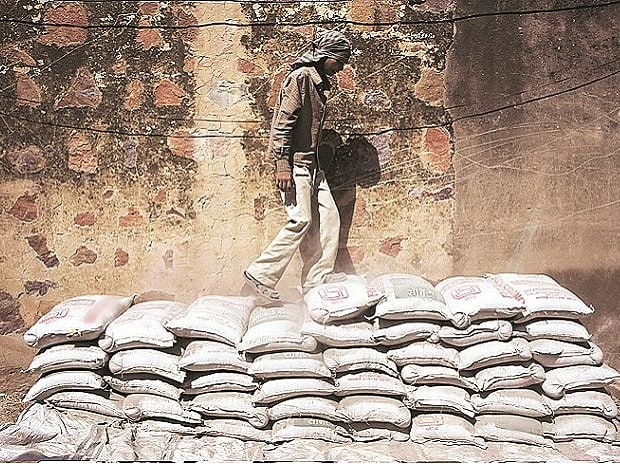

Shares of cement companies were in focus on Thursday as they surged up to 7 per cent on the BSE in intra-day trade in an otherwise subdued market on expectation of demand recovery in the coming quarters.

Ambuja Cements and JK Lakshmi Cement each hit their respective record highs in intra-day trade today while Saurashtra Cement, Andhra Cements, KCP, JK Lakshmi Cement and Gujarat Sidhee Cement gained between 4 per cent and 7 per cent. Besides, Orient Cement, JK Cement, Ambuja Cements, and UltraTech Cement advanced in the range of 2 per cent to 3 per cent. In comparison, the S&P BSE Sensex was down 0.16 per cent at 54,417 points at 01:11 pm.

Analysts expect the recent spike in Covid-19 cases and consequent restrictions imposed in almost all states across the country from April 2021 onwards to impact the demand-supply dynamics in the cement industry in April-June quarter (Q1FY22).

"The varied localised restrictions imposed in almost all the states in the country since April 2021 could slow down the construction activities and in turn affect the demand-supply scenario for cement industry in Q1-FY22. In addition to the above, growth in rural demand had aided the demand for cement in the last fiscal year. However, that may not be the case this year as rural areas too seem to be affected on account of the second wave of Covid-19," according to CARE Ratings.

That said, with ease in restrictions from July onwards, demand, they say, is expected to pick up on a gradual basis as the situation evolves based on the containment of the virus and the progress in the vaccine inoculation drive. Further, possibility of a third wave of Covid-19 in the near future might affect the industry dynamics again, the rating agency cautioned.

Yet, analysts at Emkay Global Financial Services do not expect margins to be impacted in Q1FY22 as average pan-India prices are up around 6 per cent quarter on quarter, which would largely mitigate the impact of various cost escalations, as also weaker demand/offtake during this quarter.

"Continued lockdown relaxations, low demand base in the past two years, government’s focus on infrastructure-spends, and robust FY21-exit volumes augur sustainable demand recovery in the coming quarters," the brokerage firm said in cement sector update.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU