Top Searches

- News

- Business News

- India Business News

- Retail loan demand sees faster growth in B-towns

Retail loan demand sees faster growth in B-towns

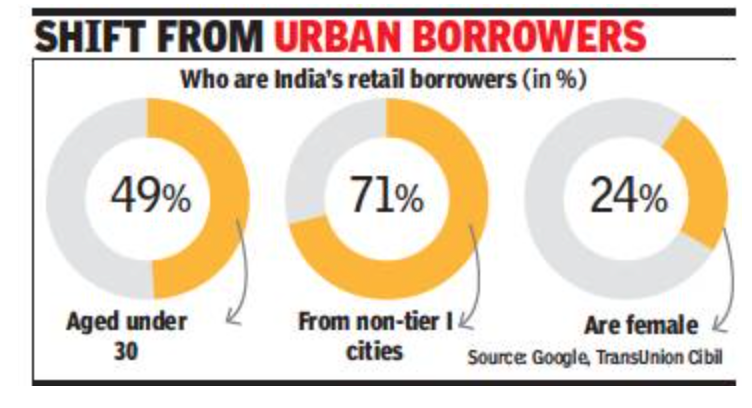

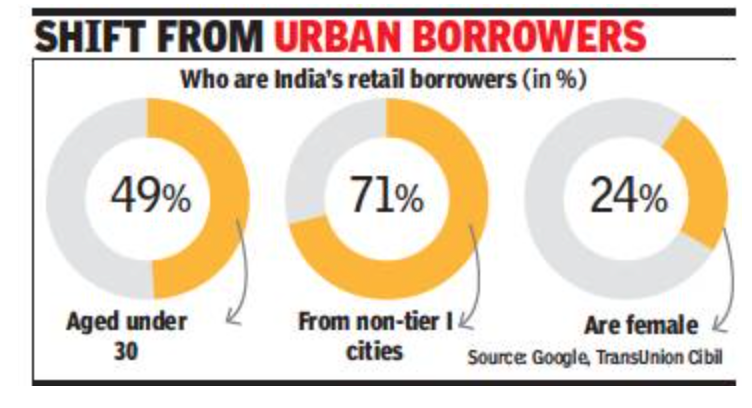

MUMBAI: Growth in consumer loans is moving from metros and large cities to non-urban areas with over 70% disbursals taking place outside tier-1 cities. The shift is set to accelerate as reflected by online trends which show that searches outside cities are growing 2.5 times faster as compared to cities.

According to a study by TransUnion Cibil and Google, searches for loans grew the most in tier-3 cities at 47%, followed by tier-2 (32%) and tier-4 (28%). Indian retail credit industry stood at $613 billion (Rs 44 lakh crore), which reflects an 18% compounded annual growth rate (CAGR) since 2017. While home loans at $290 billion (Rs 21 lakh crore) form the largest chunk, loan against property and business loans are growing the fastest.

Digital lending is enabling small loans which are driving up volumes. According to the report loans of below Rs 25,000 have grown 23 times since 2017. The data shows that those who avail small loans are not less creditworthy. According to TU Cibil in 2020, 38% of loans disbursed to the ‘prime’ credit tier was through fintech NBFCs (non-banking financial companies).

Additionally, these fintech NBFCs no longer have only ‘urban youth’ as their primary audience — 70% of disbursals are outside tier-1, with 78% of customers being millennials (between 25-45 years of age). “Consumer credit demand and access have undergone a paradigm shift over the last few years, with the post-pandemic circumstances having further accelerated this change,” said TU Cibil MD & CEO Rajesh Kumar.

According to a study by TransUnion Cibil and Google, searches for loans grew the most in tier-3 cities at 47%, followed by tier-2 (32%) and tier-4 (28%). Indian retail credit industry stood at $613 billion (Rs 44 lakh crore), which reflects an 18% compounded annual growth rate (CAGR) since 2017. While home loans at $290 billion (Rs 21 lakh crore) form the largest chunk, loan against property and business loans are growing the fastest.

Digital lending is enabling small loans which are driving up volumes. According to the report loans of below Rs 25,000 have grown 23 times since 2017. The data shows that those who avail small loans are not less creditworthy. According to TU Cibil in 2020, 38% of loans disbursed to the ‘prime’ credit tier was through fintech NBFCs (non-banking financial companies).

Additionally, these fintech NBFCs no longer have only ‘urban youth’ as their primary audience — 70% of disbursals are outside tier-1, with 78% of customers being millennials (between 25-45 years of age). “Consumer credit demand and access have undergone a paradigm shift over the last few years, with the post-pandemic circumstances having further accelerated this change,” said TU Cibil MD & CEO Rajesh Kumar.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST