Top Searches

- News

- Business News

- India Business News

- Direct tax kitty swells 57%, govt gets relief

Direct tax kitty swells 57%, govt gets relief

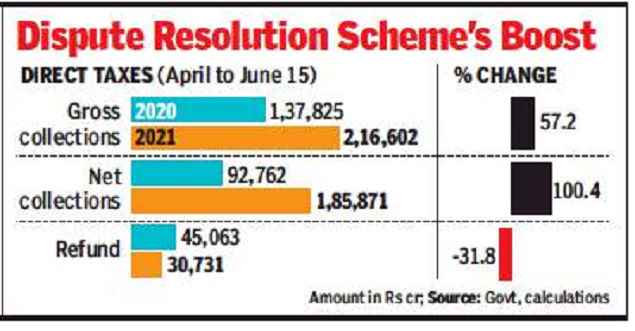

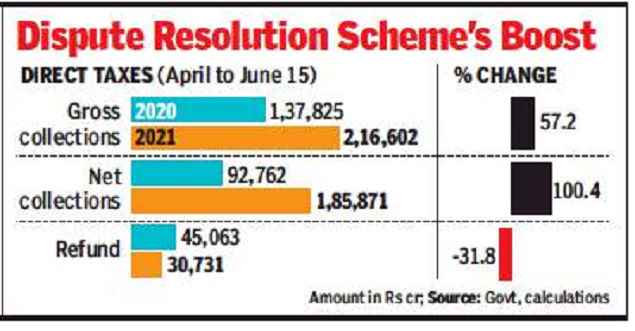

NEW DELHI: Direct tax collections have shot up 57% to Rs 2.16 lakh crore during the financial year so far on the back of a low base in the previous year due to a national lockdown as well as collections through the dispute resolution scheme.

After netting out refunds — which have slowed down over the last few weeks on account of glitches in the income tax portal — the mop-up has more than doubled to Rs 1.85 lakh crore between April and June 15, latest data released by the finance ministry on Wednesday showed.

Refunds have dropped by almost a third to Rs 30,731 crore during the first 10 weeks of the year. The department expects the number to improve once the tax portal is fully operational.

The growth, particularly the first instalment of advance tax, will provide some much-needed comfort to policy makers and experts who fear that the second wave of the coronavirus pandemic will slow down economic recovery. The government has budgeted for an over 22% increase in direct tax collections during the current financial year.

Even on the GST front, the government appeared satisfied with the collections in May, which were estimated at Rs 1,02,709 lakh crore despite lockdowns across several states.

On the direct tax front, advance tax collections — seen as an advance indicator for economic activity during a quarter — are estimated to have jumped almost twoand-a-half times to Rs 28,780 crore. The Central Board of Direct Taxes (CBDT) said the numbers came “despite extremely challenging initial months of the new fiscal” and expected that the data would improve further as more information is received from banks.

Every quarter, businesses, professionals and even salaried with income beyond salary need to pay advance tax if their annual liability exceeds Rs 10,000.

Within this, corporation tax collections were estimated at Rs 18,358 crore, with Rs 10,422 coming under the personal income tax (PIT) head.

Experts said the numbers point to healthy GDP growth in the first quarter. “The jump in the direct tax collections in the first quarter of FY22 relative to the first quarter of FY21 reflects healthy exports and a continuation of various industrial and construction activities, given the lower stringency of the staggered regional lockdowns in 2021 versus the nationwide lockdown in 2020. This supports our expectation that GDP will record a double-digit expansion in the first quarter of FY22,” said Aditi Nayar, chief economist at ICRA.

At the gross level, however, collections up to June 15 showed PIT, including securities transaction tax to have accounted for just under Rs 1.2 lakh crore, while the corporation tax kitty stood at Rs 96,923 crore.

During 2020-21, for the first time in over a decade, PIT was higher than corporation tax collections, a trend that the government expects to persist during the current financial year. Officials said that the change in the collection pattern was on account of lowering of corporation tax a couple of years ago.

“The direct tax collections have risen substantially, and it appears that the primary reason for the significant increase can be attributed to the success of government’s Vivad se Vishwas scheme. Taxpayers have taken advantage of the Vivad se Vishwas scheme and have settled their old disputes and litigations with the income tax department along with depositing their tax dues. This seems to be the main reason we are noticing a boost in the direct tax collections,” said Neeru Ahuja, a partner at consulting firm Deloitte India.

After netting out refunds — which have slowed down over the last few weeks on account of glitches in the income tax portal — the mop-up has more than doubled to Rs 1.85 lakh crore between April and June 15, latest data released by the finance ministry on Wednesday showed.

Refunds have dropped by almost a third to Rs 30,731 crore during the first 10 weeks of the year. The department expects the number to improve once the tax portal is fully operational.

The growth, particularly the first instalment of advance tax, will provide some much-needed comfort to policy makers and experts who fear that the second wave of the coronavirus pandemic will slow down economic recovery. The government has budgeted for an over 22% increase in direct tax collections during the current financial year.

Even on the GST front, the government appeared satisfied with the collections in May, which were estimated at Rs 1,02,709 lakh crore despite lockdowns across several states.

On the direct tax front, advance tax collections — seen as an advance indicator for economic activity during a quarter — are estimated to have jumped almost twoand-a-half times to Rs 28,780 crore. The Central Board of Direct Taxes (CBDT) said the numbers came “despite extremely challenging initial months of the new fiscal” and expected that the data would improve further as more information is received from banks.

Every quarter, businesses, professionals and even salaried with income beyond salary need to pay advance tax if their annual liability exceeds Rs 10,000.

Within this, corporation tax collections were estimated at Rs 18,358 crore, with Rs 10,422 coming under the personal income tax (PIT) head.

Experts said the numbers point to healthy GDP growth in the first quarter. “The jump in the direct tax collections in the first quarter of FY22 relative to the first quarter of FY21 reflects healthy exports and a continuation of various industrial and construction activities, given the lower stringency of the staggered regional lockdowns in 2021 versus the nationwide lockdown in 2020. This supports our expectation that GDP will record a double-digit expansion in the first quarter of FY22,” said Aditi Nayar, chief economist at ICRA.

At the gross level, however, collections up to June 15 showed PIT, including securities transaction tax to have accounted for just under Rs 1.2 lakh crore, while the corporation tax kitty stood at Rs 96,923 crore.

During 2020-21, for the first time in over a decade, PIT was higher than corporation tax collections, a trend that the government expects to persist during the current financial year. Officials said that the change in the collection pattern was on account of lowering of corporation tax a couple of years ago.

“The direct tax collections have risen substantially, and it appears that the primary reason for the significant increase can be attributed to the success of government’s Vivad se Vishwas scheme. Taxpayers have taken advantage of the Vivad se Vishwas scheme and have settled their old disputes and litigations with the income tax department along with depositing their tax dues. This seems to be the main reason we are noticing a boost in the direct tax collections,” said Neeru Ahuja, a partner at consulting firm Deloitte India.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST