The initial public offering of Krishna Institute of Medical Sciences (KIMS Hospitals) will open for bidding tomorrow, June 16.

The book running lead managers to the issue are Kotak Mahindra Capital Company, Axis Capital, Credit Suisse Securities (India), and IIFL Securities.

Here are 10 key things to know before subscribing the public issue:

1) Public Issue

The IPO comprises a fresh issue of Rs 200 crore and an offer for sale of up to 2,35,60,538 equity shares.

The offer for sale consists of up to 1,60,03,615 equity shares by investor General Atlantic Singapore KH Pte Ltd, 3,87,966 equity shares by Dr Bhaskara Rao Bollineni, 7,75,933 equity shares by Rajyasri Bollineni, 3,87,966 equity shares by Bolllineni Ramanaiah Memorial Hospital, and 60,05,058 shares by other selling shareholders.

The offer includes a reservation of Rs 20 crore worth of shares for subscription by employees of the company who will get shares at a discount of up to Rs 40 on the final offer price.

2) IPO Dates

The public issue will open for subscription on Wednesday till June 18. The bidding by anchor investors, if any, will open for a day on June 15.

3) Price Band

The price band for the offer has been fixed at Rs 815-825 per equity share.

4) Lot Size and Reserved Portion Categorywise

Investors can bid for a minimum of 18 equity shares and in multiples of 18 equity shares thereafter. At a minimum bid lot, the investment by retail investors comes to Rs 14,850 and a maximum would be Rs 1,93,050 at higher price band.

To Know All IPO Related News, Click Here

Up to 75 percent of total issue size has been reserved for qualified institutional buyers, 15 percent for non-institutional investors, and 10 percent for retail investors.

5) Fund Raising and Objects of Issue

The company is planning to raise Rs 2,120.18 crore-Rs 2,143.74 crore through its public issue.

The net proceeds from the fresh issue will be utilised for repayment of certain borrowings (Rs 150 crore) availed by the company and its subsidiaries viz KHKPL, SIMSPL and KHEPL; and general corporate purposes.

6) Company Profile

KIMS Hospitals is one of the largest corporate healthcare groups in Andhra Pradesh and Telangana in terms of number of patients treated and treatments offered, as per CRISIL Report. It has grown from a single hospital to a chain of multi-specialty hospitals through organic growth and strategic acquisitions.

The company provides multi-disciplinary integrated healthcare services across over 25 specialties and super specialties, including cardiac sciences, oncology, neurosciences, gastric sciences, orthopaedics, organ transplantation, renal sciences and mother & child care, with a focus on primary secondary & tertiary care in Tier 2-3 cities and primary, secondary, tertiary and quaternary healthcare in Tier 1 cities.

It operates 9 multi-specialty hospitals under the 'KIMS Hospitals' brand, with an aggregate bed capacity of 3,064, including over 2,500 operational beds as of March 31, 2021, which is 2.2 times more beds than the second largest provider in Andhra Pradesh and Telangana.

In FY21, its nine hospitals recorded average revenue per occupied bed (ARPOB) of Rs 20,609, a bed occupancy rate of 78.60 percent, and an average length of stay (ALOS) in the hospital of 5.53 days, on an aggregate basis. In FY21, ARPOB for hospitals situated in Tier 1 cities was Rs 39,571 and in Tier 2-3 cities was Rs 11,187.

Hospitals

7) Competitive Strengths & Strategies

a) It is one of the largest corporate healthcare groups in Andhra Pradesh and Telangana in terms of number of patients treated and treatments offered.

b) It has an ability to attract, train and retain high quality doctors, consultants and medical support staff.

c) It has a track record of strong operational and financial performance.

d) It is well positioned to consolidate in India's large, unorganized yet rapidly growing and underserved affordable healthcare market.

e) It has a disciplined approach to acquisitions resulting in successful inorganic growth.

f) It has an experienced senior management team with strong institutional shareholder support.

Strategies

a) The company intends to strengthen its existing hospitals by further balancing specialty mix and deepening its expertise in select specialties.

b) It plans to expand hospital network into markets that are adjacent to its core markets of Andhra Pradesh and Telangana.

c) It believes that maximizing operating efficiencies across its network is critical to maintaining and improving the affordability of healthcare services and, ultimately, profitability.

d) It is focused on developing a healthcare ecosystem that utilizes digital healthcare technologies to offer patients a fully integrated approach to manage their journey towards health and wellness.

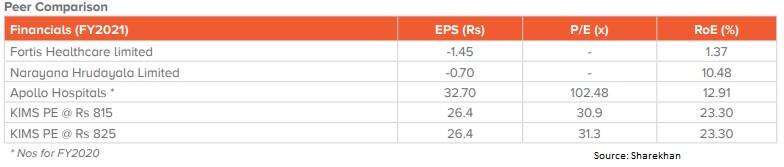

8) Financials and Peer Comparison

KIMS Hospitals consistently delivered strong operational and financial performance through strong patient volumes, cost efficiency and diversified revenue streams across medical specialties. It has achieved healthy profitability in both Tier 1 and Tier 2-3 markets.

Its revenue is diversified across specialties and doctors. In FY21, its total income mix was 17.82 percent from cardiac sciences, 12.55 percent from neuro sciences, 9.30 percent from renal sciences, 4.64 percent from orthopaedics, 5.25 percent from gastric sciences, 5.71 percent from oncology, 6.11 percent from mother & child care, 1.86 percent from organ transplant, 35.28 percent from other specialties and 1.48 percent from other income. In the same year, top 10 doctors contributed 21.80 percent of total income and the top 25 doctors contributed 36.10 percent of total income.

As of December 2020, its debt-to-adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) ratio was 0.95x and gearing ratio was 0.37x compared to the industry range of 0.1 to 5.2. As of March 2021, debt-to-Adjusted EBITDA ratio was 0.71x and gearing ratio was 0.31x. It is one of only three hospitals in India that are rated AA by CRISIL.

9) Promoters and Management

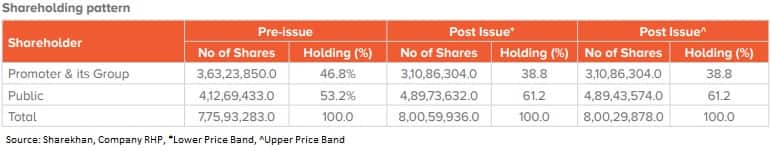

The promoters of company are Dr Bhaskara Rao Bollineni; Dr Abhinay Bollineni; Adwik Bollineni; Rajyasri Bollineni; and Bollineni Ramanaiah Memorial Hospitals. Promoters in aggregate held 2,88,41,886 equity shares or 37.17 percent of the paid-up equity share capital of company, while promoters and promoter group held 46.81 percent stake in the company.

Investor General Atlantic has 40.91 percent shareholding in the company.

Bhaskara Rao Bollineni is the Managing Director of the company. He holds a bachelor's degree in medicine and surgery from Andhra University and a master's degree in general surgery from Madras Medical College, Chennai, Tamil Nadu. He has over 27 years of experience in cardiothoracic surgery and has in the past held various positions with Apollo Hospitals, Austin Hospital, University of Melbourne and Mahavir Hospital and Research Centre.

Anitha Dandamudi is a Whole-time Director of the company. She has over 16 years of experience in the hospital industry.

Abhinay Bollineni is an Executive Director and CEO of the company. He holds a bachelor's degree in medicine and a bachelor's degree in surgery from Dr NTR University of Health Sciences, Andhra Pradesh (Faculty of Modern Medicine) through Deccan College of Medical Sciences which was affiliated to Dr NTR University of Health Sciences, Andhra Pradesh at such time.

Sandeep Naik and Shantanu Rastogi are Non-executive Directors on the board of the company. Pankaj Vaish, Rajeswara Rao Gandu, Ratna Kishore Kaza, Saumen Chakraborty, and Venkata Ramudu Jasthi are Independent Directors on the board.

Vikas Maheshwari is the Chief Financial Officer of the company. He has over 24 years of experience in accounting, finance and treasury. He has previously been associated with Endurance Technologies, Aurobindo Pharma, Gati, ABP, and Limtex Tea and Industries.

10) Allotment, refunds and listing dates

After the closing of offer on June 18, the company will finalise basis of allotment with the designated stock exchange around June 23 and the funds will be refunded around June 24.

The equity shares will be credited to demat accounts of eligible investors around June 25, and the trading in equity shares will commence around June 28.