Companies belonging to different market caps usually vary in performance over time-periods. Therefore, diversifying your investments across market caps can reduce portfolio risk and mitigate volatility, thereby maximizing portfolio returns over the long term.

Multi-cap funds and flexi-cap funds are among the mutual fund categories that aim to provide investors opportunities across the large-cap, mid-cap, and small-cap universe. Between the two, flexi-cap funds have more leeway in allocating assets across market caps while multi-cap funds are required to maintain a balanced allocation across each market cap.

Comparatively, the superior flexibility that flexi-cap funds have enables them to identify and invest in wherever opportunity exits and even cut exposure to less attractive segments if necessary. In addition, managing liquidity challenges associated with mid-caps and small-caps becomes easier in case of flexi-cap funds.

--- Advertisement ---

The Only 20 Stocks to Own Forever?

After studying the Indian stock markets for 20 years now...

Our Co-head of Research Tanushree Banerjee has zeroed in on the ultimate list of Forever Stocks that have the potential to permanently lift you into the premier orbit of extreme wealth.

On June 21 at 5pm, Tanushree will be revealing the full details on the complete list of these stocks for Indian investors.

You Register your FREE spot for her Forever Stocks event with this link.

------------------------------

UTI Flexi Cap Fund is one such flexi cap fund that has managed to limit the downside during the recent market crash and participate in the recovery phase.

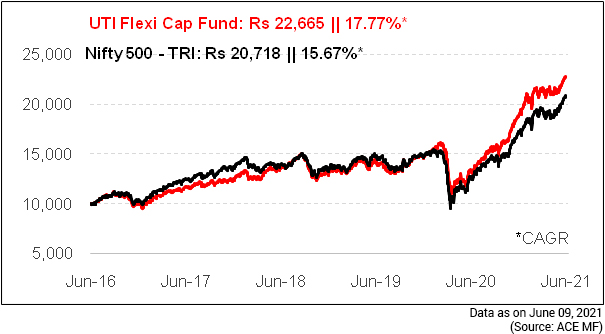

UTI Equity Fund, one of the oldest schemes in the Indian mutual fund industry, has been renamed as UTI Flexi Cap Fund (UFCF) in line with the change in the fund's categorisation to the flexi cap category. However, the change in mandate is not expected to have any impact on its key philosophy or investment strategy. In its new category, UFCF has the mandate to invest minimum 65% of its assets in equity and equity related instruments and the flexibility to invest across market capitalization spectrum. The fund remained a mute spectator during the 2016-2017 market rally where it significantly underperformed the benchmark. However, UFCF has shown a great breakthrough in its performance, standing strong in the recent market crash and participated well in the subsequent recovery phase. Over the last 5 years, UFCF has registered a growth of around 17.8% CAGR as against 15.7% CAGR by its benchmark Nifty 500 - TRI, thus outpacing the benchmark by a noticeable margin.

| Scheme Name | Corpus (Cr.) | 1 Year | 2 Year | 3 Year | 5 Year | 7 Year | Std Dev | Sharpe |

|---|---|---|---|---|---|---|---|---|

| PGIM India Flexi Cap Fund | 929 | 82.84 | 32.16 | 22.65 | 20.16 | -- | 23.18 | 0.218 |

| Parag Parikh Flexi Cap Fund | 9,179 | 60.58 | 30.56 | 21.51 | 20.03 | 17.71 | 18.80 | 0.256 |

| UTI Flexi Cap Fun | 17,096 | 70.54 | 26.25 | 18.54 | 17.77 | 15.73 | 21.71 | 0.189 |

| Canara Rob Flexi Cap Fund | 3,818 | 57.42 | 21.71 | 17.65 | 18.18 | 13.90 | 19.84 | 0.183 |

| DSP Flexi Cap Fund | 5,048 | 63.08 | 23.20 | 17.62 | 18.27 | 14.91 | 22.51 | 0.164 |

| Union Flexi Cap Fund | 496 | 62.77 | 21.83 | 16.37 | 14.91 | 11.12 | 20.92 | 0.158 |

| HDFC Flexi Cap Fund | 23,060 | 69.59 | 14.54 | 14.23 | 15.37 | 12.12 | 25.79 | 0.120 |

| Aditya Birla SL Flexi Cap Fund | 13,340 | 63.90 | 19.64 | 14.16 | 16.76 | 15.05 | 23.16 | 0.129 |

| SBI Flexicap Fund | 12,034 | 62.65 | 17.60 | 14.12 | 15.58 | 16.61 | 22.18 | 0.128 |

| KotakFlexicap Fund | 34,115 | 54.34 | 15.65 | 14.10 | 16.24 | 16.01 | 22.01 | 0.136 |

| Nifty 500 - TRI | 64.23 | 18.55 | 14.14 | 15.67 | 12.91 | 22.74 | 0.130 |

UFCF has evolved exceptionally in the last few years. With an absolute return of around 70.5% over the last one year, UFCF has managed to generate an alpha of around 6 percentage points over the benchmark Nifty 500 - TRI. Its outperformance in the last couple of years has placed it among the top quartile performers. In addition, it has even scaled up its performance across time periods. Though UFCF has marginally trailed the benchmark and category average during past bull market rallies, it has done reasonably well, as well as managed to limit the downsides across bear market phases.

UFCF has shown fair level of stability in performance. Its standard deviation of 21.71% signifies that the fund's volatility has been lower than the benchmark (22.74%), though nearly in line with the category average (21.67%). With superior performance in the recent past, the fund has shown significant improvement in its risk-adjusted return. Its Sharpe Ratio of 0.19 is amongst the best in the category and higher than the benchmark.

--- Advertisement ---

READ: FULL Transcript of Our Urgent Broadcast

The full transcript of our urgent broadcast on India's Revival is available for a limited time now.

In case you missed watching our broadcast LIVE...

You can see all the important highlights from our broadcast in this transcript.

Please note that we may take this transcript off the internet any minute.

So it is highly recommended you read it immediately.

Click Here to Read the Transcript NOW

------------------------------

Classified under Flexi-Cap Funds category, UFCF is mandated to invest minimum 65% of its investment in equity & equity related instruments with exposure across market caps. However, there is no minimum limit or restriction specified for any market cap segment. Positioned as a flexi cap fund investing across the market capitalization spectrum, UFCF holds a portfolio spread across large-cap, mid-cap, and small-cap stocks, but with predominant allocation to large caps.

The fund endeavours to pick high quality businesses run by seasoned quality managements with the ability to show strong growth for a long period of time. The focus is on businesses operating in secular growth industries that can generate economic value through the cycle rather than cyclical industries which are highly volatile.

Accordingly, the fund looks for stocks of quality companies that can perform across market cycles and mitigate drawdown during depressing market conditions, as well as rebound faster based on the strong fundamentals of balance sheets & business models.

UFCF follows bottom-up stock selection process with well-defined metrics of free cash flows, capital efficiency and the ability to compound earnings. The investment strategy involves picking of stocks with strong earnings quality (high operating cash flow and high free cash flow characteristics) and those that can continue to show strong growth into the foreseeable future, thus providing opportunities for compounding wealth. UFCF usually holds a large-cap bias with significant allocation to mid and small-cap stocks and invests in a well-diversified portfolio of about 55-60 stocks.

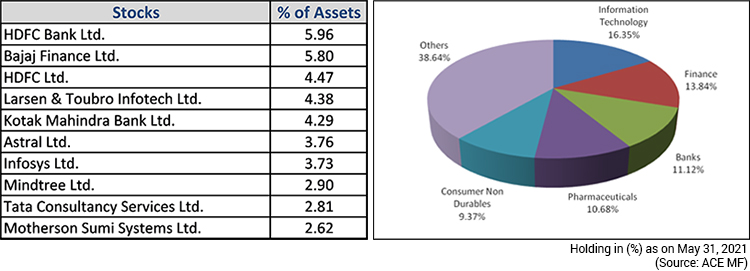

As of May 31, 2021, UFCF held a well-diversified portfolio of 59 stocks. The fund held its top exposure in names like HDFC Bank, Bajaj Finance, HDFC Ltd., L&T Infotech, and Kotak Mahindra Bank together accounting for about 25% of its assets. Most of these names have been prominent candidates in the fund's portfolio for over a year now. Notably, the fund has steered itself away from some of the index heavyweights like Reliance Industries, ICICI Bank, HUL, etc., and it has limited the top allocation to under 7%.

In the last one year, names like Bajaj Finance, L&T Infotech, Infosys, Astral, Infosys, HDFC Bank, Motherson Sumi Systems, HDFC Ltd., TCS, AU Small Finance Bank, Kotak Mahindra Bank, Info Edge (India), among others have been the major contributors to its performance.

Around one-fourth of the fund's portfolio is allocated to stocks in the Banking and Financial sector. Infotech follows with an allocation of 16.4%. Pharma, Consumption, Engineering, Auto & Auto ancillaries, Retail, Consumer Durables, Healthcare Services, and Chemicals are among the other core sectoral holdings of the fund.

BREAKING: It's Good Time to Invest in Gold, but Just Don't Go Blindfolded

UFCF has shown a turnaround performance and made a mark in terms of returns over the last couple of years. While the rally in large caps has been conducive for the fund's growth, it has managed downsides well, particularly during volatile market conditions. Its superior performance in extreme conditions certainly cannot be ignored. Moreover, the fund manager has done well to keep volatility at a reasonable level and has delivered results in terms of risk-adjusted returns.

Its significant exposure to defensives along with a balanced exposure towards cyclical has helped it perform well over complete market cycles. The fund's flexi-cap mandate offers the fund manager enough flexibility to dynamically manage the portfolio allocation to benefit from changing market sentiments and valuation that could help generate alpha for its investors.

UFCF is suitable for cautious investors looking for a relatively stable flexi-cap fund that can offer capital appreciation as well as stability for the long term.

PS: Here's a high potential opportunity that can multiply wealth you. Get access to PersonalFN's high-return generating Alpha Funds Report 2021 that could potentially boost your portfolio returns significantly over the next few years.

PersonalFN's research team has developed a 'SMART Alpha Score' model that has additional parameters to select the top equity mutual funds.

With optimum weightage to each parameter, which we consider important in identifying fundamentally strong funds with the potential to generate alpha, this model helps zero in on quality names that have the ability to outperform the benchmark and generate alpha returns for its long term investors.

Subscribe to The Alpha Funds Report -2021 today!

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

Shares of Steel Authority of India (SAIL) surged over 5% on the BSE today after the company reported robust March quarter numbers.

So far in 2021, IPOs in India have raised nearly US$ 3 bn, the best start to the year since 2018.

Here's the rundown on the company's latest quarterly results.

The best unlock investments you can make in the market.

Charlie Munger's open secret about investing success.

More Views on NewsTo become a better intraday trader, follow these rules religiously.

This is why I'm bullish on the hotel and hospitality sector.

May 31, 2021Is the Indian central bank correct in warning you about a market crash?

Jun 2, 2021Get ready to profit from a massive stimulus that you've never seen before.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!