Mehul Kothari, AVP – Technical Research at AnandRathi

We have a cautious stance on the market and would advise traders to remain extremely selective while going long. It is better to keep booking longs at higher levels, Mehul Kothari, AVP – Technical Research at AnandRathi said in an interview with Moneycontrol’s Kshitij Anand. Edited excerpts:

Q) The US Fed hawkish stance rocked the boat of bulls at least for now. What led to the price action on D-Street last week?

A) The week was full of actions for the domestic markets as both bulls and bears displayed their strength following the correction in the US markets.

Although, the hawkish stance of the US Fed irked the markets. But, for our markets some profit booking was much anticipated and needed.

On the whole, there was too much optimism in our markets and the crack in Dow Jones just provided the trigger for some profit booking.

Q) India Inc is showing signs of recovery, and with unlock in many states we could be heading for full recovery in the next few quarters. In case we do get a dip – what is a healthy dip which investors should not be worried about?

A) Thankfully, the 2nd wave is settling down and yes this can lead to a nationwide unlock gradually but we cannot be very complacent at this point in time.

Settling of the 3rd wave can be temporary and hence the markets would still remain under the ambiguity of Covid – 19. Volatility is likely to stay for few more months.

In such a scenario, a 10% dip can still be a healthy dip for which the investors should not be worried about.

However, anything below 14,000 in the Nifty would be a cause of concern for few more months. For very short term, 15,400 – 15,000 could be a strong support area.

Q) Do you think we have made a top in Nifty50 and chances of more consolidation is much higher than a steady uptrend? What are the levels which one should watch out for?A) We are not sure whether the top is in place or not but we are of the opinion that from here on it won’t be that easy for the markets to sustain at higher levels.

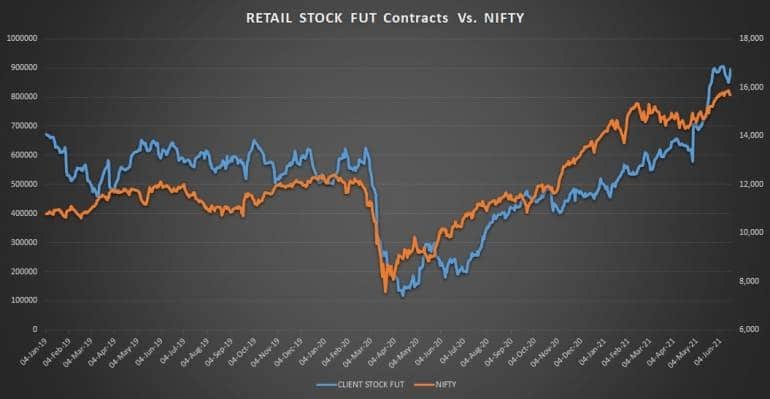

There are few data points which has started showing some red flags. The derivative stats indicate that retail participation is highest in the stock futures in comparison to the past few years.

They have a net 8.8 lac contracts longs in the stock futures and that seems to be a bit heavy. Off course, one would argue the new Demat openings have been phenomenal since the year 2020.

However, the new restrictions imposed by the SEBI to curb the leverage positions do not go hand in hand with such huge participation. The data is indicating some kind of over-optimism. On the front of the level, 15400 is decisive support for the coming weeks.

A breach of the same might halt the momentum. On the contrary, if the index moves towards new life high then near 16000 there is a potential reversal zone of a bearish AB=CD harmonic pattern.

Thus, we have a cautious stance on the market and would advise traders to remain extremely selective while going long. It is better to keep booking longs at higher levels.

Q) What is your call on the broader market space? Do you see small & midcaps to underperform and with cheap money slowly receding – time of easy money making in small & midcaps is behind us?

A) If we see the larger degree chart of the Nifty Midcap 100 index that has a strong hurdle at around 28000 – 29000 zone. Although, the zone is a bit far from the current price of 26500, in the coming weeks the index might get stuck in the mentioned zone.

Even, the index NIFTY 500 is stuck at the larger degree trend line resistance at the 13700 mark. This resistance coincides with the 200% retracement of its previous move.

The above two points dictate that we are reaching an exhaustion point for broader markets. To conclude, similar to the benchmark index even the broader markets has some room left but post that there could be a decent correction. Thus we advise traders to stay very selective and stick to quality.

Q) What led to the price action on the sectoral front?

A) The Nifty FMCG and NIFTY IT were the only sectoral index which gained during the week. If we recall the crash of March 2020 then even that time FMCG sector remained resilient and similarly, in this small correction they proved to be dependable.

On the other hand, recovery in USDINR (depreciation of INR) might be the reason why the entire IT pack remained in limelight. Going ahead; we expect further traction in both sectors as a part of defensive bets.

Q) Any 3-5 trading ideas for the next 3-4 weeks?

A) Here is a list of top trading ideas for the next 3-4 weeks:

Aurobindo Pharma: Buy| LTP: Rs 952| Stop Loss: Rs 915| Target: Rs 1020| Upside: 7%

Due to the high volatility in the markets, we would stick to defensives/consumption stocks with a short-term view. Aurobindo Pharma is one of them.

The stock recently found support near the Rs 920 level which is the placement of Ichimoku cloud on the daily scale.

In addition, the support falls between 50% and 61.8% retracement of the previous rise. Hence, traders are advised to buy the stock near 950 with a stop loss of 915 for the upside potential target of 1020 in the next 2 – 4 weeks.

Sun Pharma: Buy| LTP: Rs 668| Stop Loss: Rs 645| Target: Rs 705| Upside: 5%

During the month of May 2021, Sun Pharma confirmed a major breakout above the 650 mark and has now again retested the breakout level.

Similar to Aurobindo even Sun Pharma has found support at the Ichimoku cloud support on the daily chart.

The risk-to-reward ratio looks lucrative for a short-term buy. Thus, traders are advised to buy the stock near 665 with a stop loss of 645 for the upside potential target of 705 in the next 2 – 4 weeks.

UBL: Buy| LTP: Rs 1366| Stop Loss: Rs 1300| Target: Rs 1480| Upside: 8.42%

Last, to last week, the stock UBL underwent a strong breakout above the 1320 mark from the pattern which resembles a bullish Cup and Handle pattern.

From then the stock has been consolidating. At this juncture, it is trading near the placement of 20 DEMA and rising trend line support.

Thus, traders are advised to buy the stock at 1360 with a stop loss of 1300 for the upside potential target of 1480 in 2 – 4 weeks.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.