A group of state ministers is learnt to have recommended cutting of Goods and Service Tax rates on a number of COVID-related essential items including medical oxygen, cylinders, ventilators, concentrators, and life-saving drugs like Remdesivir, which are domestically produced or commercially imported.

These items are expected to be up for discussions in the next meeting of the all-powerful Goods and Service Tax Council on June 12, a senior official told Moneycontrol.

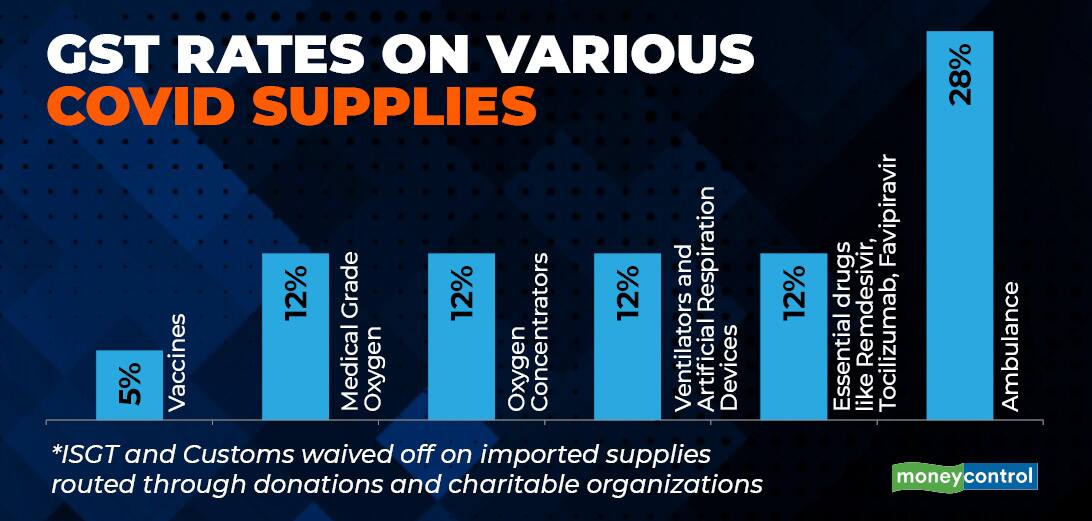

The Group of Ministers (GoM), formed after the last GST Council meeting on May 28 to deliberate on possible reductions in COVID-related items, has however not suggested a reduction in the levy for COVID-19 vaccines, the rate of which stands at 5 percent. The GoM submitted its report on June 8.

"The issue of reduction in rates will be taken up on June 12. The GoM has submitted its recommendations," the official cited above said.

"It is good to see that the Council is showing an urgency to decide on critical issues. Hopefully, they will balance out the concerns of revenue collections and impact on the common man and take an informed decision on the rate cuts,” said Rajat Bose, Partner, Shardul Amarchand Mangaldas & Co.

The GoM includes Meghalaya Chief Minister Conrad Sangma, Gujarat Deputy Chief Minister Nitin Patel, Maharashtra Deputy Chief Minister Ajit Pawar, Goa Transport Minister Mauvin Godinho, Kerala Finance Minister KN Balagopal, Odisha Finance Minister Niranjan Pujari, Telangana Finance Minister T Harish Rao, and Uttar Pradesh Finance Minister Suresh Khanna.

Case for zero-rating?

It is not immediately clear whether the recommendation by the GoM was on just cutting of rates on COVID items or completely zero-rating them. The issue with cutting rates has been articulated by Finance Minister Nirmala Sitharaman in the recent past.

Sitharaman has said that exempting domestically produced and commercially imported items from GST will lead to manufacturers unable to avail of input tax credit, which in turn could lead to higher prices for customers.

Zero-rating, on the other hand, means that the entire value chain of the supply is exempt from tax, not only the final product, hence eliminating the issue of input tax credit. This proposal was first mooted by Bharatiya Janata Party’s Rajya Sabha member and former Bihar Deputy Chief Minister Sushil Kumar Modi late last month, and was backed by various GST experts.

"While rate reductions on all essential medicines including those used in the treatment of COVID are a good welfare measure, it is necessary to ensure that the reductions are passed on in the form of lower prices to the patients," said MS Mani, Senior Director, Deloitte India.

At the meeting on May 28, the Council did not decide on rate cuts or zero-rating. It, however, decided to exempt from integrated GST COVID-related items which are imported on payment basis for donating to the government or on recommendation of state authority to any relief agency, till August 31.