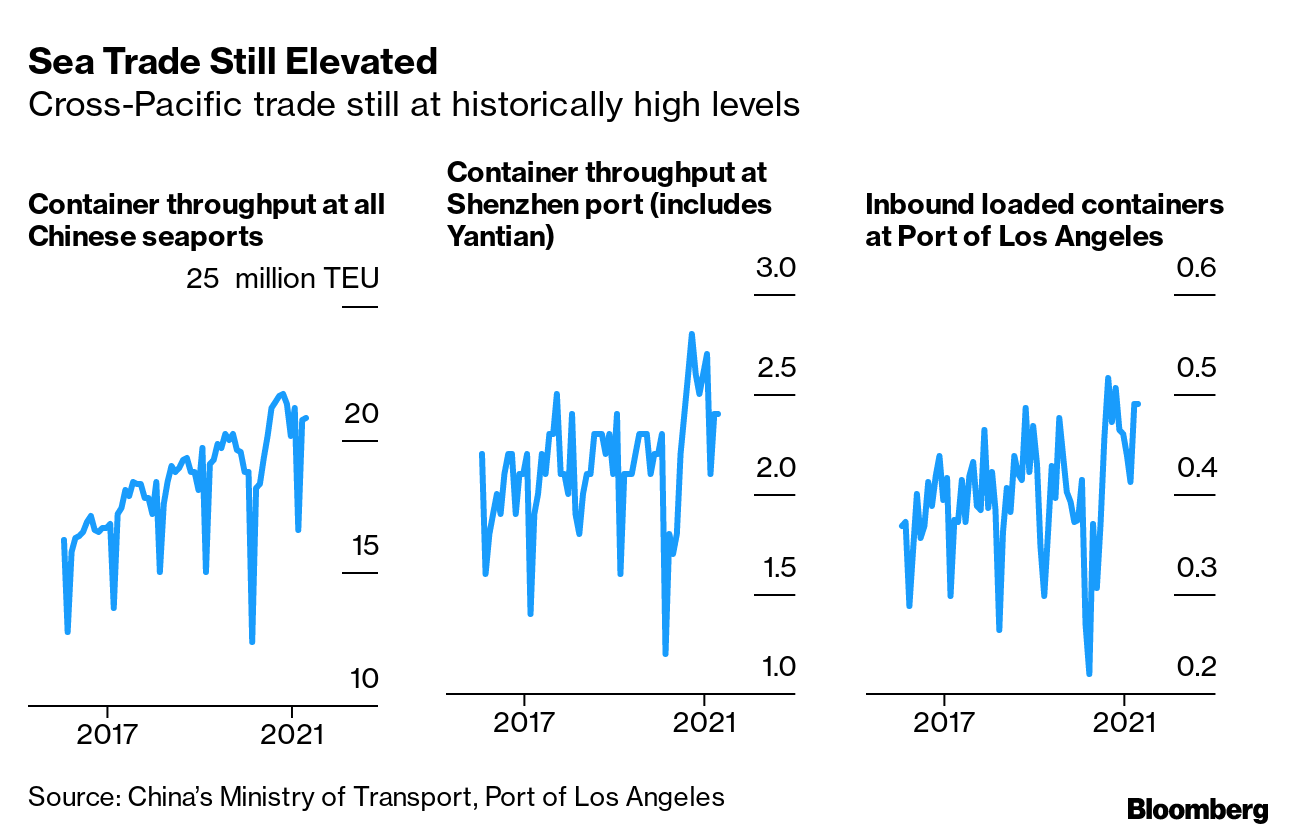

The combination of Covid-related port closures and the significant increase in trade volumes is choking up shipping terminal globally and with the Christmas season on the horizon there might not be much improvement soon.

“We expected that things would start to ease during the second quarter but then we had the situation in Suez with the Evergiven, now we have a situation in Yantian, and we keep on seeing Covid impacts and congested terminals,” according to Lars Mikael Jensen, head of global Ocean network at Maersk.

While Maersk sees the situation at Yantian Port in Shenzhen slowly recovering with productivity at 45% of normal, that still means at average waiting time of 16 days per vessel, the company said Friday.

Sea Trade Still Elevated

Cross-Pacific trade still at historically high levels

Source: China’s Ministry of Transport, Port of Los Angeles

The delays due to the Covid-19 outbreak at Yantian port is limiting capacity by about 25,000 twenty-foot containers a day, compared with 55,000 TEU a day during the Suez congestion, according to a report from Sydbank Senior Analyst Mikkel Emil Jensen. However, the congestion at Suez lasted for about 6 days, whereas the Yantian-related problems have continued for more than two weeks, he wrote last week.

Once the partial shutdown ends, it will take time to fix the bottleneck, just as it took weeks for global shipping to recover after the Suez Canal was cleared. Even without the logistic issues, the demand for shipping continues to be incredibly strong, pushing the cost of moving a container to record levels.

China’s trade boom shows no sign of letting up, with exports the third-largest on record in May. In addition, the third and fourth quarters arehistorically the biggest periods for trade in any given year, as companies in the U.S., Europe and elsewhere stock up ahead of Christmas. With those areas reopening as the pandemic subsides there and stimulus payments boosting incomes, that trend looks set to continue.

“We are hearing from a lot of customers that they expect continued strong volume shipments also through the second half of the year,” Maersk’s Jensen said last week. “The Christmas season is starting, and I think the trend that we’re seeing with customers is that a number of them will actually start the shipment of their Christmas season earlier” than the usual August-September period, he said.

— James Mayger in Beijing

Read More on Yantian Port

Charted Territory

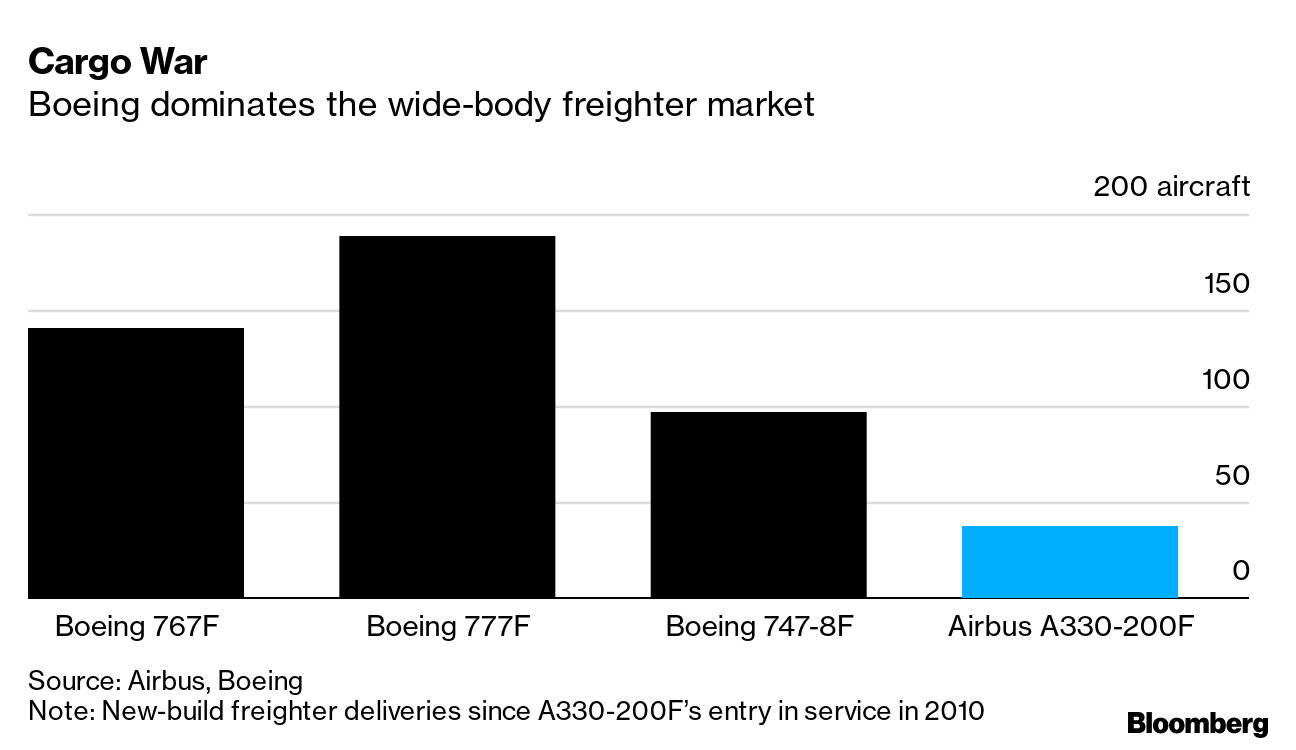

Cargo War

Boeing dominates the wide-body freighter market

Source: Airbus, Boeing

Airbus is poised to begin taking orders for a freighter version of its A350 wide-body as soon as next month, in a challenge to Boeing’s dominance in the market for dedicated cargo aircraft. The European planemaker has been speaking to more than a dozen potential customers and will seek board authorization to market the new plane in the coming weeks, provided it can line up enough commitments, according to people familiar with the matter. The program could officially launch by year-end, said the people, who sought anonymity discussing confidential matters.

Today’s Must Reads

- G-7 divisions | Even with President Donald Trump gone, there are still tensions among the Group of Seven leaders. China’s economic might was one concern and a summit failed to form a united front.

- Chip crunch | South Korea posted record sales in logic semiconductors last month, amid a global shortage of chips to operate everything from cars to smartphones.

- Balkan opportunity | The European Union is at risk of losing out to Russia and China in its own backyard, with delays in its decision making creating an opening for the rival powers and increasing tensions in the Balkans — the continent’s most volatile region.

- Brexit fallout | Prime Minister Boris Johnson clashed with EU leaders, warning the U.K. could suspend parts of the Brexit agreement if a dispute over trade rules for goods shipped to Northern Ireland is not resolved.

- Reset sought | Australian Prime Minister Scott Morrison said his government wants to restart dialog with Beijing, as a series of trade reprisals from China strain the already-weakened relationship between the two countries.

- Farm boost | The Biden administration will strengthen U.S. regulatory protections for livestock and poultry producers in their dealings with meatpackers after Covid-19 outbreaks and a cyber attack on JBS highlighted domination of the industry by a few giant companies.

- Think pig | A workers’ strike at a pork plant in Quebec is allowing U.S meat packers, who are struggling to find enough domestic pigs, to make some Canadian bacon instead.

Save the Date

Watch the future unfold. Wednesday, June 30 for Bloomberg New Economy Catalyst, a global 6-hour virtual event celebrating the innovators, visionaries, scientists, policymakers, and entrepreneurs accelerating solutions to today’s greatest problems. The conversations will explore what matters, what’s next, and the what-ifs in climate, agriculture, biotech, digital money, e-commerce, and space — all through the imaginations and stories of these ascendant leaders. Register here.

On the Bloomberg Terminal

- Markets alight | Robust freight demand and easier comparisons drove the Cass Freight Shipment Index 35% higher in May from a year earlier. Bloomberg Intelligence expects demand momentum will remain supported by a prolonged restocking cycle and U.S. stimulus measures.

- No luck | Two U.S. importers lost their challenge to tariffs on their goods from China, because the U.S. Court of International Trade said their failure to timely protest the tariffs meant it didn’t have jurisdiction over their claims. Bloomberg Law reports.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- See BNEF for BloombergNEF’s analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

- Click VRUS on the terminal for news and data on the coronavirus and here for maps and charts.

Like Supply Lines?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish the New Economy Daily, a briefing on the latest in global economics.

For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters.

How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know.

— With assistance by James Mayger

Leave a Comment