Indian markets ended in the green for the third consecutive week amid declining COVID cases and reopening of the economy. RBI's continued accommodative stance further helped Nifty climb to all-time high levels.

The BSE Sensex closed the week above 52,000 mark for the first time, rising 677.17 points or 1.32 percent to 52,100.05, while the Nifty50 rallied 234.60 points or 1.52 percent to 15,670.25.

The broader markets outweighed frontliners as the BSE Midcap index gained nearly 4 percent and Smallcap index jumped 3.3 percent amid increasing hope for demand recovery across sectors once the opening of economy in coming weeks.

Experts expect the momentum to continue in the coming week too, even after nearly 7 percent gains in the benchmark indices and more than 9 percent rally in broader markets in the previous three consecutive weeks, experts feel.

"With quarterly results and RBI policy behind us, the focus would shift to pace of unlocking and vaccination domestically and global cues. We remain constructive on equities over the medium term," said Gaurav Dua, SVP, Head - Capital Market Strategy at Sharekhan by BNP Paribas.

In the coming week, the market participants will closely watch the monsoon updates as IMD and Skymet have predicted a normal monsoon this year as well, which could be one of the supporting factors in coming weeks.

Here are 10 key factors that will keep traders busy in the coming week:

Earnings

The March quarter earnings season will continue in the coming week so there will be more of a stock-specific seen. More than 250 companies will release their quarterly earnings next week including GAIL India, Union Bank of India, Central Bank of India, MRF, Engineers India, Petronet LNG, Prestige Estates Projects, Bata India, Century Plyboards, Cera Sanitaryware, Mazagon Dock Shipbuilders, NHPC, SAIL, BEML, BHEL, CG Power and Industrial Solutions, DLF, Sun TV Network, CARE Ratings, JK Cement, and Sobha.

Coronavirus Risk Subsiding

The subsiding second COVID wave lifted the investors' mood at Dalal Street as benchmark, as well as broader indices, hit fresh record highs in the passing week. In fact, the fall is in line with the government and medical experts' expectations. The same momentum in market is expected to continue in coming days too if the daily infections fall further, experts feel.

India reported 1.20 lakh cases in the last 24 hours ended at 8 am on Saturday, the lowest increase in last 2 months, taking the total cases tally to 2.87 crore so far. There has also been a significant fall in active cases with sharp rise in recoveries.

The active cases stood at 15.55 lakh now against 22.2 lakh cases in the previous week. The positivity rate fell below 6 percent, at 5.78 percent, the lowest level in more than 2 months, against 8.35 percent on week-on-week basis, while the recovery rate jumped to 93.38 percent, from 90.80 percent in the same period.

Experts feel the vaccination drive is expected to see more pick up in coming weeks with the availability of doses in bulk quantity, so the virus risk could get subsided. In the last 24 hours ended at 8 am on Saturday, more than 31 lakh doses were administered, taking the total tally to over 23 crore doses administered in the country.

Economic Data Points

The industrial production and manufacturing production data for the month of April will be released on coming Friday, which is key to watch out for.

The industrial output in March 2021 jumped to 22.4 percent, indicating significant increase in industrial activity, but experts fel April may not be seen on same lines due to state wise lockdowns to control spread of virus.

Foreign exchange reserves for the week ended June 4 will also release on Friday. RBI Governor Shaktikanta Das on June 4 said, "Forex reserves have risen to $598 billion. We are within striking distance of reaching $600 billion on forex reserves."

Oil At Two-Year High

Crude oil price has steadily been rising in the international markets, hitting two-year high on Friday amid hope for recovery in demand given the improving economic data points, and after OPEC (Organization of the Petroleum Exporting Countries) & allies decided to stick to supply restraints.

This is expected to be a risk going ahead for a country like India which is net importer of oil. Experts feel there could be inflationary pressure if the oil price continues to rise in coming weeks and that ultimately could cap market upside.

Brent crude August futures, the international benchmark for oil prices, rallied up to $72,17 a barrel, the highest level since May 2019, before signing off Friday's session higher at $71.89 a barrel. In the year 2021 so far, crude oil prices surged 39 percent.

The Reserve Bank of India in its recent policy statement also intimated the risk of inflation due to rising oil prices. "The rising trajectory of international commodity prices, especially of crude, together with logistics costs, pose upside risks to the inflation outlook. Excise duties, cess and taxes imposed by the Centre and States need to be adjusted in a coordinated manner to contain input cost pressures emanating from petrol and diesel prices," the central bank said on June 4.

FII Flow

The mood at foreign institutional investors' desk seem to be improving now as they turned net buyers in June so far after selling in previous two straight months. In fact they have been net buyers from the second half of May onwards largely due to the receding COVID risk with the significant fall in daily infections, which all ultimately supported the market sentiment. Experts feel the flow may continue in coming sessions if the cases recede further.

FIIs net bought Rs 3,049.81 crore worth of shares in June so far and made Rs 2,697.91 crore of buying in last two weeks of May, though they net sold Rs 6,015 crore of shares in the month of May.

On the other side, domestic institutional investors could be using the strong market opportunity to book some profits. They have net sold Rs 981.73 crore of shares in June so far.

Technical View

The Nifty50 hit a fresh record high of 15,733.60 on Friday but failed to sustain the same amid consolidation and closed moderately lower by 20.10 points, forming bearish candle which resembles Hanging Mand kind of pattern formation on the daily charts. But for the week, there was bullish candle formation as it gained 1.5 percent.

Hence, experts expect the momentum to take the index towards 15,850 levels in coming sessions, though there could be intermittent consolidation and correction.

"Though, Nifty placed at the new highs, there is no indication of any reversal pattern unfolding at the highs, which signal lack of selling enthusiasm in the market at the new highs/after a reasonable upmove. Now minor higher highs and higher lows is going on as per daily chart in the last couple of weeks. Hence, any minor weakness from here could be a buy on dips opportunity for the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty on the weekly chart formed a reasonable bull candle. Technically, this pattern signal a formation of 'three advancing soldiers' which is uptrend continuation pattern," he said.

"The next upside levels to be watched around 15,800-15,900 levels, before showing any downward correction from the highs. This could be achieved by next week. Immediate support is placed at 15,600 levels," he added.

F&O Cues

On the weekly basis, maximum Call open interest was seen at 15,700 strike, followed by 16,000 and 15,800 strike, while the maximum Put open interest was seen at 15,500 strike, followed by 15,000 and 15,600 strikes.

Call writing was seen at 15,800 strike, followed by 15,700 and 16,300 strikes with Call unwinding at 15,600, 15,200 and 15,400 strikes. Put writing was seen at 15,500, 14,900 and 15,400 strikes with hardly any Put unwinding.

Option data indicated that the Nifty50 could see a trading range of 15,000 to 16,000 levels in coming sessions.

"The highest Call option concentration is at ATM 15700 Call strike, which is the highest open interest base among Call and Put strikes. Among Put strikes, the highest Put base is placed at the 15500 strike," said ICICI Direct.

"On the index futures front, net short positions from FIIs are one of the lowest ever and some short accumulation should be seen at higher levels. This may keep upsides restricted for the Nifty in short-term," the brokerage added.

VIX At 17-Month Low

The volatility has consistently been declining, hitting the lowest levels since February 2020, largely due to declining COVID risk with significant fall in daily infections. The India VIX closed at 15.94 levels on Friday, falling 8.4 percent from 17.40 levels on week-on-week basis. Experts feel this is positive sign for bulls but also sends some caution signal given the significant fall in volatility.

"The volatility index has moved to its lowest levels since February 2020 and trading near 16 levels. Such low levels also suggest some caution in the market and a rise in volatility cannot be ruled out, which may result in the Nifty moving towards 15,500 on the Nifty50 in short-term," ICICI Direct said.

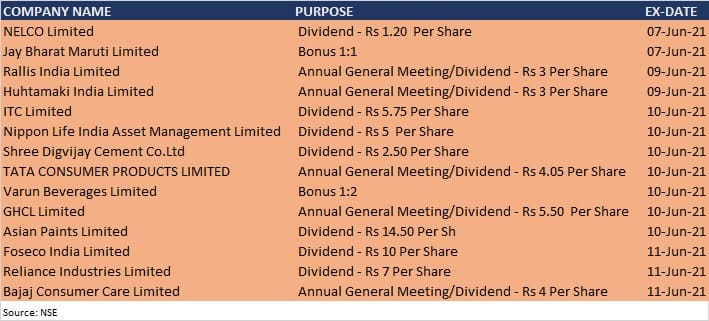

Corporate Action

Here are key corporate actions taking place in the coming week:

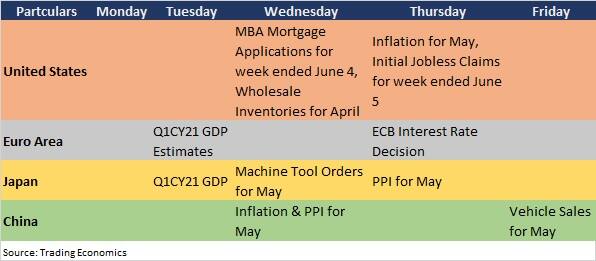

Global Cues

Here are key global data points to watch out for next week: