Kolkata: Vendors wait for customers at a wholesale fruit market after the ease in the ongoing COVID-19 lockdown restrictions, in Kolkata, Wednesday, June 2, 2021. (PTI Photo)

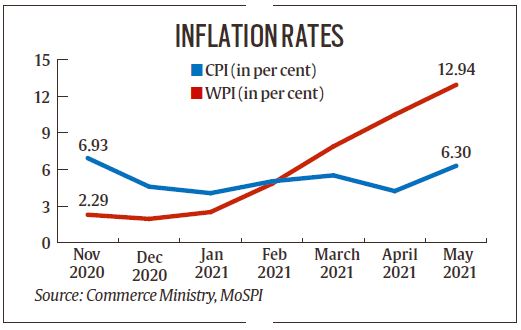

Kolkata: Vendors wait for customers at a wholesale fruit market after the ease in the ongoing COVID-19 lockdown restrictions, in Kolkata, Wednesday, June 2, 2021. (PTI Photo) IN WHAT complicates the RBI’s task of setting the direction of monetary policy, Wholesale Price Index-based inflation scaled to a record high of 12.94 per cent in May, pushed by higher fuel and commodity prices, and a low base effect. It also translated into a higher retail inflation of 6.30 per cent in May — a six-month high, data released by the government on Monday showed.

With this, the retail inflation has breached the inflation target of 4+/-2 per cent set by the Reserve Bank of India’s (RBI).

The wholesale inflation has been rising for five months, and is expected to rise further as the impact of high crude prices and surging commodity prices feeds in. This would cause the retail inflation to rise as well, putting the central bank on a tightrope walk in balancing the growth-inflation dynamics. While the RBI is unlikely to change its accommodative stance or the policy rate anytime soon, there is also pressure on the government for fiscal policy action to spur growth.

WPI inflation rate was -3.37 per cent in May 2020 and 10.49 per cent in April 2021, while CPI inflation rate was 4.23 per cent in April 2021.

The food inflation component for retail inflation rose significantly higher to 5.01 per cent in May from 1.96 per cent in the preceding month. Some of the items that pushed retail inflation were fuel which recorded an inflation of 11.6 per cent (the highest since March 2021), transport and communication at 12.6 per cent, edible oil at 30.8 per and pulses at 9.3 per cent.

Core inflation — the non-food, non-fuel inflation component — surged to a 83-month high of 6.55 per cent in May.

The RBI, which primarily focuses on retail inflation while deliberating on its monetary policy, had left the key interest rate unchanged earlier this month. It has projected CPI inflation at 5.1 per cent during 2021-22 — 5.2 per cent in Q1; 5.4 per cent in Q2; 4.7 per cent in Q3; and 5.3 per cent in Q4 of 2021-22.

In WPI inflation, among the three major components namely primary articles, fuel and power, and manufacturing that contributed to the rise in inflation, the key driver was fuel and power which registered an inflation of 37.6 per cent, followed by the manufacturing at 10.8 per cent and primary article at 9.6 per cent.

“Since for a large number of commodities, their global prices are a pass through, the same is now getting reflected in their domestic prices. For example, petrol, diesel and LPG witnessed an inflation of 62.3 per cent, 66.3 per cent and 60.9 per cent in May 2021,” Sunil Kumar Sinha, Principal Economist, India Ratings & Research, said.

The high rate of inflation in May 2021 is primarily due to low base effect and rise in prices of crude petroleum, mineral oils viz. petrol, diesel, naphtha, furnace oil etc. and manufactured products when compared with the corresponding month of the previous year, the Ministry of Commerce said. Core WPI inflation also rose to a double-digit level of 10 per cent in May. Wholesale food inflation, however, moderated to 4.3 per cent in May.

Rising global crude oil and commodity prices are expected to push up WPI inflation further in coming months. With most developed countries opting for monetary stimulus measures, global commodity prices are rising amid expectations of a global economic recovery. In India too, an ebbing of the second wave of the pandemic and increasing vaccination numbers have led to expectations of a recovery in demand. This has led producers to expect higher raw material prices in the coming months.

“The continued rise in global crude oil prices, a weaker rupee and the upward revision in domestic fuel prices remain risk factors for the upcoming WPI print,” Aditi Nayar, Chief Economist, ICRA said.

- The Indian Express website has been rated GREEN for its credibility and trustworthiness by Newsguard, a global service that rates news sources for their journalistic standards.