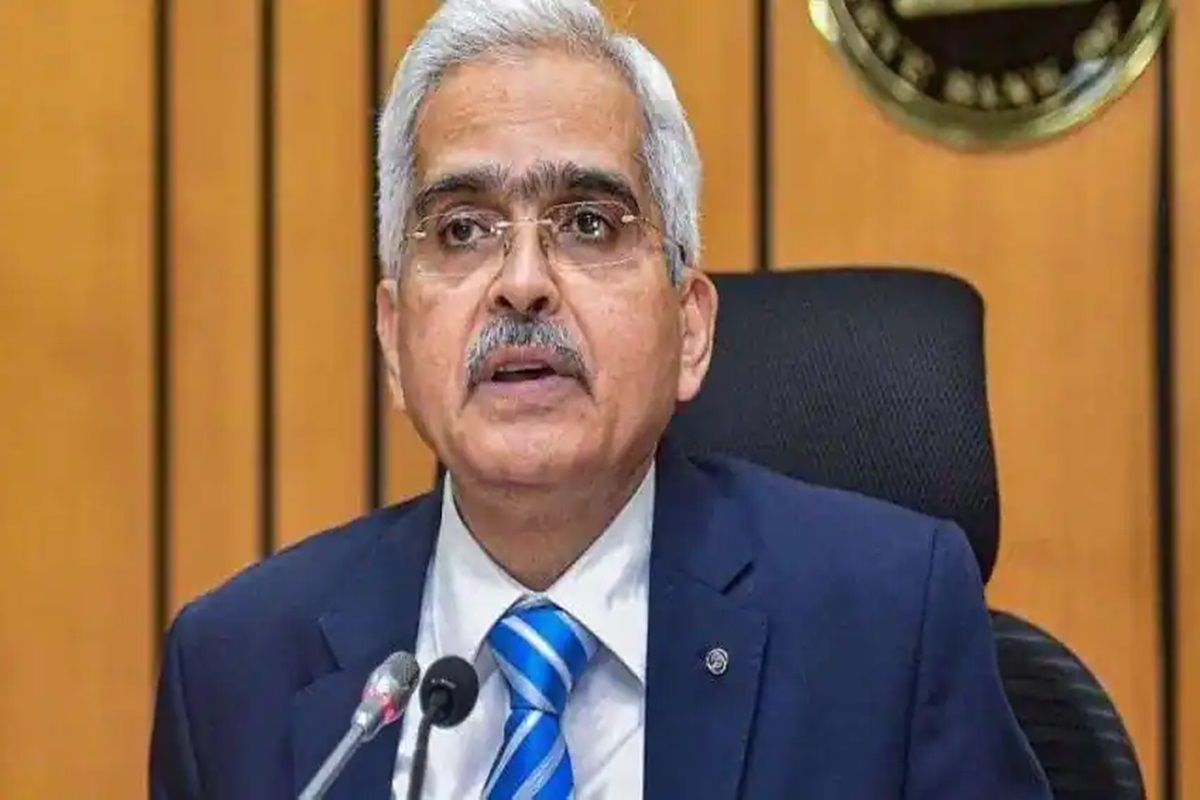

New Delhi: RBI Monetary Policy 2021 June – Reserve Bank of India Governor Shaktikanta Das today announced the bi-monthly RBI Monetary Policy 2021. This is second such monetary policy announcement for ongoing Financial Year of 2021-22. Fiscal’s first monetary policy was announced back in April. In the RBI Monetary Policy today, Governor Das has listed out a raft of data and measures. Here are 10 Big Takeaways

1. RBI Repo Rate, Reverse Rate

RBI decided to maintain the status quo and continued with accommodative stance. The Central Bank has not changed lending rate or RBI Repo Rate at 4 per cent. RBI also did not make any change in RBI Reverse Repo Rate or borrowing rate at 3.35 per cent.

2. India’s GDP Growth

RBI Governor Shaktikanta Das has said that Reserve Bank of India has lowered its projection for Indian economy’s Gross Domestic Product (GDP) growth rate at 9.5 per cent. Earlier in April’s monetary policy statement, the GDP growth rate projection was at 10.5 per cent.

3. For the first quarter India’s GDP growth estimate is 18.5 per cent, 7.3 per cent in the Quarter 2 of FY 22, 7.2 per cent in the third quarter of Financial Year 2021-2022, and 6.6 per cent in the fourth quarter of FY22.

4. CPI Inflation:

Governor Shaktikanta Das has said that RBI Monetary Policy 2021 has estimated CPI inflation at 5.1 per cent for Financial Year 2021-2022.

5. RBI has predicted CPI inflation at 5.2 per cent in Quarter 1, 5.4 per cent in Quarter 2, 4.7 per cent in the third quarter, and 5.3 per cent in the fourth and final quarter.

6. RBI has kept the marginal standing facility (MSF) rate and bank rate unchanged at 4.25 per cent.

7. Liquidity window for restaurants, tourism, aviation support services: RBI has stated that a separate liquidity window of Rs 15,000 crore will remain till March 31, 2022 for contact-intensive sectors. Under this, banks can provide support to aviation support services, tourism sector, hotels and restaurants under this programme.

8. RBI Governor Shaktikanta Das said that Reserve Bank of India has extended a special liquidity facility worth Rs 16,000 crore to SIDBI for on-lending and refinancing.

9. RBI Governor Shaktikanta Das has disclosed that Reserve Bank of India will expand the limit of restructure loans for small businesses and individual to Rs 50 crore from earlier Rs 25 crore.

10. RBI Governor Shaktikanta Das has said that National Automated Clearing House (NACH) payment system will function on seven days a week from August, 2021. So far, the facility is available only on banks’ working days.