The market traded higher throughout the session to end at a record closing high, though there was volatility on June 15, led by positive global cues. Banks, select FMCG, IT and auto stocks aided gains.

The BSE Sensex climbed 221.52 points to 52,773.05, while the Nifty50 rose 57.40 points to 15,869.30 and formed a Doji candle on the daily charts as closing was near opening levels.

"Another small body candle was formed at the highs on the daily chart with almost identical open and close. This candle pattern signals the formation of a Doji type pattern (not a classical one) at the new highs. This pattern again raises concern for bulls to sustain the higher levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"We observe a formation of Doji, Hanging Man and again Doji patterns in the last three sessions around 15,800-15,900 levels. All these patterns at the highs indicate a weak bias for the market. Though the Nifty is placed at highs, there is no confirmation of any reversal pattern at the highs," he said.

"The overall chart pattern of the Nifty indicates chances for further consolidation or minor weakness from the highs in the next 1-2 sessions. Immediate support is placed at 15,700," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,840.53, followed by 15,811.87. If the index moves up, the key resistance levels to watch out for are 15,899.73 and 15,930.27.

Nifty Bank

The Nifty Bank rallied 297.20 points to close at 35,247.80 on June 15. The important pivot level, which will act as crucial support for the index, is placed at 35,004.66, followed by 34,761.53. On the upside, key resistance levels are placed at 35,404.16 and 35,560.53 levels.

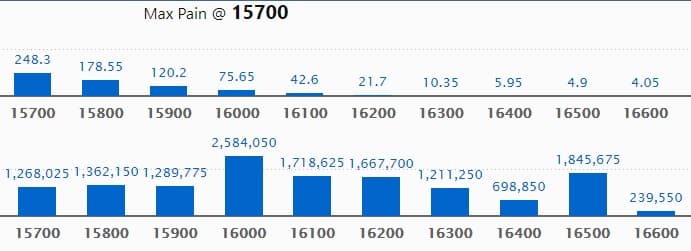

Call option data

Maximum Call open interest of 25.84 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16500 strike, which holds 18.45 lakh contracts, and 16100 strike, which has accumulated 17.18 lakh contracts.

Call writing was seen at 16300 strike, which added 5.52 lakh contracts, followed by 16200 strike which added 5.26 lakh contracts, and 16100 strike which added 3.33 lakh contracts.

Call unwinding was seen at 15700 strike, which shed 1.32 lakh contracts, followed by 15800 strike which shed 1.29 lakh contracts, and 15500 strike which shed 35,100 contracts.

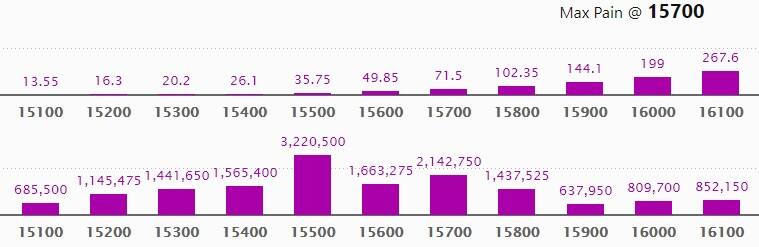

Put option data

Maximum Put open interest of 32.2 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the June series.

This is followed by 15700 strike, which holds 21.42 lakh contracts, and 15600 strike, which has accumulated 16.63 lakh contracts.

Put writing was seen at 15900 strike, which added 4.11 lakh contracts, followed by 15700 strike which added 3.31 lakh contracts, and 15800 strike which added 3.1 lakh contracts.

Put unwinding was seen at 15100 strike which shed 4.6 lakh contracts, followed by 15200 strike which shed 77,475 contracts and 15300 strike which shed 50,475 contracts.

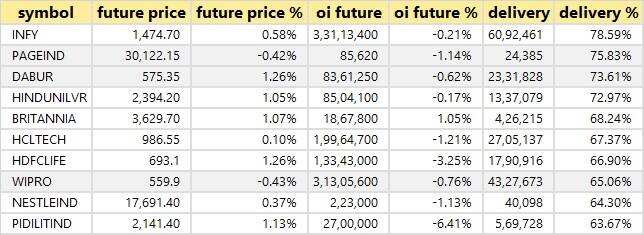

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

39 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

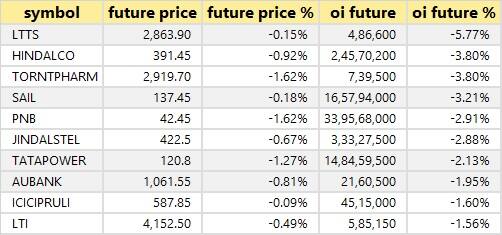

32 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

42 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

Adani Ports' open interest increased 10.18 percent along with 0.76 percent decline in price.

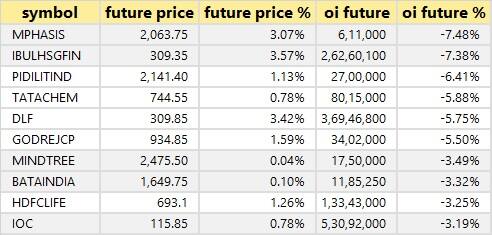

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

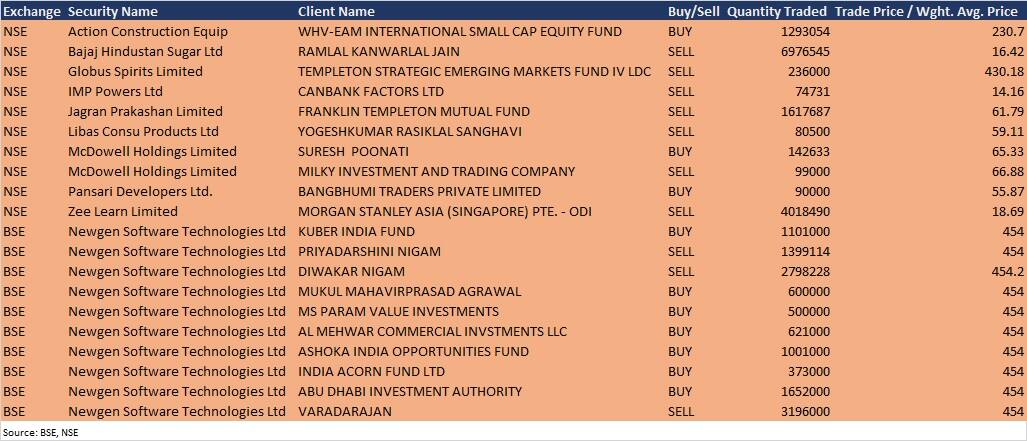

Bulk deals

Globus Spirits: Templeton Strategic Emerging Markets Fund IV LDC sold 2.36 lakh equity shares in Globus Spirits at Rs 430.18 per share on the NSE, the bulk deals data showed.

Jagran Prakashan: Franklin Templeton Mutual Fund sold 16,17,687 equity shares in Jagran Prakashan at Rs 61.79 per share on the NSE, the bulk deals data showed.

Zee Learn: Morgan Stanley Asia (Singapore) Pte - ODI sold 40,18,490 equity shares in Zee Learn at Rs 18.69 per share on the NSE, the bulk deals data showed.

Newgen Software Technologies: Promoters sold a 10.57 percent stake to a group of institutional investors. As per BSE bulk deals data, promoters Priyadarshini Nigam sold 13,99,114 equity shares at Rs 454 per share, Diwakar Nigam sold 27,98,228 shares at Rs 454.2 per share, and Varadarajan sold 31.96 lakh shares at Rs 454 per share. Kuber India Fund acquired 11,01,000 equity shares in Newgen Software, Mukul Mahavirprasad Agrawal bought 6 lakh shares, MS Param Value Investments 5 lakh shares, AL Mehwar Commercial Invstments LLC 6.21 lakh shares, Ashoka India Opportunities Fund 10,01,000 equity shares, India Acorn Fund 3.73 lakh shares, and Abu Dhabi Investment Authority 16.52 lakh shares. These shares were acquired at a price of Rs 454 per share on the BSE.

(For more bulk deals, click here)

Results on June 16 and Analysts/Investors Meeting

RITES, Asahi India Glass, CESC, Commercial Syn Bags, DIC India, Kakatiya Cement Sugar, Manaksia Steels, Nureca, Pritika Auto Industries, Somany Ceramics, and Welspun Enterprises will release quarterly earnings on June 16.

Endurance Technologies: The company's officials will meet Grandeur Peak, USA on June 16.

Surya Roshni: The company's officials will meet PhillipCapital (India) on June 16.

VIP Industries: The company's officials will meet Enam AMC on June 16.

Cosmo Films: The company's officials will meet analyst/investors on June 16.

Can Fin Homes: The company's officials will meet Investors/Analysts on June 17.

Time Technoplast: The company's officials will meet analysts on June 17.

RITES: The company's officials will meet investors and analysts post results on June 17.

Bata India: The company's officials will interact with fund houses/investors on June 16.

Stocks in News

Flexituff Ventures International: The company reported loss at Rs 1.33 crore in Q4FY21 against Rs 7.82 crore in Q4FY20; revenue rose to Rs 265.5 crore from Rs 178.35 crore YoY.

Lupin: Life Insurance Corporation of India acquired 2.019 percent stake in Lupin via open market transaction, raising stake to 6.629 percent from 4.61 percent.

Wipro: The company collaborated with Aachen-headquartered FEV to open Innovation Lab for developing Software Defined Vehicles. The company expanded partnership with Levi Strauss & Co. to support digital commerce.

Hindustan Organic Chemicals: The company reported consolidated profit at Rs 7.5 crore in Q4FY21 against loss of Rs 20.39 crore in Q4FY20; revenue increased to Rs 110.55 crore from Rs 92.75 crore YoY.

KPI Global Infrastructure: The company signed new long term Power Purchase Agreement (PPA) with Polycab India, Vadodara for sale of 5.70 MW solar power for their different units for a period of 20 years under Independent Power Producer business vertical.

LIC Housing Finance: The company reported lower standalone profit at Rs 398.92 crore in Q4FY21 against Rs 421.43 crore in Q4FY20; revenue rose to Rs 4,967.69 crore from Rs 4,920.17 crore YoY.

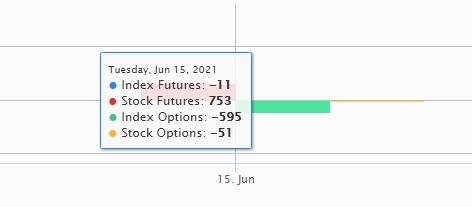

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 633.69 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 649.29 crore in the Indian equity market on June 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Adani Ports, Canara Bank, Escorts, NALCO, Punjab National Bank, and Sun TV Network - are under the F&O ban for June 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.