Top Searches

- News

- Business News

- India Business News

- Can’t tax Swiss account in India if there’s no info, says ITAT

Can’t tax Swiss account in India if there’s no info, says ITAT

MUMBAI: Steps taken by an income tax (I-T) officer to bring to tax the maximum outstanding balance allegedly lying in a Swiss bank account has not found favour with the Delhi bench of the Income Tax Appellate Tribunal (ITAT).

The late Bhushan Lal Sawhney (now represented by his wife), challenged the additions made to his income on two grounds. One, that the assessment order pertaining to the six years from financial year 2005-06 to 2010-11 was time-barred. Second, no incriminating evidence was recovered during a search that had also been conducted on the individual taxpayer.

Thus, the additions made on account of unexplained deposits in the Swiss bank account and interest earned thereon were unjustified. Based on the facts of the case, and as the Swiss authorities did not part with information pertaining to these years, the ITAT decided in his favour.

In its recent judgment, the ITAT ordered deletion of this sum of about Rs 9.2 crore that was added to the income of the individual taxpayer. It also ordered deletion of interest income allegedly earned from the overseas bank account that was assessed in the taxpayer’s hands in subsequent years. The ITAT noted that information could be provided by the Swiss competent authorities only from April 1, 2011. Earlier years (to which this litigation pertained) were not covered by the Exchange of Information Article in the India-Switzerland tax treaty.

While the I-T officer had sought to bring the bank balance (unaccounted overseas money) to tax in India, the ITAT noted that — based on the information available with the I-T department’s investigation wing — there was no incriminating material available on record to make additions to income in any of the assessment years that were under litigation. Interestingly, while the taxpayer’s son had admitted to the existence of the Swiss bank account, this was denied by the taxpayer (bank account holder).

According to government officials, the genesis of the HSBC-Geneva account cases, which are in litigation at various levels, dates back to 2007 when an employee of HSBC Bank-Geneva obtained information on nearly 30,000 bank accounts and became a whistleblower.

It is regarded as the biggest bank leak in history, covering the period 2005-07, with the aggregate sum of funds in these accounts amounting to $120 billion. The employee took refuge in France, and in 2011 the French government shared information of the bank account holders with authorities in India and other countries by way of what is referred to as a ‘base note’.

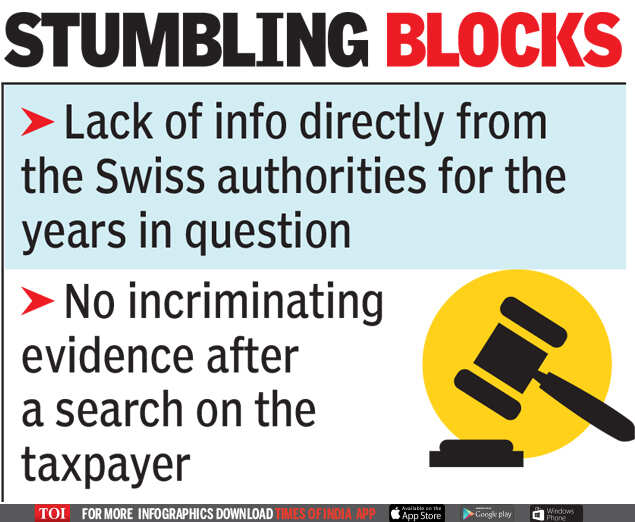

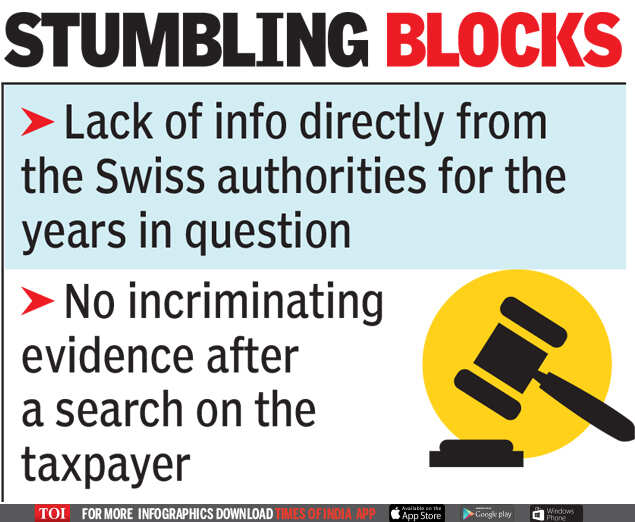

Even in this case heard by the ITAT, the information was received by the I-T authorities from the French competent authorities. However, the lack of information directly from the Swiss authorities for the years in question and lack of incriminating evidence consequent to the search proved to be a stumbling block.

The late Bhushan Lal Sawhney (now represented by his wife), challenged the additions made to his income on two grounds. One, that the assessment order pertaining to the six years from financial year 2005-06 to 2010-11 was time-barred. Second, no incriminating evidence was recovered during a search that had also been conducted on the individual taxpayer.

Thus, the additions made on account of unexplained deposits in the Swiss bank account and interest earned thereon were unjustified. Based on the facts of the case, and as the Swiss authorities did not part with information pertaining to these years, the ITAT decided in his favour.

In its recent judgment, the ITAT ordered deletion of this sum of about Rs 9.2 crore that was added to the income of the individual taxpayer. It also ordered deletion of interest income allegedly earned from the overseas bank account that was assessed in the taxpayer’s hands in subsequent years. The ITAT noted that information could be provided by the Swiss competent authorities only from April 1, 2011. Earlier years (to which this litigation pertained) were not covered by the Exchange of Information Article in the India-Switzerland tax treaty.

While the I-T officer had sought to bring the bank balance (unaccounted overseas money) to tax in India, the ITAT noted that — based on the information available with the I-T department’s investigation wing — there was no incriminating material available on record to make additions to income in any of the assessment years that were under litigation. Interestingly, while the taxpayer’s son had admitted to the existence of the Swiss bank account, this was denied by the taxpayer (bank account holder).

According to government officials, the genesis of the HSBC-Geneva account cases, which are in litigation at various levels, dates back to 2007 when an employee of HSBC Bank-Geneva obtained information on nearly 30,000 bank accounts and became a whistleblower.

It is regarded as the biggest bank leak in history, covering the period 2005-07, with the aggregate sum of funds in these accounts amounting to $120 billion. The employee took refuge in France, and in 2011 the French government shared information of the bank account holders with authorities in India and other countries by way of what is referred to as a ‘base note’.

Even in this case heard by the ITAT, the information was received by the I-T authorities from the French competent authorities. However, the lack of information directly from the Swiss authorities for the years in question and lack of incriminating evidence consequent to the search proved to be a stumbling block.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST