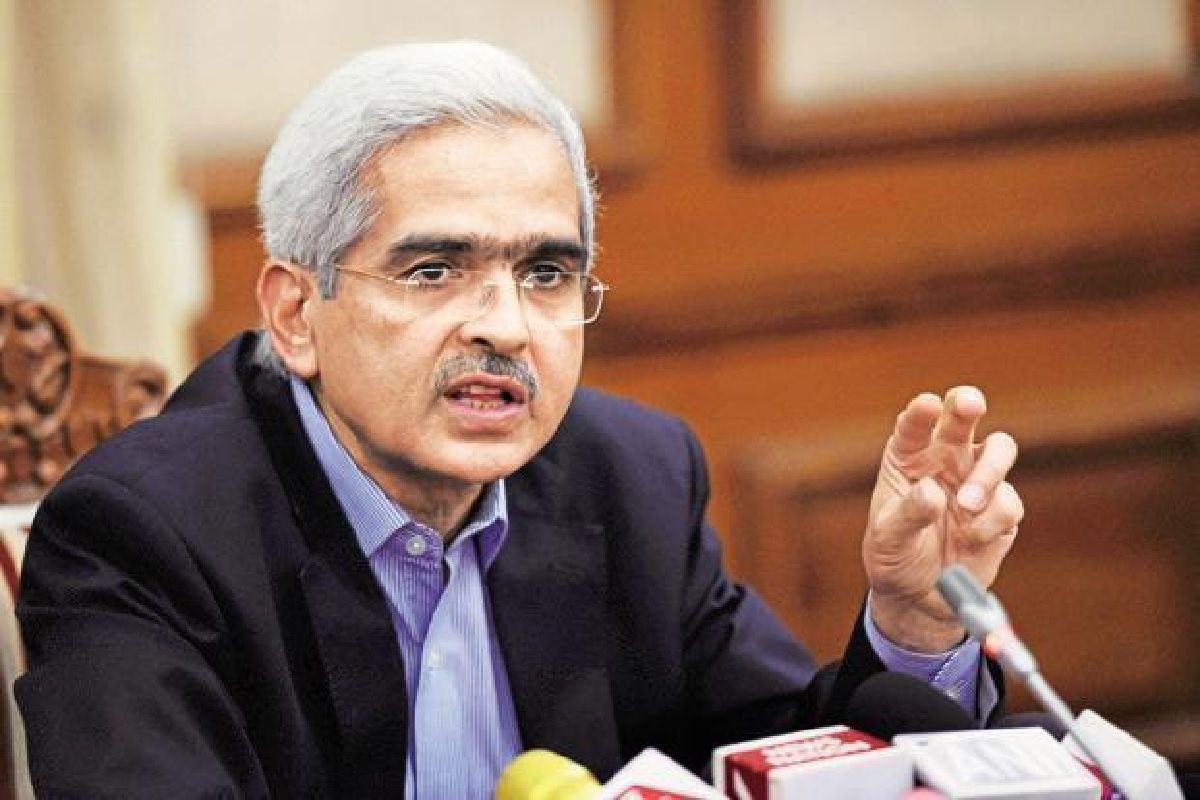

Mumbai: In an effort to revive the ailing economy at this time of COVID pandemic, Reserve Bank Governor Shaktikanta Das on Friday pitched for policy support from all sides — fiscal, monetary and sectoral, saying it is a prime requirement to return to normalcy.

“Overall, the second wave of COVID-19 has altered the near-term outlook, and policy support from all sides fiscal, monetary and sectoral is required to nurture recovery and expedite return to normalcy,” Das said.

The RBI governor also added that the dent in economic activity due to the second wave of the pandemic during April-May necessitated the continuation of monetary measures to support the process of economic recovery to make it durable.

The RBI governor further said the pace of vaccination and the speed with which the second wave can be brought under control will have considerable bearing on the evolving growth as well the inflation trajectory.

The Reserve Bank remains committed to undertake pro-active conventional and unconventional measures and to effectively channelling the systemic liquidity to alleviate stress of critical sectors which have borne the brunt of the second wave, he said.

Das, and the other five members of the MPC — Shashanka Bhide, Ashima Goyal, Jayanth R Varma, Mridul K Saggar and Michael Debabrata Patra — had voted for keeping the policy repo rate unchanged at 4.0 per cent.

External MPC member Jayanth R Varma said inflation rates have been consistently well above the mid point of the tolerance zone for an extended period and are forecast to remain elevated for some time.

“Moreover, survey data and other indicators show that businesses have no difficulty in passing on cost increases to consumers, and are able to maintain (and even expand) their margins,” he said.

Ashima Goyal said the slump in consumer confidence in the second wave is slightly more than that in the first wave. It had, however, recovered to July 2019 levels in January 2021, and may show a similar V-shape this time.

(With inputs from PTI)