ED transfers Rs 9,371 crore assets seized from Vijay Mallya, Mehul Choksi and Nirav Modi to PSBs, Centre

'Forty percent of the total loss to the banks has been handed over to public sector banks,' the ED said in a statement

File photo of Enforcement Directorate logo

New Delhi: About 40 percent of the money lost by banks in the PNB scam and the fraud linked to fugitive businessman Vijay Mallya's defunct Kingfisher Airlines has been realised by way of sale of shares seized under the Prevention of Money Laundering Act (PMLA), the Enforcement Directorate said on Wednesday.

It said the Debts Recovery Tribunal (DRT), on behalf of an SBI-led consortium that lent money to Mallya, on Wednesday sold shares worth over Rs 5,800 crore of United Breweries Limited (UBL) that were earlier attached by the agency under provisions of the PMLA.

This attachment was earlier done by the ED as part of its criminal probe against 65-year-old Mallya, who is now in the UK.

The ED said the DRT action came after the agency transferred the shares (worth nearly Rs 6,600 crore of UBL) attached by it to the SBI-led consortium on the direction of the special PMLA court in Mumbai.

Mallya and fugitive diamantaires Nirav Modi and Mehul Choksi, who were involved in the PNB scam, "defrauded public sector banks by siphoning off the funds through their companies which resulted in a total loss of Rs 22,585.83 crore to the banks", it said.

ED not only attached/ seized assets worth of Rs. 18,170.02 crore (80.45% of total loss to banks) in case of Vijay Mallya, Nirav Modi and Mehul Choksi under the PMLA but also transferred a part of attached/ seized assets of Rs. 9371.17 Crore to the PSBs and

Central Government.— ED (@dir_ed) June 23, 2021

As of date, the agency has attached total assets worth Rs 18,170.02 crore in these two bank fraud cases, it said.

"Assets worth Rs 329.67 crore have been confiscated and assets worth Rs 9,041.5 crore, representing 40 percent of the total loss to the banks have been handed over to public sector banks," the ED said in a statement.

The further realisation of Rs 800 crore by sale of shares is expected by June 25, it said.

While the Punjab National Bank fraud at its Brady House branch in Mumbai is alleged to be worth nearly Rs 13,000 crore, Mallya is accused to have cheated the banks of Rs 9,000 crore by way of criminal loan default in the operations of Kingfisher Airlines.

Mallya has lost the case challenging his extradition to India and has "been denied permission to file an appeal in the UK Supreme Court".

"His extradition to India has become final," the ED said.

Modi, now in the UK, has also lost his extradition battle. His uncle Choksi had mysteriously gone missing on May 23 from Antigua and Barbuda, where he has been staying since 2018 as a citizen, and later surfaced in neighbouring Dominica.

also read

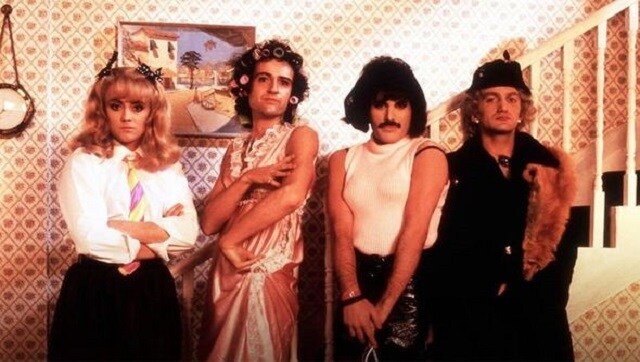

Celebrate World Music Day and Pride Month with a carefully curated list of 10 international queer songs

From Queen's 'I Want To Break Free' to Shamir Bailey's 'On My Own,' here are 10 queer songs that have been powerful allies and source of catharsis for the LGBTQ+ community.

CBI, MEA approach Dominica HC to be made party to Mehul Choksi case seeking his return to Antigua and Barbuda

If the Dominica High Court admits the two affidavits filed by the CBI and the MEA, it will pave way for noted lawyer Harish Salve to plead India's case in the country

Dominica high court rejects Mehul Choksi's bail plea, deems him flight risk; key events so far

Choksi, 62, who has an Interpol Red Notice against him, had mysteriously gone missing on 23 May from Antigua and Barbuda where he has been staying since 2018 as a citizen after fleeing from India.