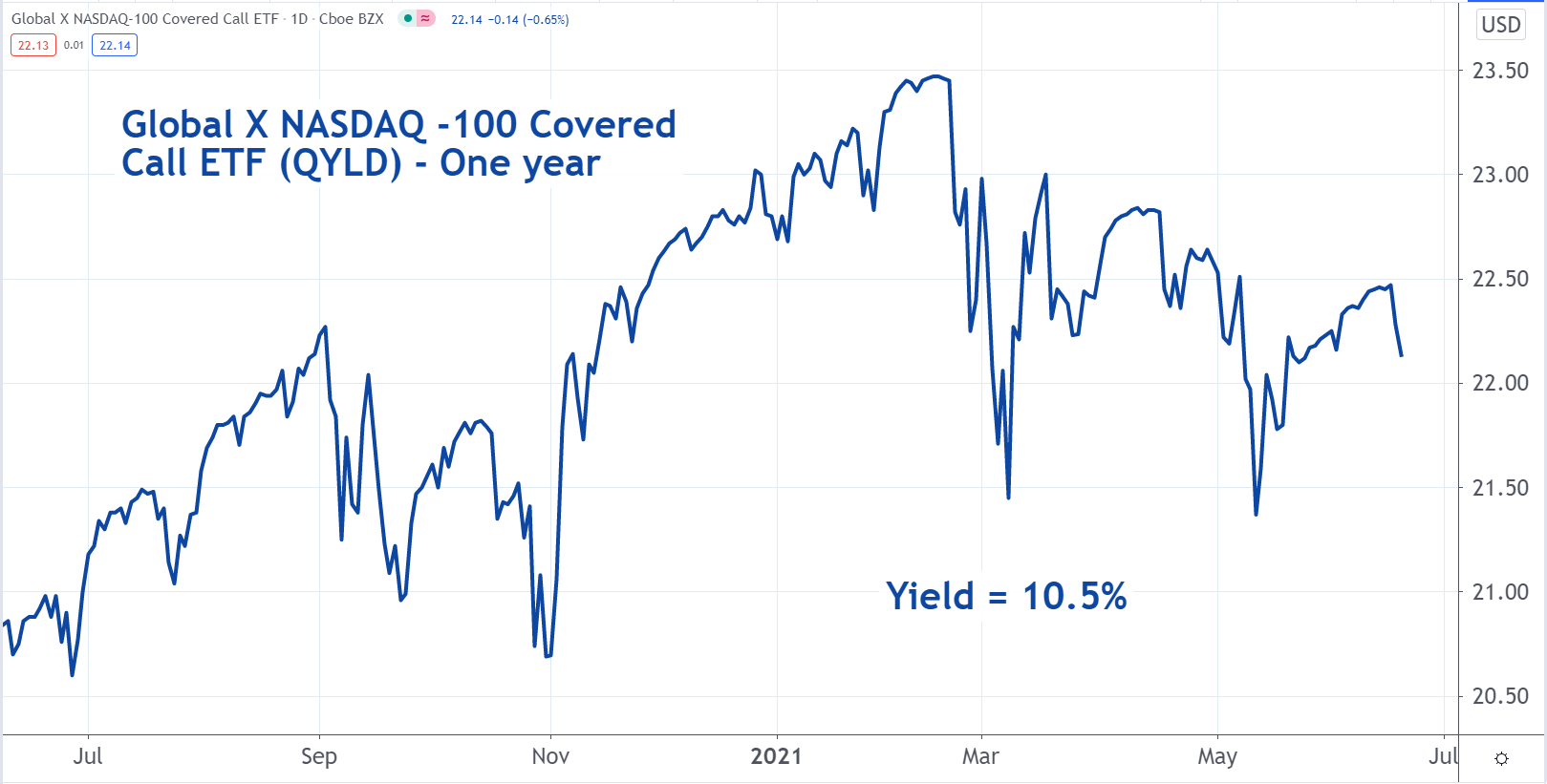

This ETF Has A 10.5% Dividend Yield

Despite inflation and rising interest rates, investors who are seeking income don’t have many good choices. The yield of a 10-year US Treasury Bond is only about 1.5% and the average yield of a corporate bond is only about 2.7%. These are both significantly lower than their historical averages.

Income-seeking investors should consider the Global X NASDAQ 100 Covered Call ETF (NASDAQ: QYLD). This ETF uses an options strategy to enhance its income. This could limit the price appreciation, but the trade-off results in an increased level of dividends and a higher yield.

At the current price level, QYLD is paying about 10.5%.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dividends Specialty ETFs Trading Ideas ETFs