personal-finance

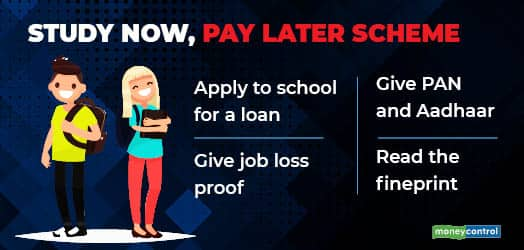

How Study Now, Pay Later option works

Jun 15, 04:06

Due to loss of income triggered by Covid-19 in the past year, many parents have found it hard to pay for their children's education fees. GrayQuest, a fintech company that gives education loans, says an average Indian household spends nearly 26 percent of its total annual income on children's education. Some fintech firms give education loans with ‘Study Now, Pay Later' schemes. They have tie-ups with schools. Once you take a loan, the firm pays the school lumpsum fees and allows you to repay the loan in over 12 instalments. The school bears the interest cost, but in exchange, gets the entire year's fee in advance. Only deserving parents can avail of this facility. They must read the fingerprint.