For almost 3 years, smallcaps have been muted in terms of performance and now all of a sudden like ‘Sleeping Giants’ they have woken up and have been outperforming on the charts for almost a year now!

Looking back, small caps have generated 120 percent in returns for the last year! This is by no means a small matter and has been trending within the Indian Financial Markets.

Equity Analysts suggest that small caps have outperformed mid and large caps due to the significant gap in valuation that they had had a head start at the beginning of the rally.

To find out more we asked a few questions to some of our smallcase managers on why this has happened. Here’s what they had to say.Q) Small caps have been on the rise and they've been skyrocketing! What could be the reason for smallcaps to rise at a time like this?

A) “From what we have observed in our investing career of multiple market cycles, during a bull run, smallcaps start moving after large caps and midcaps,” Divam Sharma, Co-Founder, and CEO, Green Portfolio said.

“Moreover, we have witnessed smallcap stocks are more susceptible to macro trends, so when the economy is going into an expansive phase, smallcap stocks tend to outperform largecaps and midcaps,” he said.

Q) Smallcaps have been giving some exceptional returns after a period of muted performance. What could be the reason for this?

A) Arvind Kothari, Founder, and Director of, Niveshaay says that Liquidity, low interest rate, and currency stability in the past year explain a good rally in the small and mid-cap index after a muted performance.

Small-sized companies rely on external capital for their growth as compared to large companies. Higher interest rates mean a higher cost of capital, he added.

This results in growth becoming more expensive. If the interest rate is lower, that means the denominator while estimating the valuation is lower resulting in higher estimated valuations for small companies, explains Kothari.

Also, low-interest rates create liquidity. This resulted in more money coming into equity markets.

Small and Mid-Cap were trading at attractive valuations

The small and mid-cap indices are far more volatile than largecap. During the March lows, many good-quality smallcap companies were trading at attractive valuations. Ample liquidity in the market combined with the government's effort to revive the economy, positive FPI inflows boosted the investor sentiments and took markets to higher levels including the small-and mid-cap stocks, added Kothari.

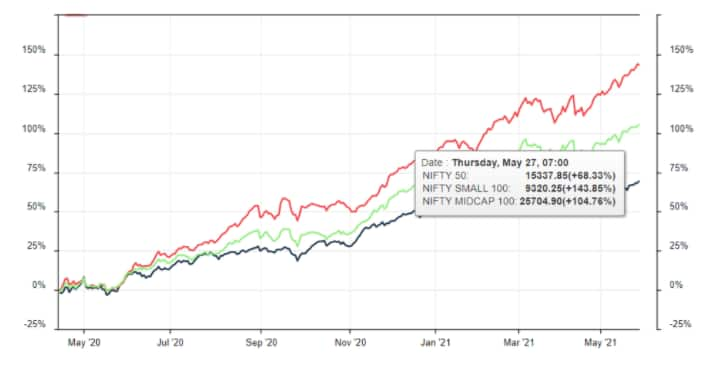

Last One Year Performance Chart of NIFTY 50, NIFTY SML 100 & NIFTY Midcap 100

*Source - Marketscreener

Q) What are the risk factors that need to be taken into account before investing in smallcaps?

A) Sonam Srivastava, Founder, and CEO, Wright Research says that smallcap companies tend to be riskier investments than largecap companies.

“If you pick an emerging stock there is greater growth potential and it would tend to offer better returns over the long-term, but these stocks do not have the resources of large-cap companies, making them more vulnerable to negative events and bearish sentiments,” added Srivastava.

Smallcaps have higher volatility and are awarded higher returns due to their nimbleness but during economic contractions, they suffer more than large caps, she said.

Q) What does the trend for smallcaps look like moving forward?

A) Ashwini K Shami, EVP and Portfolio Adviser, Omniscience Capital said the trends will vary for each segment of the smallcap universe.

“With 500+ stocks to pick from, the bottom-up approach becomes extremely important to optimize returns. Investors should focus on SuperNormal companies which are available at SuperNormal prices through a well-defined investment process,” added Shami.

Q) How long do you think this trend can last?

A) Anubhav Mukherjee, Co-Founder, Prescient Capital said that investors need to do thorough research to understand the long-term sustainable fundamentals and growth prospects of a business and not get carried away by near term growth.

Also, one should be conscious of valuation and never overpay to invest in fad ideas, hot stock tips, etc. “That being said, we believe the easy money in smallcaps has already been made as the broad-based rally in small caps led by a rebound from their muted valuations last year has played out,” says Mukherjee.

“In order to earn index beating return from here on, investors will have to do research and selectively invest in high quality businesses that have shown resilience during this difficult time of Covid-19 pandemic and are poised to deliver good growth despite the continuing challenges,” he added.

Q) What could be the easiest way for investors to have a share of the pie with heavy returns?

A) Divam of Green Portfolio said that with experience of more than 15 years in the industry. After studying the market behaviour and to help our investors capitalise on this opportunity, we have launched our brand new ‘Smallcap Multibagger Smallcase’.For retail investors, smallcases are one of the easiest ways to capitalise on macro trends in the market, the risk is well managed as investment decisions are made on the ‘High-Quality Right Price Philosophy’, which identifies value stocks that are in a growth trajectory and have a good margin of safety.”

Arvind who is quite the Investing Wizard reflected on the bumps along the way that lead to their success,

“Niveshaay is a SEBI Registered Investment Advisory Firm with a Dedicated Research Team specializing in unearthing high-quality undervalued stocks. We are focused on mid and smallcap companies.

At Niveshaay, we have continuously invested in stocks that are available reasonably and have huge earning potential upside. We have designed ‘Mid and Small Cap Focused Portfolio’ on smallcase.It is a portfolio that constitutes more than 70-80% allocation in quality small-cap stocks. Our portfolio is perfectly suitable for an investor with a time horizon of 3-5 years, and strongly looking for long-term investments.

We have been live on the smallcase platform since Sep 2019. The unprecedented COVID crisis was the most stringent stress test that one could have applied on their portfolio companies. We have proved our strategy on the platform by outperforming the index returns with good margins.”

Being the Financial genius that she is, Sonam Srivastava of Wright Research pitched in her take on the matter,

“To pick up a smallcap winner one needs to pick up emerging companies that have a big growth potential and also have a sense of momentum & volatility in the markets. We at Wright Research offer a smallcap portfolio that uses a mix of fundamental and technical factors to pick winners for the smallcap rally,” she added.

Wright Smallcaps“This portfolio has given amazing returns in the period of 3 months when it has been live and historical analysis show that this has a great outperformance potential. It is also closely managed for risk with systematic deallocation procedure in place and can be a good way for people to get a flavour of the juicy smallcap returns,” she added.

With a determined focus on the market, Ashwini K Shami of Omniscience Capital also had a lot to say on the matter,

OmniScience Smallcap portfolio offers investors multiple sub-themes to invest in. These segments of Omni Supertrons are in an accelerating and potentially explosive growth phase, yet not fully identified by the market.“The portfolio has companies from 5 key segments with strong secular growth momentum that include Digital Transformation, Railway Infrastructure, Financial Services, Defense & Power. The target addressable markets (TAM) for the portfolio companies is significantly large giving them a sustained growth opportunity,” added Shami.

Last but not the least, with an exceptional knack and skill for analysing the markets, Anubhav Mukherjee of Prescient Capital put forth his opinion as well,

“To earn index-beating returns from here on, investors need to follow a disciplined and rigorous investment framework of selecting small cap companies that are sector leaders in niche industries and enjoy some competitive advantages. We have shown resilience during this difficult time of Covid-19 pandemic and are poised to deliver good growth despite the continuing challenges,” he said.“As most investors don’t do investment research as a full-time activity, it is best for them to put faith in an experienced and trusted advisor like us and invest in products like our smallcase ‘High Quality Companies’ to reap rewards of healthy returns from here on,” said Mukherjee.

(This is a partnered post)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.