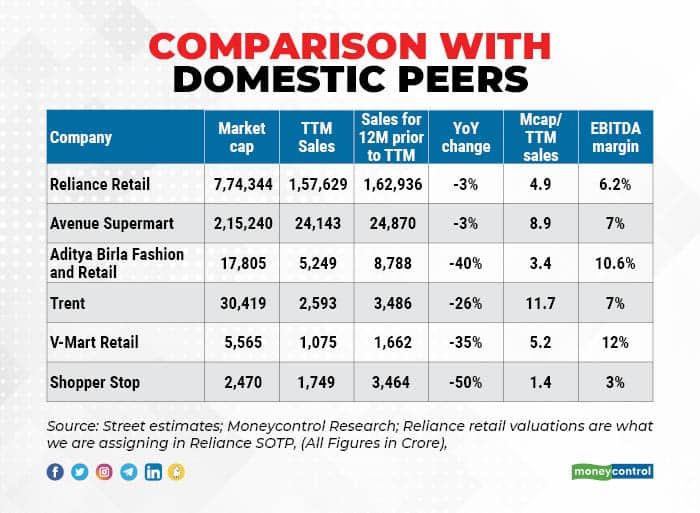

Vis a vis domestic peers

The domestic peer group (excluding Reliance Retail) is trading at about 6x Market cap to Trailing twelve months (TTM) sales. Our revised valuation for RR implies a market cap to TTM sales multiple of 4.9x as compared to 4.2x earlier.