The market witnessed consolidation throughout session and finally closed with moderate losses on June 8. Banking & financials and metals stocks were under pressure, whereas the buying was seen in IT, FMCG, Pharma and Auto stocks.

The BSE Sensex fell 52.94 points to 52,275.57, while the Nifty50 declined 11.60 points to 15,740.10 and formed bearish candle which resembles Hanging Man kind of pattern on the daily charts.

"The daily price action has formed a small bearish candle carrying a long lower shadow indicating buying support at lower levels. On the daily chart, Nifty continues to form a series of higher Tops and a higher Bottom formation, indicating a sustained strength," said Rajesh Palviya, VP - Technical and Derivative Research, Axis Securities.

"The next higher levels to be watched are around 15,800 levels. Any sustainable move above 15,800 levels may cause momentum towards 15,900-15,950 levels. On the downside, any violation of an intraday support zone of 15,700 levels may cause profit booking towards 15,600-15,500 levels," he added.

The Nifty Midcap 100 and Smallcap 100 indices outperformed frontliners, rising 0.6 percent and 0.54 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,687.13, followed by 15,634.17. If the index moves up, the key resistance levels to watch out for are 15,785.93 and 15,831.77.

Nifty Bank

The Nifty Bank declined 358.40 points or 1 percent to close at 35,085.30 on June 8. The important pivot level, which will act as crucial support for the index, is placed at 34,882.1, followed by 34,678.9. On the upside, key resistance levels are placed at 35,369 and 35,652.7 levels.

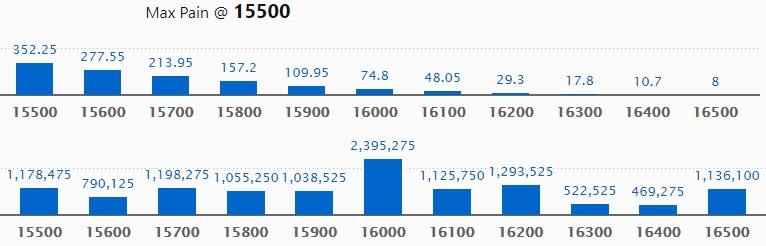

Call option data

Maximum Call open interest of 23.95 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,200 strike, which holds 12.93 lakh contracts, and 15,700 strike, which has accumulated 11.98 lakh contracts.

Call writing was seen at 15,700 strike, which added 1.2 lakh contracts, followed by 16,200 strike which added 39,825 contracts, and 16,400 strike which added 32,325 contracts.

Call unwinding was seen at 15,600 strike, which shed 60,300 contracts, followed by 15,800 strike which shed 52,650 contracts, and 16,100 strike which shed 43,500 contracts.

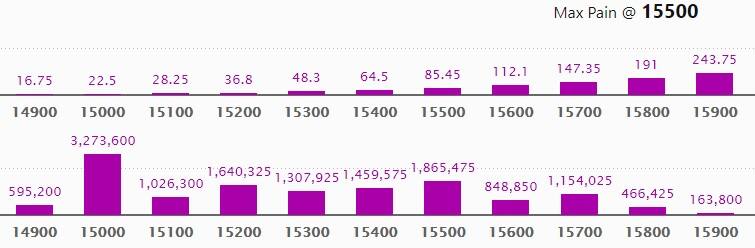

Put option data

Maximum Put open interest of 32.73 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 18.65 lakh contracts, and 15,200 strike, which has accumulated 16.4 lakh contracts.

Put writing was seen at 15,500 strike, which added 1.91 lakh contracts, followed by 16,200 strike which added 1.4 lakh contracts, and 15,700 strike which added 1.34 lakh contracts.

Put unwinding was seen at 15,600 strike which shed 88,050 contracts, followed by 15,200 strike, which shed 70,500 contracts.

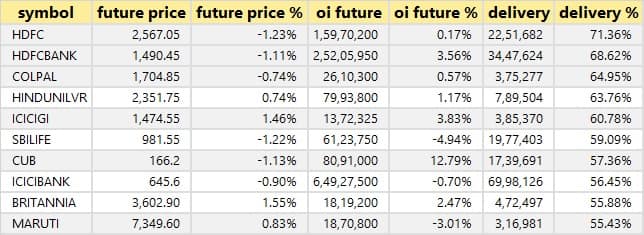

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

43 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

45 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

32 stocks saw short build-up

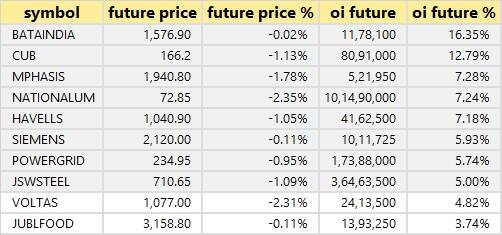

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

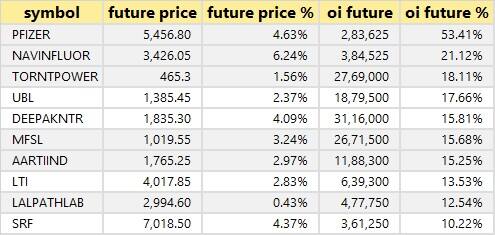

37 stocks witnessed short-covering

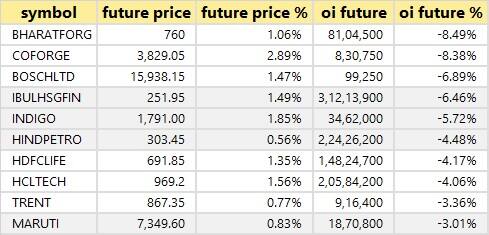

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

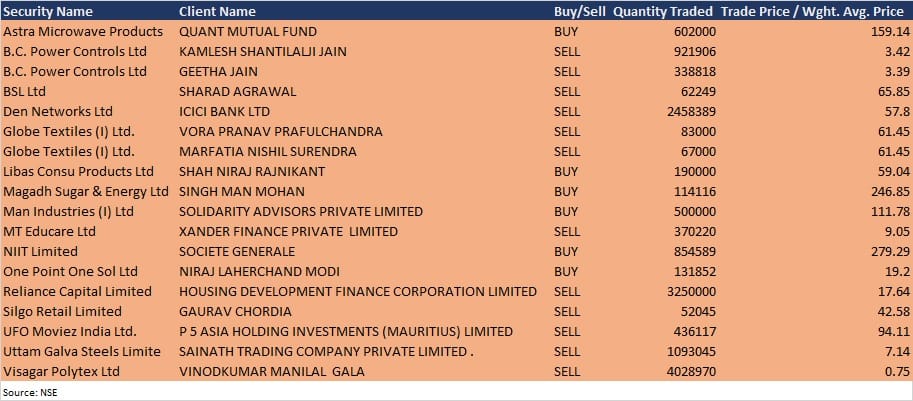

Bulk deals

Astra Microwave Products: Quant Mutual Fund bought 6.02 lakh equity shares in Astra Microwave Products (0.69% of total paid up equity) at Rs 159.14 per share on the NSE, the bulk deals data showed.

NIIT: France-based financial services company Societe Generale acquired 8,54,589 equity shares in NIIT (0.6% of total paid up equity) at Rs 279.29 per share on the NSE, the bulk deals data showed.

UFO Moviez India: P5 Asia Holding Investments (Mauritius) sold 4,36,117 equity shares in UFO Moviez at Rs 94.11 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 9

GAIL India, Bata India, Bajaj Healthcare, BCL Industries, Dynamic Cables, Gayatri Highways, GSS Infotech, Indian Metals & Ferro Alloys, Indraprastha Medical Corporation, Munjal Auto Industries, Shivam Autotech, Star Cement, Taneja Aerospace, and TeamLease Services will release quarterly earnings on June 9.

Stocks in News

Ion Exchange India: The company reported higher consolidated profit at Rs 70.48 crore in Q4FY21 against Rs 28.86 crore in Q4FY20, revenue rose to Rs 445.15 crore from Rs 351.09 crore YoY.

Bandhan Bank: Reserve Bank of India granted approval for re-appointment of Chandra Shekhar Ghosh, Managing Director & Chief Executive Officer of the bank, for a period of three years, with effect from July 10, 2021.

Engineers India: The company reported lower consolidated profit at Rs 24.92 crore in Q4FY21 against Rs 119.68 crore in Q4FY20, revenue rose to Rs 1,131.9 crore from Rs 864.38 crore YoY.

Talbros Automotive Components: The company reported higher consolidated profit at Rs 27.43 crore in Q4FY21 against Rs 0.27 crore in Q4FY20, revenue jumped to Rs 157.63 crore from Rs 91.63 crore YoY.

Galaxy Surfactants: The company reported higher consolidated profit at Rs 78.68 crore in Q4FY21 against Rs 62.80 crore in Q4FY20, revenue jumped to Rs 783.52 crore from Rs 656.65 crore YoY.

Welspun Corp: The company received multiple orders of approximately 164 KMT valuing close to Rs 1,725 crore.

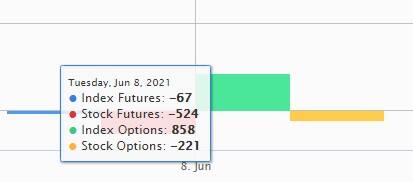

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,422.71 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,626.98 crore in the Indian equity market on June 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Indiabulls Housing Finance, NALCO, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for June 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.